How they describe themselves: Communications compliance is a major issue within financial services, with billions spent annually for management and control of digital messages.

WordSentry is the first innovation to help enforce compliant communications DURING message composition, before written messages leave the corporate premise.

Developed as an application service provider, the WordSentry ASP can be customized to deliver its results via any open or proprietary interface.

How they describe their product/innovation: The demonstration is of WordSentry for Outlook. E-mail messages are composed during the demo and WordSentry analyzes words and phrases for ambiguity, tone, compliance, and emotionality.

Comments are displayed alongside questionable message components, along with explanations of problems detected. When questionable components are corrected or improved the comments disappear and the message is Clear to Send.

Product Distribution Strategy: Direct to Business (B2B), through financial institutions, archiving companies, terminal suppliers, and other fintech companies & platforms

Contacts:

Bus. Dev., Press, & Sales: Harris Turner, CEO, [email protected], 317-281-0082

How they describe themselves: Yodlee is the platform for financial innovation. With the largest collection of consumer and small business transactional data on the planet, Yodlee powers the next generation of digital services, from personal financial management (PFM) to digital wallets & more.

How they describe their product/innovation: When it comes to finances, where you stand depends on which “hat” you’re wearing. Most people have several âshared financesâ in their life. Elderly parents. Spouses. Children. Friends. Now, through a single app, you can manage them all. Yodlee created TANDEM to enable safe and meaningful dialogue about finances between individuals and among groups. With its unique tools to access, learn, manage, project, and control, TANDEM empowers you to make financial decisions as a family, a couple, a group, or a parent. Â And making financial decisions has never been more rewarding or more actionable. Close, Closer, Closest. Regardless of the relationship(s), you get one app, different views, full financial control.

Product Distribution Strategy: Direct to Business (B2B), through financial institutions, & through other fintech companies and platforms

Contacts:

Bus. Dev.: Karim Bhalwani, Strategy & Bus. Dev. Manager, [email protected],

650-980-3647

Press: Melanie Flanigan, Senior Marketing Director, [email protected], 650-980-3707

Sales: Nick Kamali, Inside Sales Rep, [email protected], 650-980-3675

How they describe themselves: Yseop is the first artificial intelligence software, which writes (and speaks) intelligent text, just like a human being, but at a speed of thousands of pages per second. Yseop revolutionizes the financial industry by turning bankers into top sales experts without specific training. For example, Yseop Financial analyzes customer data, dialogs intelligently with the banker to help him analyze the customerâs situation, and produces written conclusions in seconds, which helps the banker to close more business. Yseop automates the production of personalized prep-to-meeting documents, financial reports, executive summaries, online expert diagnosis, guidance and more. Yseop currently writes in English, Spanish, French, etc.

How they describe their product/innovation: Yseop Financial Suite, the latest round of financial applications developed on Yseopâs technology, is designed to boost sales performance in the financial market. This suite of products covers the full range of possibilities offered by Yseopâs text-generating software: including an online personalized expert guidance application for lead generation, whose output can be displayed in multiple languages and a prep-to-meeting report, which demonstrates Yseopâs ability to improve sales productivity in retail or commercial banking. Finally, a third application shows our ability to generate a two-page market summary report based on the latest financial data instantly.

Product Distribution Strategy: Direct to Business (B2B), through financial institutions, & through other fintech companies and platforms

Contacts:

Bus. Dev. & Sales: Matthew Kropp, Sales & Marketing Director, [email protected],

+1 214 393 9719

Press: Elizabeth Farabee, VP Marketing, [email protected], +33 6 59 04 33 50

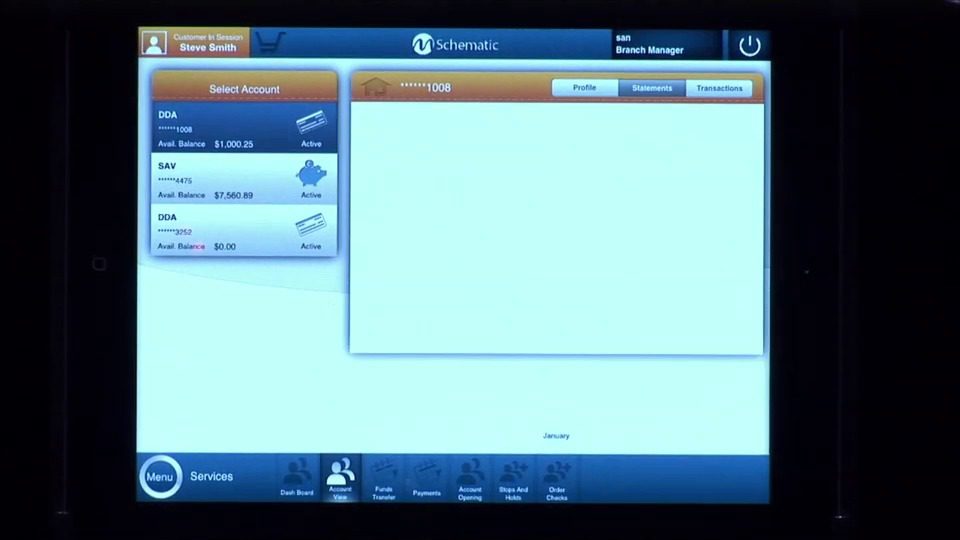

How they describe themselves: Zenmonics is a provider of information technology services and mobility products to the global financial markets. We work directly with financial institutions as well as FinTech 100 partners to deliver unique capabilities in core system extensions, channel integration, and digital applications. Through our mobility platform, mSchematic, we offer financial institutions the ability to deploy a common platform that can support mobile banking, online banking, mobile banker, and mobile wallet initiatives.

How they describe their product/innovation: Our pioneering mobileBanker tablet gives universal associates access to sales and servicing features both inside and outside the branch or store.

Built upon our secure channel integration technology, mobileUNITED, banks can easily extend their current systems without costly core system upgrades or lift-and-replace projects. The system-agnostic approach provides an accelerated path for financial institutions to have customer data, product information, sales tools, and account opening at their fingertips – whether they are meeting with customers inside or outside the branch.

This disruptive platform is uniquely positioned to align to current branch transformation initiatives and become the leading form factor for lean advice centers.

Product Distribution Strategy: Direct to Business (B2B), through financial institutions, through other fintech companies and platforms, & licensed Key Executives: Riaz Syed (CEO & Founder) & Chris Siemasko (SVP Product Solutions)

Contacts:

Bus. Dev., Press, & Sales: Chris Siemasko, SVP Product Solutions, [email protected], 704-564-1107

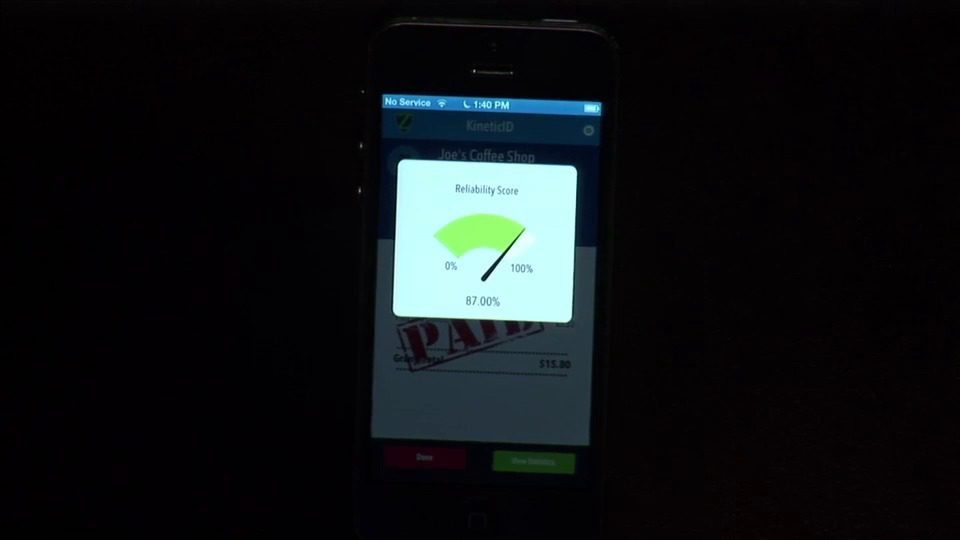

How they describe themselves: With operations in North America, the Middle East, and India, Zighra is playing a leading role in leveraging mobile telephony, collective intelligence, and implicit user authentication to reduce online and offline payment fraud. Our mission is to close the payment fraud gap, accelerate legitimate transactions, and build trust between consumers, merchants, and financial institutions.

How they describe their product/innovation: Zighra KineticID provides effortless, automatic, and instantaneous user recognition by adding an invisible security layer to mobile authentication. KineticID implicitly recognizes a user by actively evaluating the userâs unique kinetic interaction signature with their mobile device. Securely avoiding mandatory password and pin authentication eliminates observational shoulder surf, keylogger, and touchlogger risks vectors.

Product Distribution Strategy: Direct to Business (B2B) & through other fintech companies and platforms

Contacts:

Bus. Dev. & Sales: Vivekanand Gopalan, Director of Sales, [email protected]

Press: Deepak Dutt, CEO

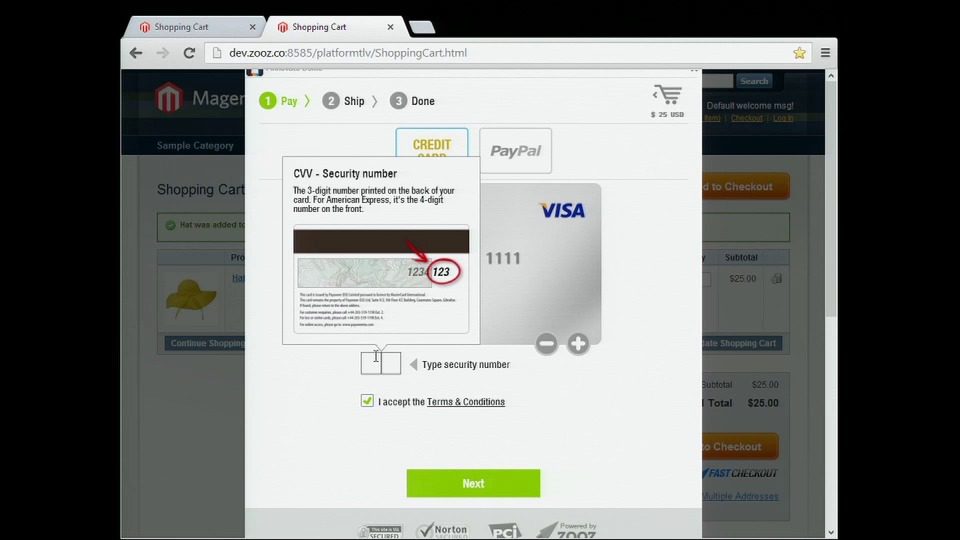

How they describe themselves: Zooz is a global payment platform that enables ecommerce merchants to optimize their checkout across all channels. We provide merchants and developers with a plug and play solution that lets them present their users with a fast, one-tap checkout experience and increase their conversion rates.

Zooz’s approach is focused on usersâ behaviors and needs and not just on technical aspects of payments. Zooz has partnered with leading payment gateways, processors, and e-wallets in the world to ensure that both users and retailers enjoy full flexibility.

How they describe their product/innovation: We showed an exciting new version of our product, which takes consumer experience to the next level, and presented a case study of our strategic partnership with FirstData.

Product Distribution Strategy: Direct to Business (B2B), through financial institutions, & through other fintech companies and platforms

Contacts:

Bus. Dev., Press, & Sales: Noam Inbar, VP Bus. Dev.

How they describe themselves: As the convergence towards the smart phone crystallises, the need for the security is paramount, and telecommunications is at the core of the capability. At ValidSoft, we offer world-class telecommunications based security solutions, custom built for the new mobile landscape, and are the only software security company in the world with three European Privacy Seals. ValidSoft has the worldâs only indigenous, IP based, secure multi-layer, 5-factor indigenous platform, preventing fraud before it happens and virtually eliminating very costly false-positives. At the heart of our security model is a focus on real-time “invisible” authentication and transaction verification.

How they describe their product/innovation: ValidSoftâs SMART platform caters for the disparity in mobile networks and devices, use cases and the corresponding transactional risk intrinsic in mobile payment applications. SMART achieves this by providing a layered architecture of voice and mobile networkâbased security protocols and technologies, both visible and invisible, to protect mobile payment and Mâbanking transactions alike.

Contacts:

Bus. Dev. & Sales: John Petersen, Global Head, Business Development,

[email protected]

Press: Emmanuelle Filsjean, Global Head, Marketing, [email protected]

How they describe themselves: Virtual Piggy is the first e-commerce solution that enables kids to manage and spend money within parental controls. The technology company delivers online security platforms designed for the Under 18 age group and also enables online businesses the ability to function in a manner consistent with the Childrenâs Online Privacy Protection Act (“COPPA”) and similar international childrenâs privacy laws. Virtual Piggy enables the Under 18 audience to play, transact, and socialize in a secure online environment guided by parental permission, oversight, and control.

How they describe their product/innovation: Virtual Piggyâs new mobile app will bring an innovative new technology to the market that will have a disruptive impact on global m-commerce. With over a billion U18âs worldwide shopping online at an earlier age and becoming more proficient than any previous generation with internet enabled devices, Virtual Piggy noticed that there was no easy mechanism for this group to transact online. All existing methods involved friction and often resulted in undesirable outcomes, such as fraud. Virtual Piggyâs technology allows merchants to sell to U18s in a COPPA compliant, parent approved manner, unlocking an estimated $211B in annual spending power for online retailers.

Contacts:

Bus. Dev.: Dr. Jo Webber, CEO & Founder, 310-853-1950

Press: Jenna Guarneri, Sarah Hall Productions, [email protected]

Sales: Tom Keefer, EVP Global Sales, 310-853-1950

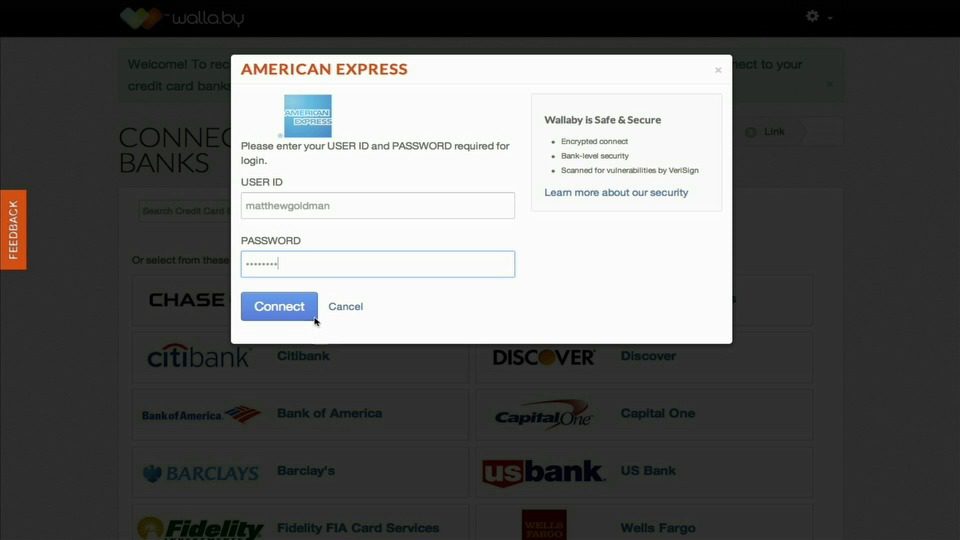

How they describe themselves: Wallaby is building the first service to combine a cloud-based wallet with an intelligent credit card. Working alongside a consumer’s existing credit cards, Wallaby’s unique App and digital wallet ensure that a consumer automatically maximizes credit card rewards from each purchase. In addition to gaining the most travel or cash back rewards from their cards, consumers can also set credit card preferences, and designate the percentage of spending that should go to individual cards. Wallaby also makes it easier for consumers to take advantage of marketing offers from merchants and banks to optimize their spending even further.

How they describe their product/innovation: We will demonstrate the new Wallaby Wallet Boost. This makes it easy for consumers to build the ideal mix of credit cards for their particular needs. Wallet Boost extends the power of the patent-pending Wallaby Engine. Wallet Boost delivers intelligent, real-time credit card recommendations to help consumers identify the optimal collection of credit cards that will earn them the most rewards, cash back, or help reduce interest. Consumers add current credit card accounts to Wallet Boost, which scans recent past transactions, and produces a customized recommendation on which cards the user should acquire to maximize their financial goals.

Contacts:

Bus. Dev. & Sales: Kimberly Fraser, VP Business Development, [email protected]

Press: Peter Mansfield, Marketing, [email protected]

How they describe themselves: Yandex.Money is a fast, secure and reliable way for e-businesses to collect payments, and an effective solution for targeting Russia and Russian-speaking countries, including the CIS. Yandex.Money facilitates access to the Russian market by attracting new customers and introducing partners’ products to millions of users.

How they describe their product/innovation: Twym is designed to facilitate instant transfers in rubles between Twitter users who have Yandex.Money accounts. To send money, users send a tweet that includes @twymru, the recipient’s username on Twitter, and the amount they want to transfer. If the recipient has already activated Twym, they receive the rubles immediately. If not, they will be prompted to activate Twym and receive the money after they have done so. If someone retweets a money tweet, another transfer will be made from their Yandex.Money account to the same recipient â a useful feature for fundraising campaigns.

Contacts:

Bus. Dev.: Maria Gracheva, Director Business Development, [email protected]

Press: Asya Melkumova, Head of Public Relations, [email protected]

Sales: Dmitriy Danilenko, Chief Commercial Officer, [email protected]

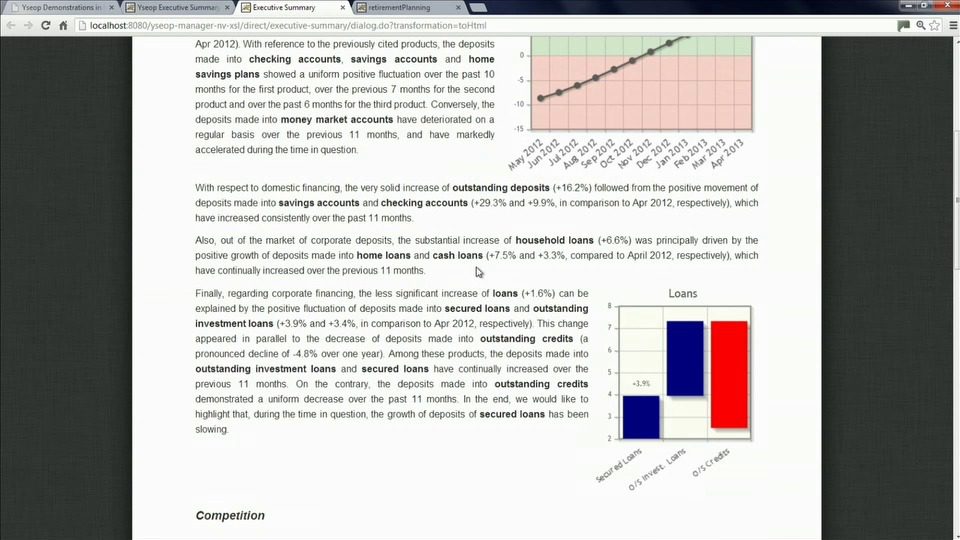

How they describe themselves: Yseop creates a new age where financial services delivered to customers are driven by artificial intelligence and human collaboration. Using a patented-technological solution based on artificial intelligence and natural language generation, Yseop boosts the productivity of business teams by automating best practices & delivering personalized expertise. Yseop is the first software that writes (and speaks) intelligent text, just like a human being, but at a speed of over a thousand pages per second. Yseop analyzes your financial and customer data, dialogs intelligently with the banker to help him or her analyze a customerâs situation and produces written conclusions. Yseop writes comments and personalized recommendations in natural language (English, Spanish, French, etc.). Yseop automates the production of personalized reports, executive summaries, prep-to-meeting materials, meeting summaries, online expert guidance and more.

How they describe their product/innovation: Yseop Financial represents the latest round of financial applications developed on Yseopâs technology. This suite of products covers the full range of possibilities offered by Yseopâs text-generating software, including a prep-to-meeting report, an automatically generated two-page financial executive summary based on the latest market data, and a personalized retirement planning application.

Contacts:

Bus. Dev. & Sales: Matthew Kropp, Director Sales, [email protected], 214-393-9719

Press: Elizabeth Farabee, VP Marketing, [email protected], +33-6-5904-3350

How they describe themselves: Zooz is a unique payment platform that offers a comprehensive solution for e-commerce websites and mobile apps. We provide merchants and developers with a set of tools that enable them to give their consumers an optimized payment experience with one tap checkout and increase their conversion rates, based on smart consumer insights generated by our platform.

Zoozâs approach is focused on usersâ behaviors and needs and not just on technical aspects of payments. Zooz has partnered with leading payment gateways, processors, and e-wallets in the world to ensure that both users and retailers enjoy full flexibility.

How they describe their product/innovation: We will show an exciting new feature that would demonstrate an important use case of the Zooz consumer driven platform capabilities.

Contacts:

Bus. Dev., Press & Sales: Noam Inbar, VP Business Development, [email protected],

(o) 718-878-5775, (m) +972-54-442-6643