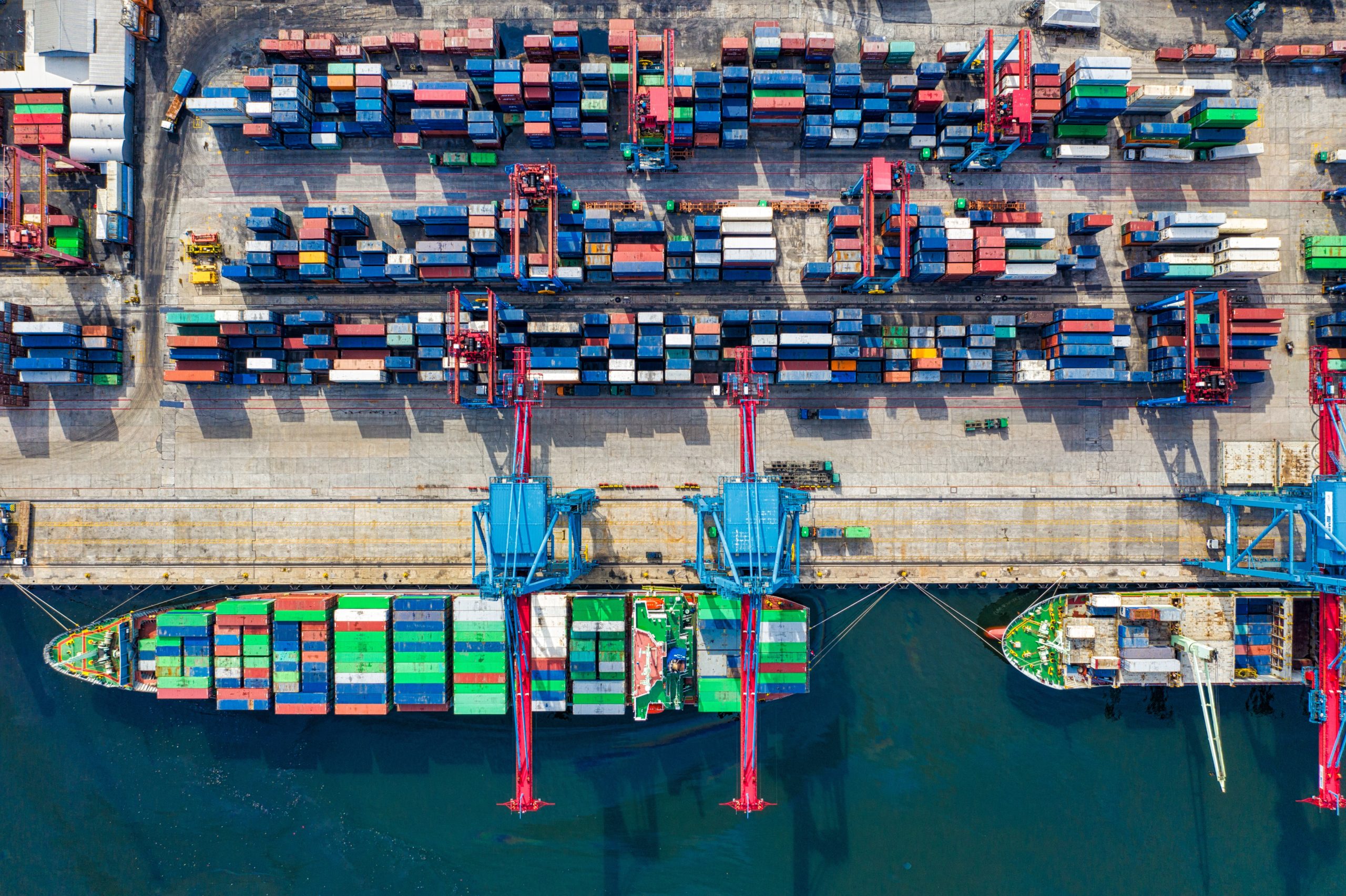

One of Finovate’s most recent alums, Finzly, announced this week that Fulton Bank has achieved significant operational efficiencies in its foreign exchange business courtesy of Finzly’s FX START and EXIM STAR solutions.

“International trade and foreign exchange can be a complex business for financial institutions of any size to manage successfully,” Finzly CEO and founder Booshan Rengachari said. “With one integration to the core, our FX STAR and EXIM STAR solutions help institutions like Fulton Bank to more efficiently, securely, and cost-effectively meet the needs of their customers.”

Finzly specializes in connecting banks and their customers via a real-time payment services hub and cloud-based bank operating system, BankOS, delivering a modern, digital banking experience. The company’s platform leverages open APIs and integrations into core technology to enable financial institutions to subscribe, try, and launch both Finzly’s and third-party fintech apps and solutions. With FX STAR, Finzly’s customers are able to execute foreign currency transactions, purchase foreign currencies in bulk using multi-currency accounts, as well as initiate payments. EXIM STAR serves as an international trade finance solution to help financial institutions manage the transaction lifecycle for commercial letters of credit, standby letters of credit, and documentary collections.

“We recognize Finzly as a proven provider that understands the unique business needs of regional financial institutions,” Fulton Bank International SVP and Manager Amy Sahm said. “Through the implementation of their user-friendly platform, our bank has been able to achieve better standard functionality across the board – from improved access to reports and confirming trades, to upgrades in investigation and reconciliation capabilities.”

Fulton Bank operates more than 223 financial centers in Pennsylvania and New Jersey, as well as in the mid-Atlantic states of Maryland, Delaware, and Virginia. The firm is a subsidiary of Fulton Financial Corporation, a financial holding company based in Lancaster, Pennsylvania, with $26 billion in assets.

Finzly made its Finovate debut in 2019. The Charlotte, North Carolina-based company most recently demonstrated its digital account opening solution at FinovateWest 2020, earning a Best of Show award from conference attendees. This year, in addition to its partnership with Fulton Bank, Finzly teamed up with Lead Bank, a Kansas City, Missouri-based “community-minded” commercial bank. Lead Bank implemented Finzly’s Payment Hub – part of Finzly’s Bank OS – to boost its own payment and digital capabilities.

“The ability to service our fintech and corporate clients with a Banking as a Service solution, as well as communicate messages to and from the core platform, is crucial to fulfilling and facilitating the requirements of Lead Bank and our channel partners,” Sheila Stratton, Director of Digital Strategy, Lead Bank said. “Finzly’s solution provides a modern technology platform in which our bank can expand payment capabilities while tapping a flexible and innovative solution to support our bank in delivering on the specialized needs of our clients.”

As well as partnerships, 2021 marked the launch of Finzly’s SWAP STAR solution. The new technology provides an end-to-end, sales, trading, and post-trade processing system for interest rate derivatives. SWAP STAR is available as an app within Finzly’s BankOS cloud-based bank operating system.

Photo by Andre Furtado from Pexels