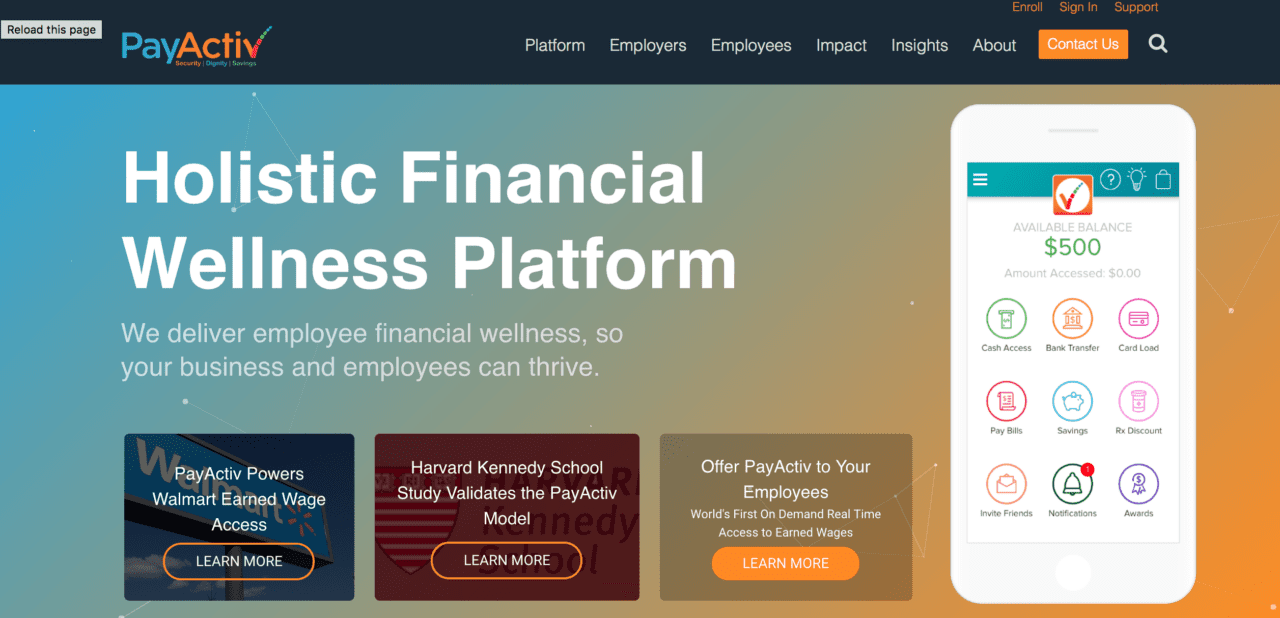

Employer-provided financial wellness platform PayActiv is receiving some wellness of its own this week in the form of $20 million. The Series B financing round was led by Generation Partners, with contributions from existing investors Ziegler Link•Age Fund II and affiliate funds of Softbank Capital.

Combined with its previous investments totaling $13.5 million, today’s round more than doubles PayActiv’s total funding, which now adds up to $33.5 million. PayActiv will use today’s investment to expand its platform, accelerate growth, and develop more financial solutions for workers across the globe.

Mark Jennings, Managing Partner at Generation Partners, said that his firm chose to invest because it believes PayActiv has “the potential to positively change the lives of millions of workers, while also growing a profitable and successful business.”

The California-based company has experienced significant growth since its launch in 2012, expanding six-fold in the past year alone. Contributing to that growth was a large-scale contract signed with Walmart in December of 2017 and an agreement with ADP in July of 2018, which makes PayActiv’s services available to more than 600,000 businesses across the U.S.

Commenting on the growth, John Hawkins, Managing Partner at Generation Partners, said, “PayActiv has created a massive positive impact on the relationship between employees and employers. Already, they are settling more than $100 million in earned wage access transactions each month, and the company estimates that employees are avoiding an estimated $10 million each month in eliminated late charges, overdraft fees, and interest charges.”

As part of the deal, Hawkins will join the PayActiv Board of Directors.

At FinovateSpring 2016, PayActiv CEO and Founder Safwan Shah demonstrated how the PayActiv app encourages saving by helping users approach saving in units of time vs. percent of income. Earlier this fall, NPR featured PayActiv as Walmart’s payday loan alternative and in May the company was highlighted in the Wall Street Journal as a better alternative to payday loans.

Presenters

Presenters

Lincoln Yin, CEO

Lincoln Yin, CEO