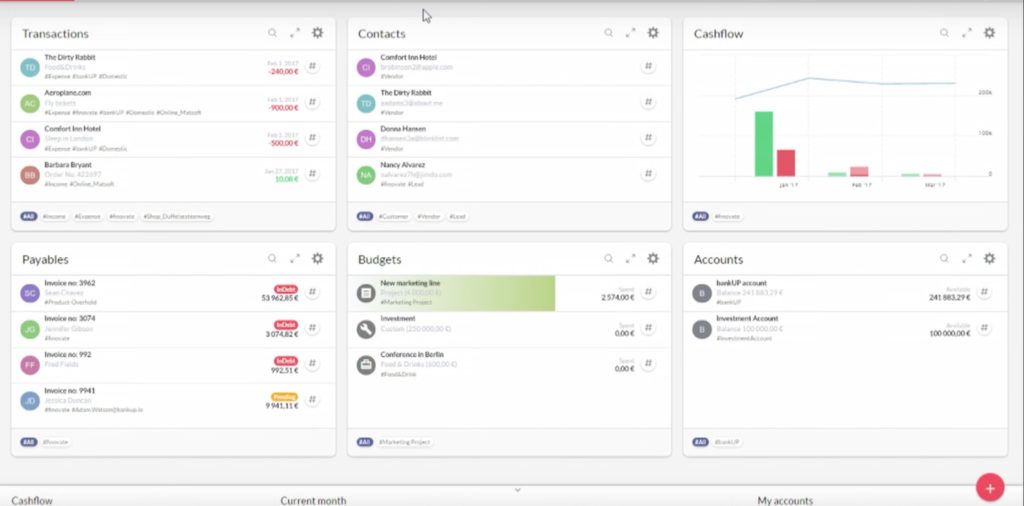

With Finovate making its debut on the European continent just over a month from now, we thought it was a good time to catch up with one of the major fintech innovators in the region, banqUP.

The company, headquartered in Belgium and “proudly developed in Poland,” demonstrated its small business banking platform at FinovateEurope 2017. We reached out to company CEO and founder Krzysztof Pulkiewicz to talk about banqUP’s latest accomplishments in open banking, as well as what the landscape for fintech innovation is like inside and outside the CEE region.

Finovate: The most recent news from banqUP is the news of your AIS license from the Polish Financial Supervision Authority. What does this license enable and how important was this development to your company?

Krzysztof Pulkiewicz: It allows us to broaden our reach and gain new clients. We have been working with a number of banks but now, with our newly gained license, we have the possibility to work both with banks and other entities that can gain access to the opportunities provided by open banking thanks to our solutions.

Finovate: You also recently announced that the company will focus fully on its B2B2C open banking platform. Can you tell us a little bit about the thinking behind this decision?

Pulkiewicz: For banqUP, the main reasons of moving from an idea of a fintech bank to a platform integrating banking APIs were challenges related to the acquisition of customers, especially on mature digital banking markets like Poland. There were also several limitations like opening accounts in polish zloty. On the other hand, we were already closely working with banks interested in our technology. We have seen that a number of our partners were interested in our open banking solutions. We have been working in a sort of a schizophrenic environment – both working with banks and building our own bank as well.

Multibanking was a core element of banqUP fintech bank from day one, and we have decided to focus on this aspect of the platform. We knew that sticking to what we are really good at – technology and data analytics – will be working for us. And it proved true.

Finovate: In line with this, the company has decided to launch a TPP-as-a-Service business line. Why do this and how large are the opportunities there?

Pulkiewicz: This is something we have been thinking about since we have started considering open banking. Multibanking solutions are the beginning of the open banking ecosystem, but we are sure that what the future brings, are the new ideas and products that will come from PSD2. There are many companies that do not consider getting their TPP licenses, as it is not a core of their business. However, they are willing to use the information provided by the banking system, and our solution is created for such partners.

The number of inquiries we are getting from prospective partners is really astonishing – and these are both new companies and major players from different industries.

Finovate: You mentioned in an email that you plan to open the next generation of your platform to the public early next year. Can you give us a preview of what’s new and what to expect – as well as any update on the timeline?

Pulkiewicz: Our main focus is on what we call “open banking building blocks.” We are extending our platform with best-in-class API and SDK that will offer effective integration capabilities for developers. On the functional level, we are adding new functionalities on top of data aggregation (analytics, data quality management, and data enrichment) as well as provide and expand on all the components that can support different businesses in connecting to the open-banking world (consent lifecycle management, data streaming, combining PSD2 APIs with other data sources). We know that data aggregation and payment initiation is just a starting point and we are positioning our platform as a one-stop shop for open banking.

Finovate: BanqUp operates in both CEE and non-CEE Europe – Poland, Slovakia, Hungary, and Bulgaria on the one hand, Belgium and Ireland on the other. Are there categorical differences between working with financial institutions in Central Europe compared to Western Europe? Are attitudes toward open banking the same or different?

Pulkiewicz: The ecosystems differ, but the main distinction we see is not between Central and Western Europe, but between individual countries. Ireland’s ecosystem, for example, is very open. It is not only a reaction to the British banking regulations that have been the basis for PSD2 and had an effect on Ireland, but also the number of fintech companies from the U.K. and Ireland that had quickly started working with banks as they have opened. Poland’s banks have been working on many innovative banking tech projects, and banks have implemented many solutions of their own, making their ecosystems quite closed. When you look at Hungary, it was very fast with opening its own data – with eight out of 10 of the biggest banks in the country providing their API access in March of 2019, well before the final implementation of PSD2 in June. The central bank of the country has also created a fintech cooperation strategy. The differences here do not come from geographical divisions, but from the local ecosystems.

Finovate: In addition to the platform enhancements expected in 2020, are there any other announcements you can preview? New partners, new investors, new markets?

Pulkiewicz: We are definitely planning to expand to new markets – mostly focusing on the CEE region. We have a number of really promising talks with new, large partners, but we cannot really disclose any names at this moment. When it comes to investors – we have been very proud we have managed to come to this moment without any external support, but we are now also looking for strategic partnerships and alliances.