On Finovate.com

- Open Bank Project Collaborates with Open Source Software Company Red Hat.

- Ondot Lands Strategic Investment from Citi Ventures.

- Experian, FICO, and Finicity Launch the UltraFICO Score.

Around the web

- Bloomberg TV features Best of Show winner Bumped.

- Envestnet | Yodlee launches new suite of developer tools.

- ThreatMetrix partners with SAS, bringing digital identity intelligence to machine learning to help creditors fight identity fraud.

- Finastra introduces its cloud-based instant payments offering for SMEs.

- Sberbank inks Memorandum of Understanding with SWIFT.

- Artivest appoints new Chief Compliance Officer, Kamal Jafarnia.

- Featurespace unveils its ARIC White Label solution for advanced fraud and risk prevention.

- Finextra: Fidor and GFT extend partnership to the Americas markets.

- NCR to acquire JetPay

- Kony acquires innovation subsidiary of Umpqua Bank.

- Finextra: NTT Data plans pan-Asian federated trade information platform based on blockchain.

- SuperMoney surpasses $1 billion in financing requests

- Bluefin and TokenEx partner to strengthen payment security with PCI-validated P2PE and omni-channel tokenization.

- ID.me launches KYC / AML identity verification solution and ID document verification solution.

This post will be updated throughout the day as news and developments emerge. You can also follow all the alumni news headlines on the Finovate Twitter account.

Presenters

Presenters Abhishek Joshi, Senior Associate

Abhishek Joshi, Senior Associate

Presenters

Presenters Bodo Grauer, Head of Digital Strategy and Transformation

Bodo Grauer, Head of Digital Strategy and Transformation

Presenters

Presenters Igor Pesin, Co-Founder and CFO

Igor Pesin, Co-Founder and CFO

Presenters

Presenters Ozan Vakar, CTO

Ozan Vakar, CTO

Presenters

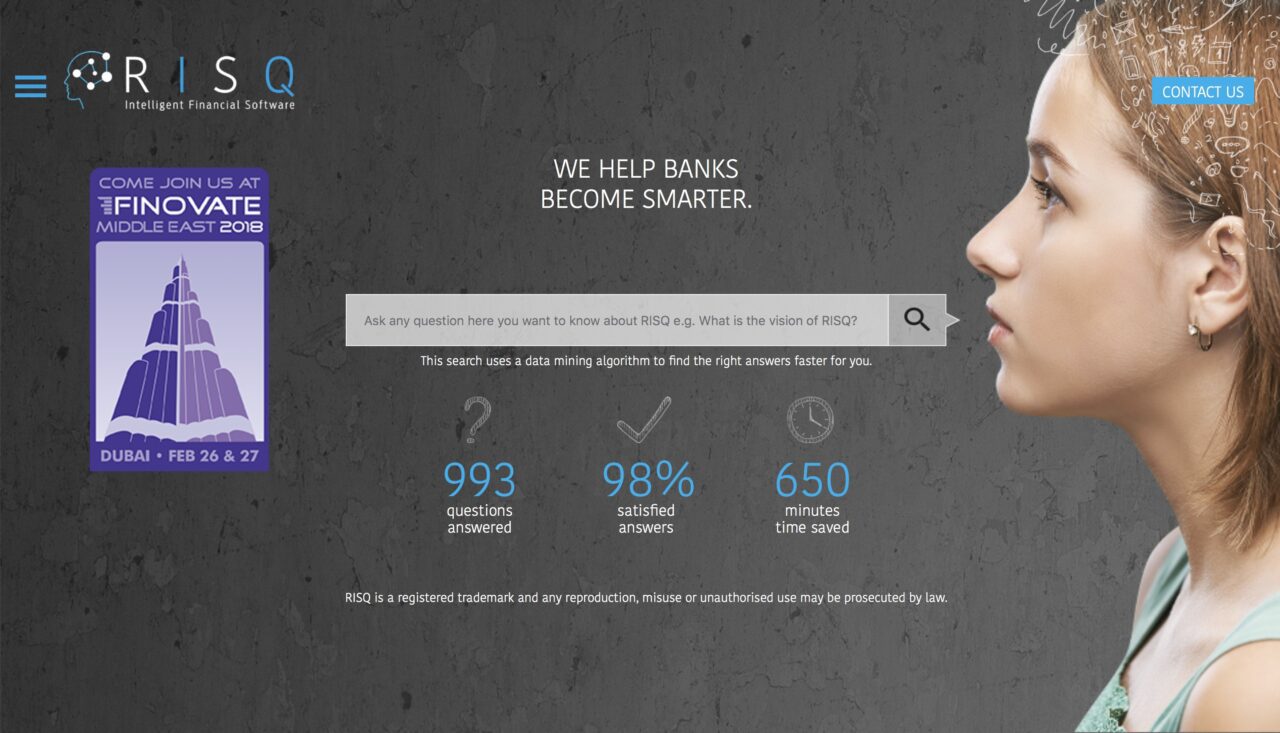

Presenters Justin Lai, Sales and Marketing Director

Justin Lai, Sales and Marketing Director

Presenters

Presenters Piyachat Kunthachaem, Business Platform Officer

Piyachat Kunthachaem, Business Platform Officer Sukanya Bowornsettanan, Project Manager, Transformation

Sukanya Bowornsettanan, Project Manager, Transformation