This is a sponsored post in collaboration with InterSystems, Gold Sponsors of FinovateSpring, and Monica Summerville, head of capital markets, Celent, a division of Oliver Wyman.

Financial institutions and data have had a love-hate relationship for many years.

On the one hand FIs and data are a match made in heaven. It is a symbiotic relationship where business functions create and consume data over and over until the result exceeds the sum of the parts. Ideally this partnering results in revenue or alpha-producing insights. On the other hand, siloed, unreliable or simply too much data creates frustration and risk as the business potential is teased, but ultimately unattainable as FIs struggle to extract value from their data (see figure 1).

Business use cases for leveraging data across financial services are plentiful, from management reporting, enterprise risk, liquidity and treasury management, and more recently, driving innovative customer experiences. More specifically within capital markets and banking, trends such as the embracing of multi-asset trading or the desire to simplify architectures have triggered a rethink of data approaches. There is also, now more than ever, the desire for cost savings – equally important to FIs whose margins are increasingly coming under pressure from increased regulation and competitive factors. Indeed, research by Oliver Wyman and Morgan Stanley found that the benefits from having clean, consistent, and automated data management could be a two-to-four percent reduction of infrastructure and control costs. When IT spend ranges into the billions of dollars, as is the case with larger FIs, every percentage point of savings is a big win.

No wonder then that cracking the data management challenge has long been considered the perfect marriage of technology achievement and business function. FIs have made repeated attempts and invested hundreds of millions of dollars through the years to get this right. From simple relational databases storing structured data, to data warehouses and more recently data lakes capable of holding all types of data, there has been no shortage of excitement that maybe (whisper it) this latest approach could be “the one.” Heartbreaks inevitably followed as the heady days of getting to know new technologies turn into frustrations and recriminations. A pristine data lake becomes a swamp.

The latest research by Celent discovered that leading FIs including Bank of America, Citi, Goldman Sachs, JP Morgan and RBC, to name a few, have lately been getting serious with a new data management approach called Smart Data Fabric. As these entities move from a process- to platform-driven organisation, their business focus has shifted to ensuring the best customer experience possible. This shift however requires mastering and leveraging data to generate insights at an enterprise level. The reality is that a history of disjointed business expansion common to financial services, means data is siloed across numerous platforms, tuned for very different use cases. There are multiple “single sources of truth,” and these vary depending on whose truth you are seeking.

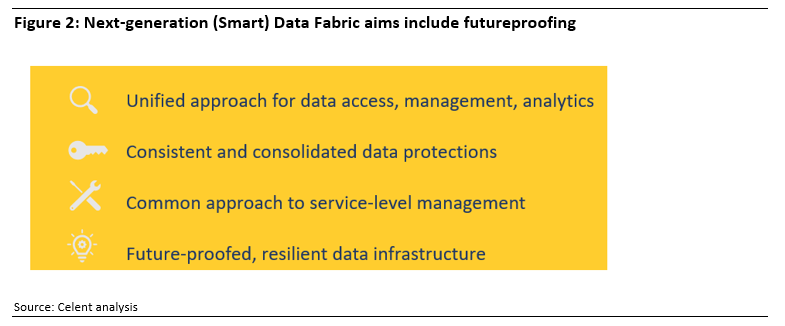

The right data management approach should empower FIs to become better versions of themselves, without fundamentally changing who they are. Unlike previous data management architectures, Smart Data Fabrics offer centralized access and a single unified view of data across the organization. Crucially, Data Fabrics do not require that copies of the data be created and stored outside its original location, so can offer a useful bridging solution between modern and legacy systems – the latter often holding the most business crucial data. In this way Data Fabrics can also avoid the creation of more data silos, which is especially important as FIs increasingly embrace cloud. A Data Fabric becomes “Smart” when it inherently supports advanced data analytics and aims to future-proof data management (see Figure 2).

Financial institutions, from asset managers to banks and brokers, have always known that they need to become smarter about data. Business end-users and clients are demanding better user experiences, targeted insights, and increased access to analytic capabilities which requires free access to accurate and harmonized data drawn from disparate sources across the entire enterprise. At the very core of modernization is the ability to innovate at scale, and this relies on freer access to data. Celent’s latest research report sponsored by InterSystems found that the business necessities and benefits of better data management is driving adoption of Smart Data Fabrics. This time it might just be for real. Read the full report here >>