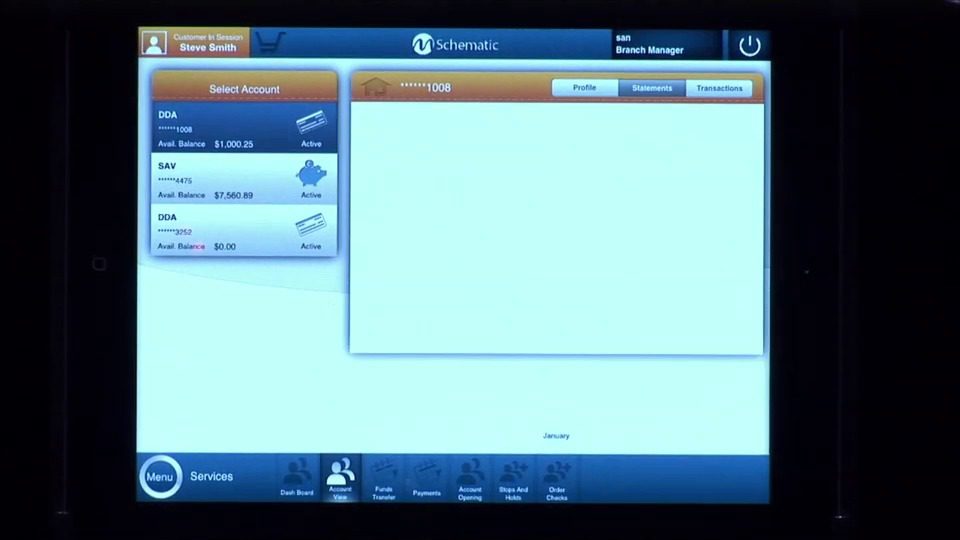

How they describe themselves: Zenmonics is a provider of information technology services and mobility products to the global financial markets. We work directly with financial institutions as well as FinTech 100 partners to deliver unique capabilities in core system extensions, channel integration, and digital applications. Through our mobility platform, mSchematic, we offer financial institutions the ability to deploy a common platform that can support mobile banking, online banking, mobile banker, and mobile wallet initiatives.

How they describe their product/innovation: Our pioneering mobileBanker tablet gives universal associates access to sales and servicing features both inside and outside the branch or store.

Built upon our secure channel integration technology, mobileUNITED, banks can easily extend their current systems without costly core system upgrades or lift-and-replace projects. The system-agnostic approach provides an accelerated path for financial institutions to have customer data, product information, sales tools, and account opening at their fingertips – whether they are meeting with customers inside or outside the branch.

This disruptive platform is uniquely positioned to align to current branch transformation initiatives and become the leading form factor for lean advice centers.

Product Distribution Strategy: Direct to Business (B2B), through financial institutions, through other fintech companies and platforms, & licensed Key Executives: Riaz Syed (CEO & Founder) & Chris Siemasko (SVP Product Solutions)

Contacts:

Bus. Dev., Press, & Sales: Chris Siemasko, SVP Product Solutions, [email protected], 704-564-1107

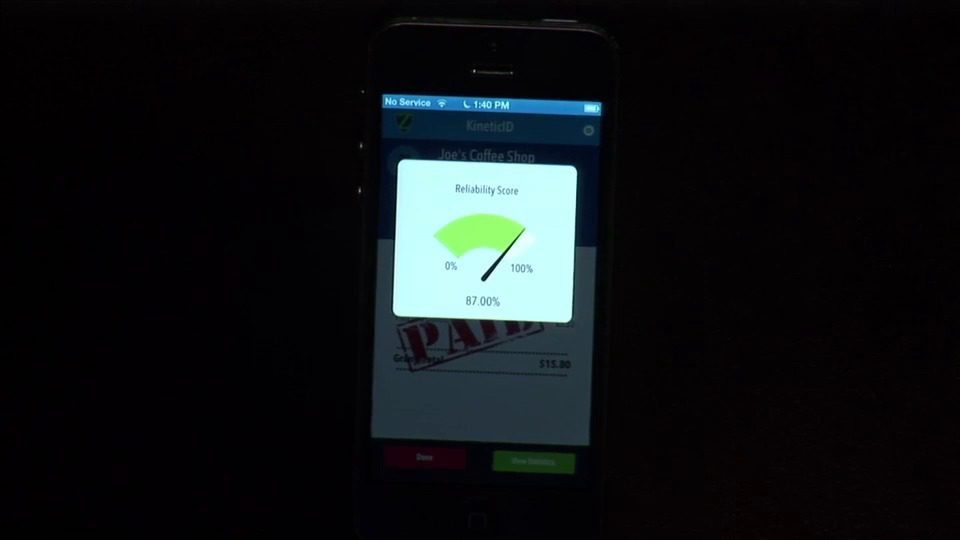

How they describe themselves: With operations in North America, the Middle East, and India, Zighra is playing a leading role in leveraging mobile telephony, collective intelligence, and implicit user authentication to reduce online and offline payment fraud. Our mission is to close the payment fraud gap, accelerate legitimate transactions, and build trust between consumers, merchants, and financial institutions.

How they describe their product/innovation: Zighra KineticID provides effortless, automatic, and instantaneous user recognition by adding an invisible security layer to mobile authentication. KineticID implicitly recognizes a user by actively evaluating the user’s unique kinetic interaction signature with their mobile device. Securely avoiding mandatory password and pin authentication eliminates observational shoulder surf, keylogger, and touchlogger risks vectors.

Product Distribution Strategy: Direct to Business (B2B) & through other fintech companies and platforms

Contacts:

Bus. Dev. & Sales: Vivekanand Gopalan, Director of Sales, [email protected]

Press: Deepak Dutt, CEO

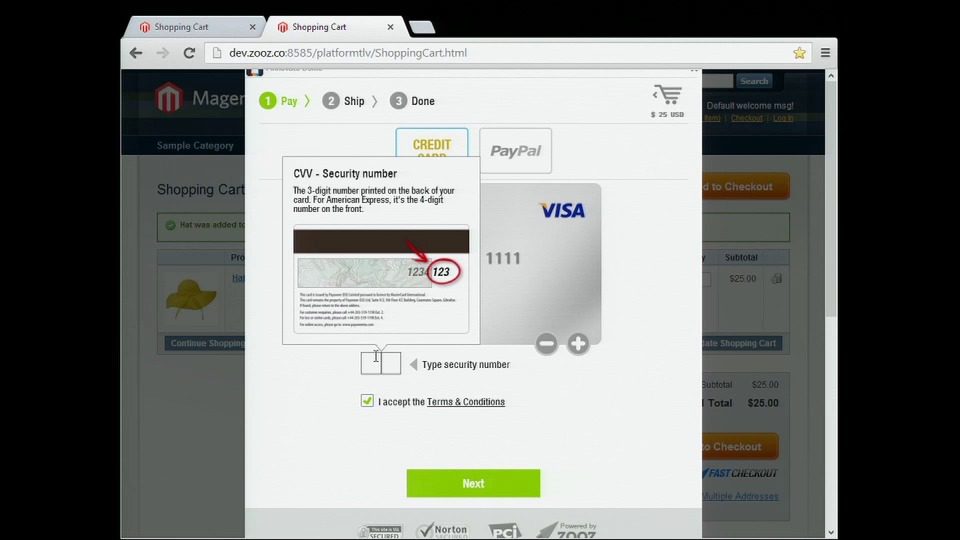

How they describe themselves: Zooz is a global payment platform that enables ecommerce merchants to optimize their checkout across all channels. We provide merchants and developers with a plug and play solution that lets them present their users with a fast, one-tap checkout experience and increase their conversion rates.

Zooz’s approach is focused on users’ behaviors and needs and not just on technical aspects of payments. Zooz has partnered with leading payment gateways, processors, and e-wallets in the world to ensure that both users and retailers enjoy full flexibility.

How they describe their product/innovation: We showed an exciting new version of our product, which takes consumer experience to the next level, and presented a case study of our strategic partnership with FirstData.

Product Distribution Strategy: Direct to Business (B2B), through financial institutions, & through other fintech companies and platforms

Contacts:

Bus. Dev., Press, & Sales: Noam Inbar, VP Bus. Dev.

How they describe themselves: As the convergence towards the smart phone crystallises, the need for the security is paramount, and telecommunications is at the core of the capability. At ValidSoft, we offer world-class telecommunications based security solutions, custom built for the new mobile landscape, and are the only software security company in the world with three European Privacy Seals. ValidSoft has the world’s only indigenous, IP based, secure multi-layer, 5-factor indigenous platform, preventing fraud before it happens and virtually eliminating very costly false-positives. At the heart of our security model is a focus on real-time “invisible” authentication and transaction verification.

How they describe their product/innovation: ValidSoft’s SMART platform caters for the disparity in mobile networks and devices, use cases and the corresponding transactional risk intrinsic in mobile payment applications. SMART achieves this by providing a layered architecture of voice and mobile network‐based security protocols and technologies, both visible and invisible, to protect mobile payment and M‐banking transactions alike.

Contacts:

Bus. Dev. & Sales: John Petersen, Global Head, Business Development,

[email protected]

Press: Emmanuelle Filsjean, Global Head, Marketing, [email protected]

How they describe themselves: Virtual Piggy is the first e-commerce solution that enables kids to manage and spend money within parental controls. The technology company delivers online security platforms designed for the Under 18 age group and also enables online businesses the ability to function in a manner consistent with the Children’s Online Privacy Protection Act (“COPPA”) and similar international children’s privacy laws. Virtual Piggy enables the Under 18 audience to play, transact, and socialize in a secure online environment guided by parental permission, oversight, and control.

How they describe their product/innovation: Virtual Piggy’s new mobile app will bring an innovative new technology to the market that will have a disruptive impact on global m-commerce. With over a billion U18’s worldwide shopping online at an earlier age and becoming more proficient than any previous generation with internet enabled devices, Virtual Piggy noticed that there was no easy mechanism for this group to transact online. All existing methods involved friction and often resulted in undesirable outcomes, such as fraud. Virtual Piggy’s technology allows merchants to sell to U18s in a COPPA compliant, parent approved manner, unlocking an estimated $211B in annual spending power for online retailers.

Contacts:

Bus. Dev.: Dr. Jo Webber, CEO & Founder, 310-853-1950

Press: Jenna Guarneri, Sarah Hall Productions, [email protected]

Sales: Tom Keefer, EVP Global Sales, 310-853-1950

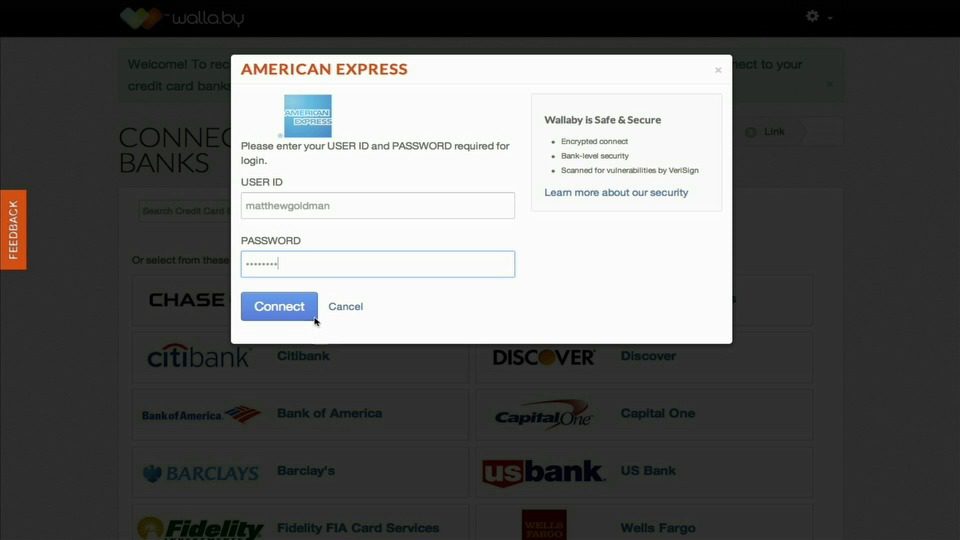

How they describe themselves: Wallaby is building the first service to combine a cloud-based wallet with an intelligent credit card. Working alongside a consumer’s existing credit cards, Wallaby’s unique App and digital wallet ensure that a consumer automatically maximizes credit card rewards from each purchase. In addition to gaining the most travel or cash back rewards from their cards, consumers can also set credit card preferences, and designate the percentage of spending that should go to individual cards. Wallaby also makes it easier for consumers to take advantage of marketing offers from merchants and banks to optimize their spending even further.

How they describe their product/innovation: We will demonstrate the new Wallaby Wallet Boost. This makes it easy for consumers to build the ideal mix of credit cards for their particular needs. Wallet Boost extends the power of the patent-pending Wallaby Engine. Wallet Boost delivers intelligent, real-time credit card recommendations to help consumers identify the optimal collection of credit cards that will earn them the most rewards, cash back, or help reduce interest. Consumers add current credit card accounts to Wallet Boost, which scans recent past transactions, and produces a customized recommendation on which cards the user should acquire to maximize their financial goals.

Contacts:

Bus. Dev. & Sales: Kimberly Fraser, VP Business Development, [email protected]

Press: Peter Mansfield, Marketing, [email protected]

How they describe themselves: Yandex.Money is a fast, secure and reliable way for e-businesses to collect payments, and an effective solution for targeting Russia and Russian-speaking countries, including the CIS. Yandex.Money facilitates access to the Russian market by attracting new customers and introducing partners’ products to millions of users.

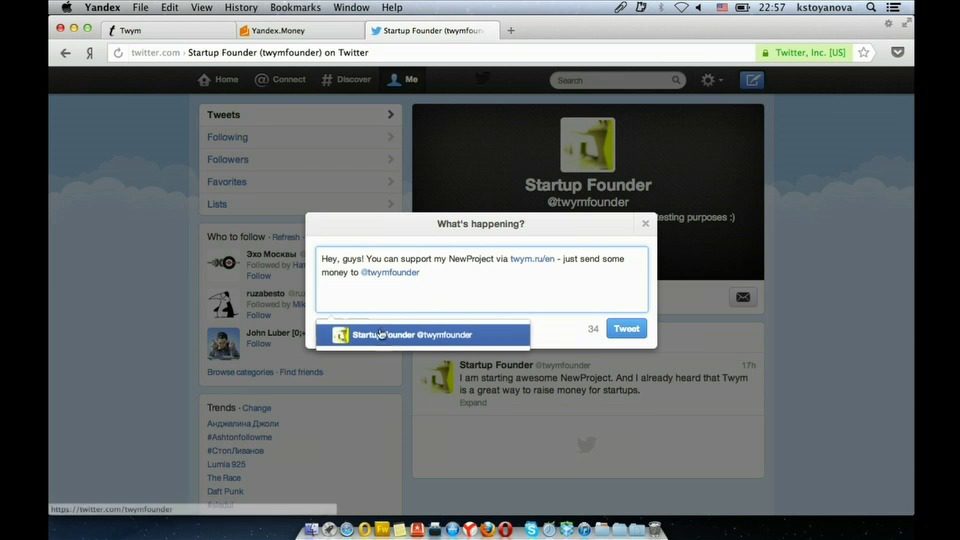

How they describe their product/innovation: Twym is designed to facilitate instant transfers in rubles between Twitter users who have Yandex.Money accounts. To send money, users send a tweet that includes @twymru, the recipient’s username on Twitter, and the amount they want to transfer. If the recipient has already activated Twym, they receive the rubles immediately. If not, they will be prompted to activate Twym and receive the money after they have done so. If someone retweets a money tweet, another transfer will be made from their Yandex.Money account to the same recipient – a useful feature for fundraising campaigns.

Contacts:

Bus. Dev.: Maria Gracheva, Director Business Development, [email protected]

Press: Asya Melkumova, Head of Public Relations, [email protected]

Sales: Dmitriy Danilenko, Chief Commercial Officer, [email protected]

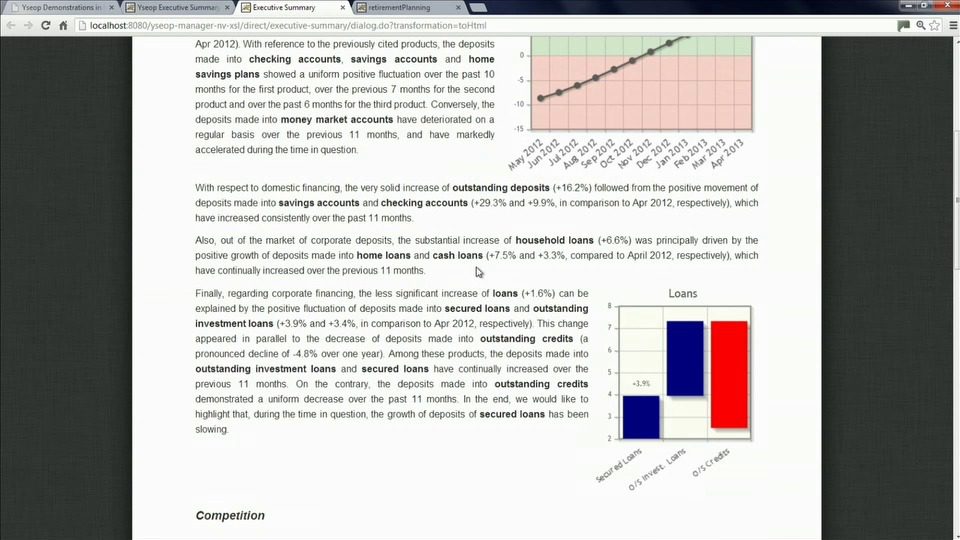

How they describe themselves: Yseop creates a new age where financial services delivered to customers are driven by artificial intelligence and human collaboration. Using a patented-technological solution based on artificial intelligence and natural language generation, Yseop boosts the productivity of business teams by automating best practices & delivering personalized expertise. Yseop is the first software that writes (and speaks) intelligent text, just like a human being, but at a speed of over a thousand pages per second. Yseop analyzes your financial and customer data, dialogs intelligently with the banker to help him or her analyze a customer’s situation and produces written conclusions. Yseop writes comments and personalized recommendations in natural language (English, Spanish, French, etc.). Yseop automates the production of personalized reports, executive summaries, prep-to-meeting materials, meeting summaries, online expert guidance and more.

How they describe their product/innovation: Yseop Financial represents the latest round of financial applications developed on Yseop’s technology. This suite of products covers the full range of possibilities offered by Yseop’s text-generating software, including a prep-to-meeting report, an automatically generated two-page financial executive summary based on the latest market data, and a personalized retirement planning application.

Contacts:

Bus. Dev. & Sales: Matthew Kropp, Director Sales, [email protected], 214-393-9719

Press: Elizabeth Farabee, VP Marketing, [email protected], +33-6-5904-3350

How they describe themselves: Zooz is a unique payment platform that offers a comprehensive solution for e-commerce websites and mobile apps. We provide merchants and developers with a set of tools that enable them to give their consumers an optimized payment experience with one tap checkout and increase their conversion rates, based on smart consumer insights generated by our platform.

Zooz’s approach is focused on users’ behaviors and needs and not just on technical aspects of payments. Zooz has partnered with leading payment gateways, processors, and e-wallets in the world to ensure that both users and retailers enjoy full flexibility.

How they describe their product/innovation: We will show an exciting new feature that would demonstrate an important use case of the Zooz consumer driven platform capabilities.

Contacts:

Bus. Dev., Press & Sales: Noam Inbar, VP Business Development, [email protected],

(o) 718-878-5775, (m) +972-54-442-6643

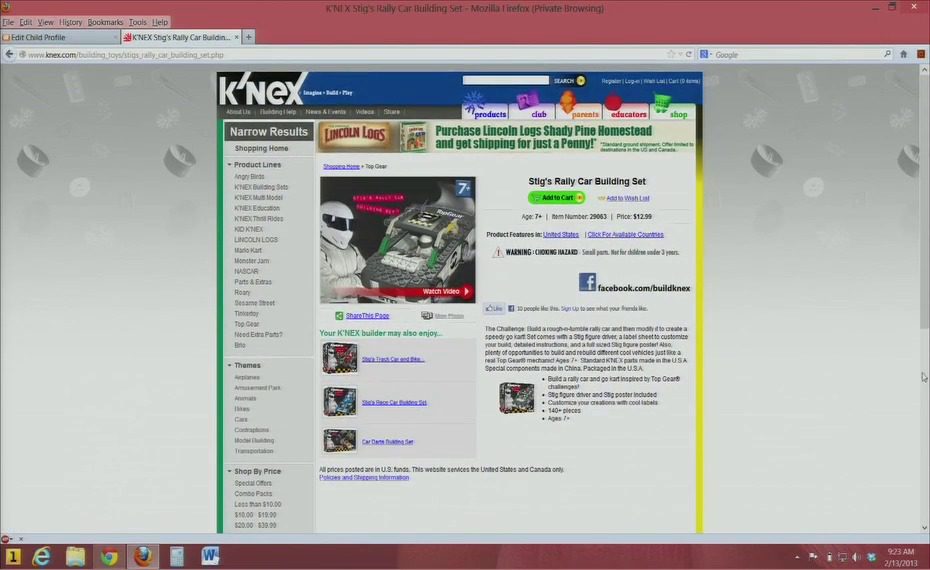

How they describe themselves: Virtual Piggy provides a unique solution to the Under 18 market. With over a billion U18s worldwide shopping online at an earlier age and becoming more proficient than any previous generation with internet-enabled devices such as tablets and smartphones, Virtual Piggy noticed that there was no easy mechanism for this group to make online purchases. All existing methods for this group involved a lot of friction and often resulted in undesirable outcomes such as fraud. Virtual Piggy’s technology allows merchants to sell to U18s in a COPPA compliant, parent-approved manner, thereby unlocking an estimated $50B+ in annual spending power.

How they describe their product/innovation: Virtual Piggy is the first e-commerce solution that enables kids to manage and spend money within a parent-controlled environment. The technology delivers online security platforms designed for the Under 18 age group in the global online market, and also enables online businesses the ability to function in a manner consistent with the Children’s Online Privacy Protection Act (COPPA) and similar international children’s privacy laws. Virtual Piggy enables the U18 audience to play, transact and socialize in a secure online environment guided by parental permission, oversight and control.

Contacts:

Bus. Dev.: Jo Webber, CEO & Founder, +1 310-853-1950

Press: Rebecca Howell, Marketing & Communications Manager, [email protected]

Sales: Tom Keefer, EVP Global Sales, [email protected]

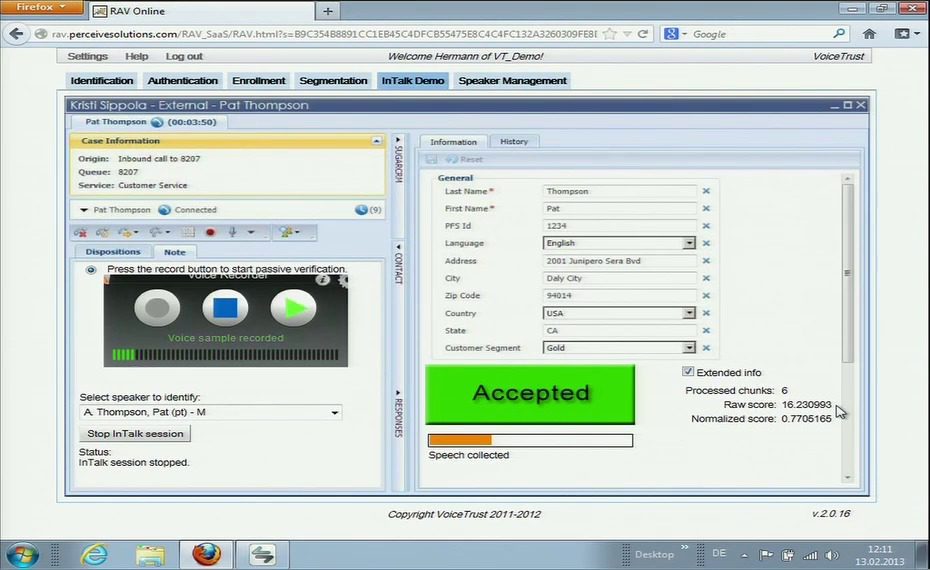

How they describe themselves: VoiceTrust is a global provider of voice biometric solutions, dedicated to continuous innovation and development of patented technologies and solutions. VoiceTrust leverages its domain expertise and intellectual property to deliver highly differentiated real-life solutions. VoiceTrust is backed by a successful Dutch private equity firm and operates globally with customers and footprints in the Americas, Europe and South Asia, Middle East & Africa.

How they describe their product/innovation: inTalk provides a simple, convenient and effective solution to the call center authentication problem by recognizing the customer’s voice using voiceprint biometrics. inTalk passively listens to the person speaking, compares the speaker’s voice to the customer’s voiceprint, and provides identity feedback to the agent. This is all done in the background during a normal, uninterrupted conversation in any language. A green light is displayed when the customer is recognized and a red light alerts the agent when inTalk detects the presence of an imposter.

Contacts:

Bus. Dev., Press & Sales: Roanne Levitt, VP, [email protected]

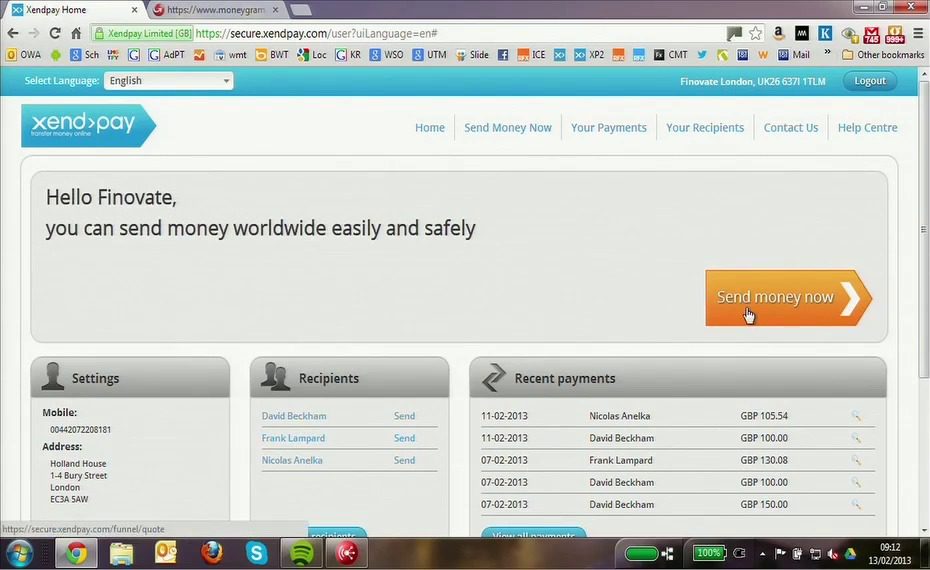

How they describe themselves: Xendpay.com is an online money transfer service that allows users to easily and cheaply send money anywhere in the world from a PC or mobile phone.

Payment can be made via card or bank transfer. Soon it will be possible to pay using cash in a large number of retail locations. Delivery is to bank accounts or, in some countries, to cash collection points via a network of partners. Xendpay is for everyone who sends money overseas including migrants, students, holidaymakers and cross-border shoppers. It is available in 5 languages (English, Spanish, German, French & Polish). Because it keeps everything online, Xendpay is cheaper than the bricks and mortar alternatives. All payments are covered by RationalFX’s FSA authorisation and safety and online security is paramount. The product itself is cloud-hosted and built on a Java framework with extreme scalability in mind.

How they describe their product/innovation: Xendpay itself is very new. However, we are demonstrating a new service – a cash-to-cash mobile international payment. The user will send a money transfer without a payment card or bank account using just their mobile phone from a corner shop. Previously to do this kind of payment the person would have to visit a Western Union (or similar) agent. Xendpay can do conventional card-to-bank payments as well.

Contacts:

Bus. Dev., Press & Sales: Jake Holloway, Xendpay COO, [email protected]