Promoting financial wellness among some of the economy’s most vulnerable participants is the goal of the new partnership between financial counseling and debt management nonprofit GreenPath and Finovate Best of Show winner Banzai. The collaboration, announced in June, will combine Banzai’s experience-based, personal finance learning solutions with GreenPath’s empathetic, nonjudgemental, one-on-one approach to debt counseling and helping consumer gain financial wellness.

“Lenders love GreenPath because they know they help people make positive, sustainable behavior changes that lead to improved credit and financial health,” Banzai’s Bryce Peterson wrote in a blog post discussing the news. “We are partnering with GreenPath so financial institutions can relieve the pressures experienced by many of their customers,” he said.

The two companies will also work together to present their respective platforms to potential financial institution customers.

A nonprofit organization founded in 1961, GreenPath has 500 employees in 40 locations who help individuals improve their financial awareness and skills, enabling them to make better financial decisions. The company leverages its relationship with creditors to help clients refinance their outstanding debts and secure lower, easier-to-afford, interest rates. Loan denial and delinquency services, CRA (Community Reinvestment Act) support, financial education workshops, and employer programs are among the services GreenPath offers financial institutions. The company currently facilitates debt management programs for 45,000 customers, and repaid more than $200 million on behalf of its clients last year alone.

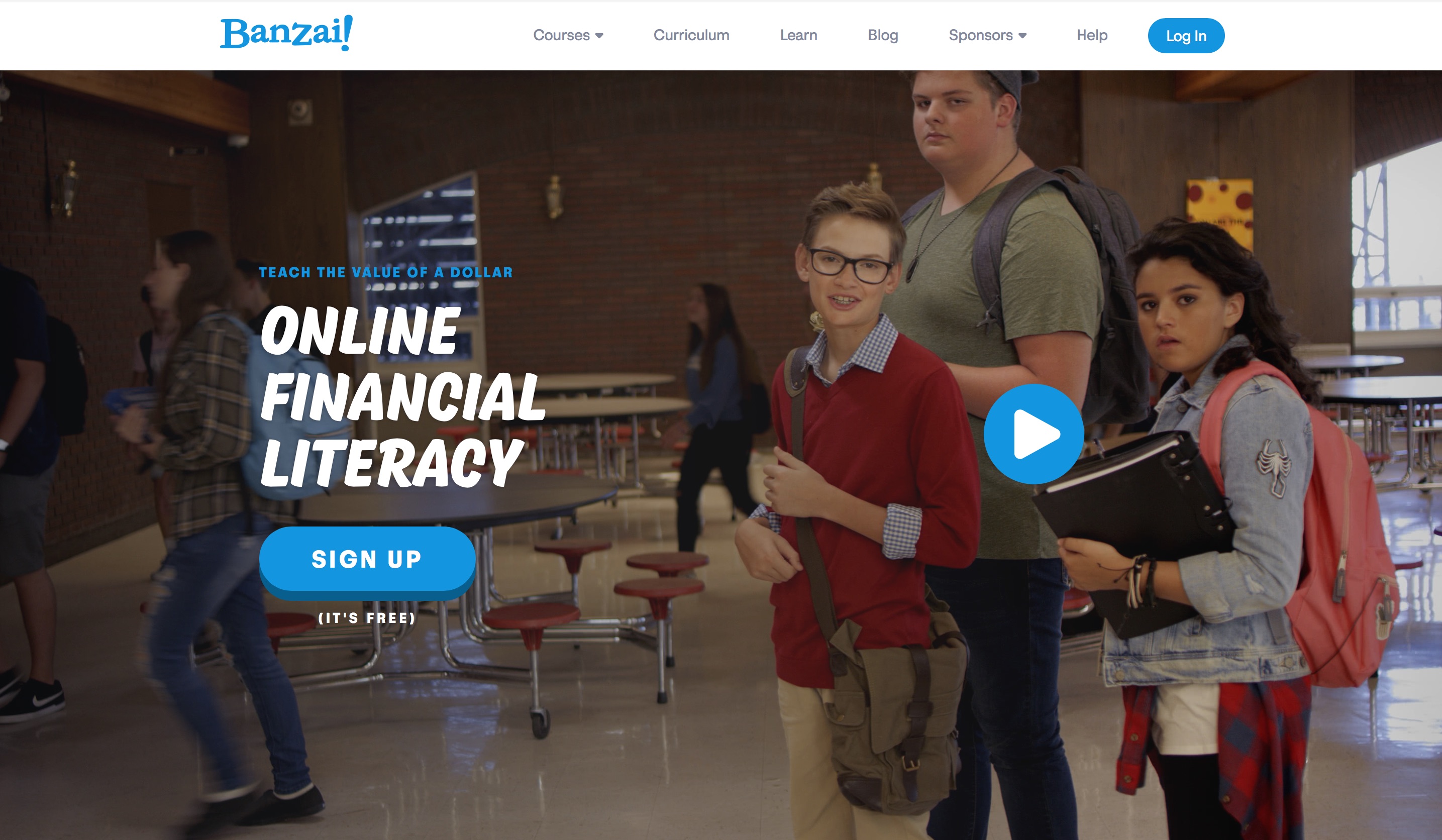

Banzai demonstrated its turnkey, CRA eligible solution, combining educational content, interactive online simulations and topical resources at FinovateFall 2018. Winning Best of Show for its experience-based learning programs, Banzai has 750 bank and credit union partners, and 45,000 teachers using its technology.

Later this month, Banzai will unveil a pair of new products: Financial Wellness Center and the Coach. These solutions, in the words of company co-founder and CTO Kendall Buchanan, “(are) designed to encourage potential customers to share their goals … think deeply about their finances, and find answers to their stickiest financial questions.”

Founded in 2007, Banzai is headquartered in Provo, Utah. Morgan Vandagriff is co-founder and CEO.