![]() This post is part of our live coverage of FinovateEurope 2015.

This post is part of our live coverage of FinovateEurope 2015.

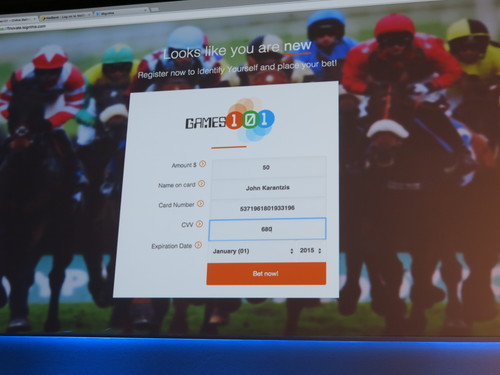

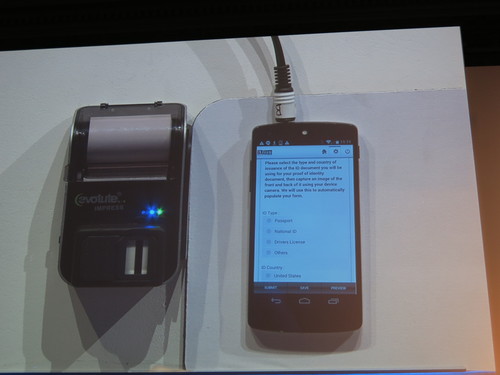

Cash Payment Solutions replaces traditional banking branches by enabling the consumer to do the most basic banking service (cash-in/cash-out) at local stores nearby with better availability; for example, flexible opening hours on Sundays. The service is conveniently combined with shopping, and more than 500 companies are successfully using CPS payment infrastructure to accept payments from different verticals like E-commerce, online gaming, utilities, and payment-collection companies.

Cash Payment Solutions is showing new-use cases outside existing verticals for mobile banking, insurance, and local authorities.

Product distribution strategy: Direct to Consumer (B2C), Direct to Business (B2B)

HQ: Berlin, Germany

Metrics: €4.65 million euros raised, 25 employees

Website: cashpaymentsolutions.com