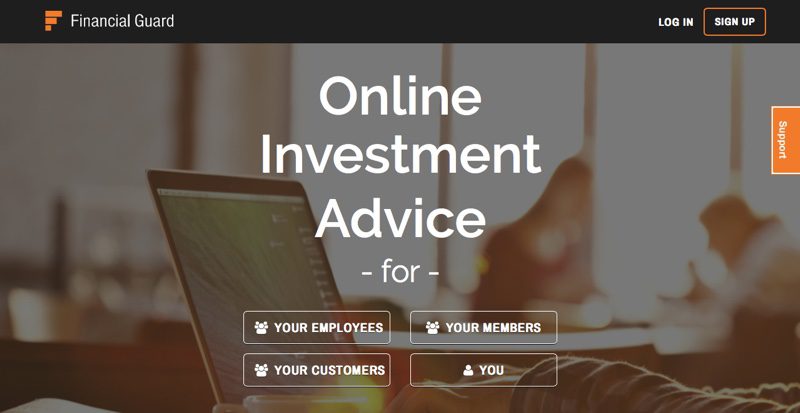

Legg Mason has acquired a majority stake in online investment adviser Financial Guard. Terms were not disclosed. Financial Guard will become a part of Legg Mason’s alternative distribution strategies business which specializes in helping the global asset manager’s investment affiliates leverage financial technology to serve customers better.

Global Head of Distribution for Legg Mason, Terence Johnson, highlighted this point, saying that technology has played a major role in “redefining consumer expectations” and that financial services companies “need a comprehensive, accessible, secure technology solution to serve their clients in this dynamic environment.” Johnson praised Financial Guard’s “simple and scalable platform” for both active and passive investing, saying the combination of the online technology platform and Legg Mason’s investment offerings would be a boon for its partners and their customers.

Left to right: Business Development Director A.J. Remlinger and President Kevin Pohmer demonstrated Financial Guard at FinovateFall 2013 in New York.

“We are excited to combine our intuitive, wide-ranging technology solution with Legg Mason’s diverse investment capabilities, scale and global reach,” said Cary Jenkins, chief innovation officer for Financial Guard. “As adoption of technology-enabled advice grows, we believe we will be well-positioned to serve the adviser channel.”

Jenkins also highlighted the retirement market in particular as an area where Financial Guard may be especially helpful to plan sponsors and “the smaller segment of the market that will continue to need advice.” As part of the acquisition, Legg Mason will also be adding to the Financial Guard platform with other investment solutions from its nine independent investment advisers, including from QS Investors.

Founded in 2010 and headquartered in Salt Lake City, Utah, Financial Guard demonstrated its technology at FinovateFall 2013. The company, which has been profiled in Barron’s, Bloomberg.com, Employee Benefit News, launched its enhanced fee-transparency service in May of last year.