I once spent almost 4 hours of my workday completing my expense report for FinovateEurope. Painful. So the news that receipt and business card digitization company Shoeboxed is ushering a travel and expense reporting system out of beta this month caught my interest. The new product, Fetch, is an “expense-report-free” expense reporting solution for small businesses.

The idea for the new product came from Shoeboxed’s clients who were using the Shoeboxed platform as an expense management system– something the company never intended. As the Fetch blog post announcement explained, “While Shoeboxed serves as a state of the art receipt and business card digitization service, it was never meant to be a full-service expense reporting tool.”

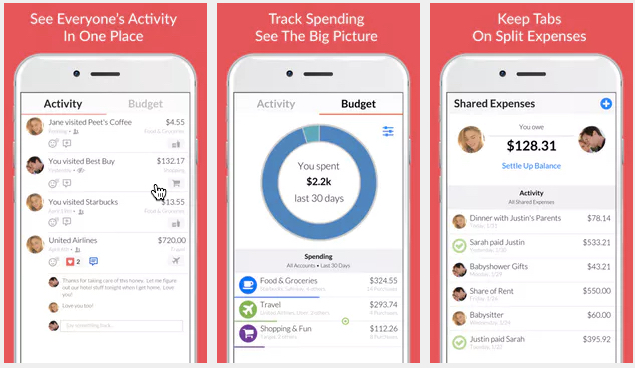

Nine months of market testing and surveys revealed that consumers wanted an expense reporting tool that was not complicated or difficult to set up. So that’s what Shoeboxed built Fetch to be. The new product’s main objective “is to be the fastest tool on the planet for getting employees reimbursed for expenses.” The company stripped down the expense reporting process and “got rid of expense reports altogether.”

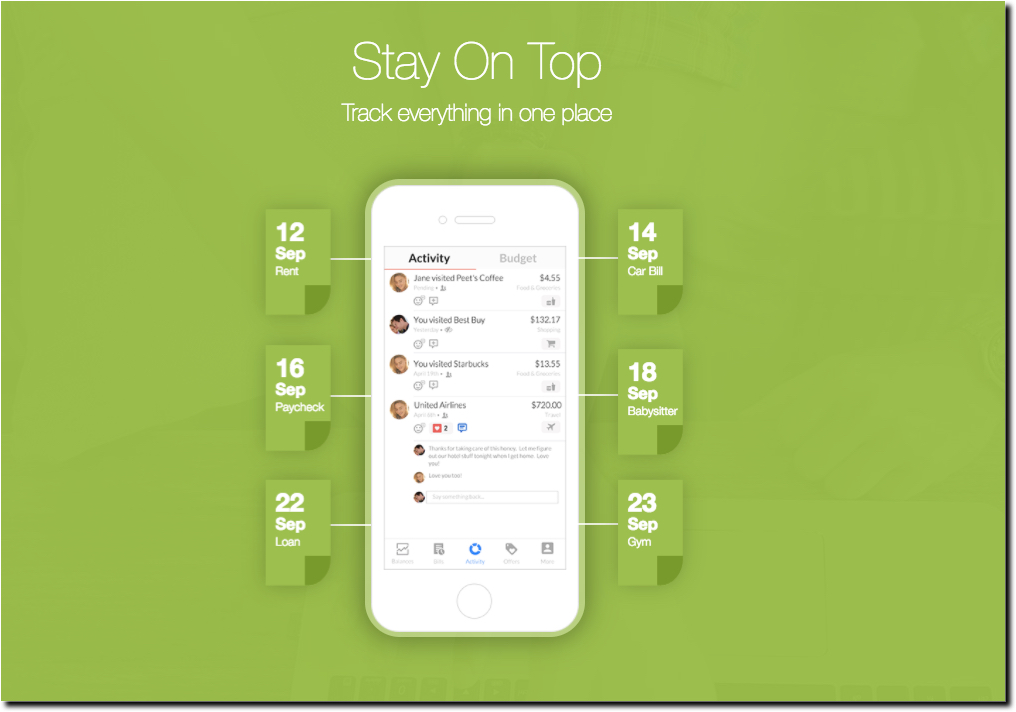

Fetch offers a streamlined way for employees to submit receipts, then batches the digitized documents and sends them in batches to team administrators for approval and repayment. To adjust to growing companies, Fetch can scale to different team sizes and adapt to organizational structures and workflow requirements.

Shoeboxed was founded in 2007 to help people turn paper receipts into organized digital data. The company’s one million account holders across 100 countries mail Shoeboxed their physical receipts, business cards, and bills and the company hosts the documents in a secure, digital format or exports the data to QuickBooks, Wave, Xero, Outright, Evernote, Excel, and more.

At FinovateSpring 2015, Shoeboxed won Best of Show for demonstrating how banks can leverage the company’s receipt capture platform. The company’s co-Founder, CFO & COO, Tobi Walter, showcased how banks can use Shoeboxed to help clients view line item data from email receipts, receive reminders about product return deadlines, product recall information, and more. Last summer, the company launched Direct Download for reports and in June of last year partnered with ScanSnap Cloud to offer a new way to scan receipts.

Doug Parr, Vice President,

Doug Parr, Vice President,