Payment platform Braintree made a move to not only make merchants’ lives easier, but also to make it smoother for consumers to pay, which makes merchants happier. So no one was complaining today when the PayPal-owned company announced it will integrate with Samsung Pay.

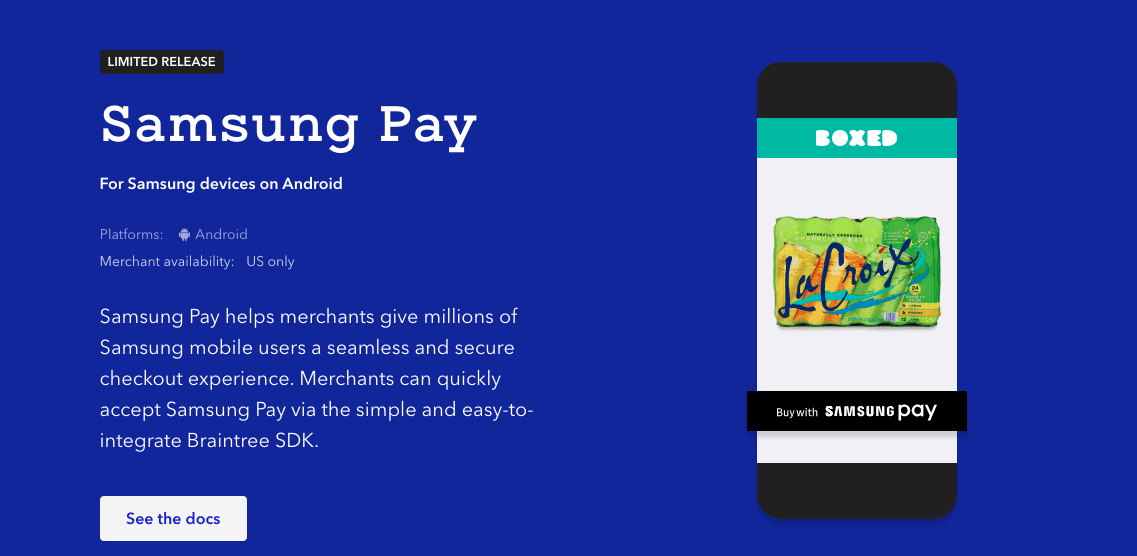

Braintree merchants in the U.S. can now accept Samsung Pay for in-app payments. According to a study conducted by PYMNTS, the percentage of adult smartphone users that have used Samsung Pay to make a purchase rose from 4.3% in March of 2017 to 5.1% in December of 2017.

Braintree has simplified the process for merchants, requiring just a few lines of code to integrate Samsung Pay into their existing checkout process, making for a streamlined purchasing experience for end users. Online wholesale retailer Boxed is among the first to pilot the integration.

Today’s announcement is a continuation of Braintree’s relationship with Samsung. Earlier this year, the San Francisco-based company announced that U.S. PayPal users can transact using PayPal within Samsung Pay.

PayPal acquired Braintree in 2013 for $800 million. Braintree most recently showcased Venmo Touch at FinovateSpring 2013. Last month, Adobe announced it is launching Magento Payments with PayPal’s Braintree for payment processing. And in April, Braintree teamed up with Yahoo! to make its payment platform available to online sellers using Yahoo Merchant Solutions and Yahoo Stores.

Data aggregation and analytics company

Data aggregation and analytics company

Arival Bank

Arival Bank Avaloq

Avaloq