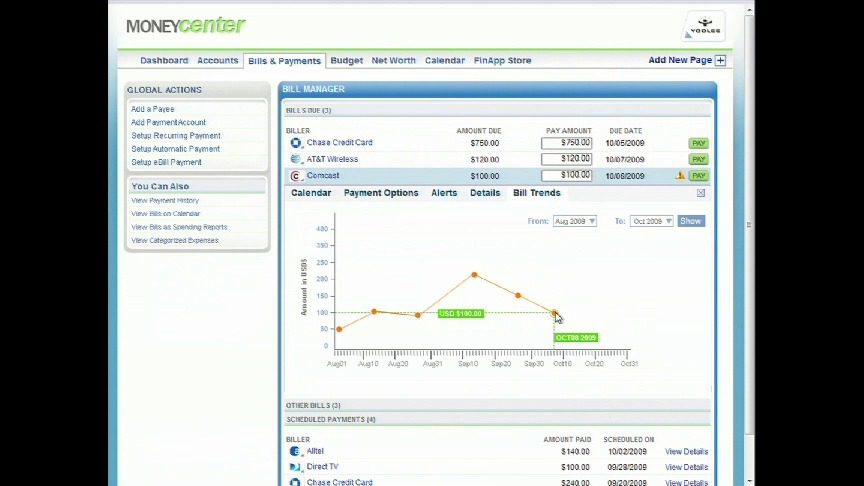

How they describe themselves: Yodlee is the leading provider of personalized financial solutions. Major financial institutions and portals trust Yodlee to power their most critical online financial applications. Yodlee’s PFM, payments, and customer acquisition solutions unify all personal financial account information to deliver a simple, centralized and secure source for consumers to manage all of their financial tasks anytime, anywhere. Every Yodlee solution helps financial providers save money over legacy systems and generate new revenue. Yodlee’s patented data, payments and risk management utility supports more account sources and types than anyone else in the industry. 150+ leading financial institutions and portals today offer Yodlee-powered solutions to millions of consumers worldwide.

What they think makes them better: Yodlee operates the world’s most robust, scalable, and secure data and payments utility, powering mission-critical financial applications that require access to diverse and disparate personal data. Differentiators include:

- 11,000+ sources and 100,000+ account types – the broadest/deepest financial account coverage in the industry – available anytime, anywhere

- Market-leading PFM that is complete, insightful, and actionable – Yodlee powers 85% of the industry today

- Only payments platform that lowers cost and generates revenue with every transaction

- Proven security leadership; audited and supervised like a bank

- Saas deployment model, suitable for banks, portals, and start-ups

- 30 issued patents on collecting, consolidating, and presenting data and payments in online and mobile environments

Contacts:

Biz Dev: Darren Voges, Director of Bus. Dev., 650-980-3683, [email protected];

Sales: Valerie Guillory, Sales Manager, 650-980-3658, [email protected];

Press: Melanie Flanigan, Senior Director of Marketing, 650-980-3707, [email protected]

How they describe themselves: Valuecruncher provides online interactive analyst reports (equity research) covering a broad range of companies in multiple markets. While providing recommendations for everyone, more advanced users can modify the valuation in the report using our interactive tools to adjust the discounted cash flow analysis (DCF). Modified valuations can be saved and shared. Valuecruncher currently covers 745 companies from the S&P500 (United States), FTSE350 (UK), TSX Composite (Canada), ASX200 (Australia) and NZX50 (New Zealand). Of the S&P500 Valuecruncher covers 370 companies. Valuecruncher is currently covering these 745 companies at an average cost of less than US$20 per company per month.

What they think makes them better: Traditionally analyst reports have been static documents – a review and valuation of a company completed by an analyst or team. These reports have got more complex over time. The reports also cannot be interacted with – you have to take the analyst’s assumptions as given. Valuecruncher changes this. Valuecruncher supplies a valuation for each company based on consensus estimates for key assumptions and Valuecruncher inputs. Anyone can then modify the valuation in the report using our interactive tools to adjust the discounted cash flow analysis (DCF). Modified valuations can be saved and shared.

Contacts:

Bus. Dev. & Sales: Mark Clare, CEO, [email protected], +64-21-470227, Skype: markclare

Press: Julia French, Managing Director, Covered Communication, [email protected], 415-216-6691

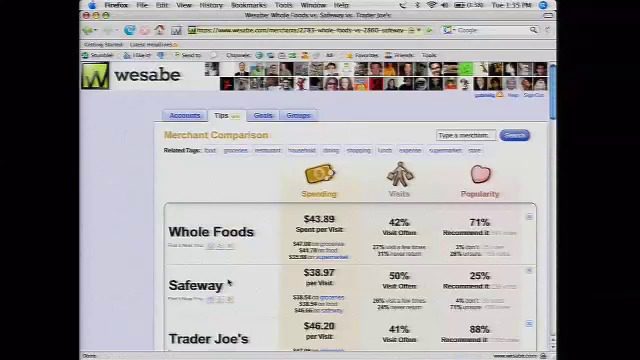

How they describe themselves: Wesabe’s web-based software helps consumers better understand their money, make good decisions and improve their financial health. Wesabe provides the Springboard platform of web-based personal finance management tools to financial institutions for their customers and members, and also delivers the leading social personal finance community on the web at Wesabe.com. The company’s suite of money management tools lets consumers see all their financial data in one place as well as ways to get more value for their money. Named “Best Free Budgeting Web Site” by Kiplinger’s, Wesabe supports more than 6,000 financial institutions in more than 30 countries.

What they think makes them better: Wesabe was the first web-based money management site, has the deepest experience, and has the largest, most active community in the space. Wesabe is a “learning” platform, where every user enriches the system based on how they tag transactions, where they shop, what Cutbacks they choose to accept, and what decisions they make. This vast consumer spending and transaction database can be used by financial institutions to help their customers make better financial decisions. In addition, Wesabe has always been unbiased in its approach, has never accepted advertising or sponsorships, and doesn’t sell financial products or try to steer members to the lowest interest rate.

Contacts:

Bus. Dev. & Sales: Gabriel Griego, [email protected], 510-599-9009

Press: Debbie Pfeifer, Director of communications, [email protected], 206-954-6831

How they describe themselves: WeSeed’s mission is to enable real, everyday people – the 100 million people who have never invested on their own – to learn about the stock market by starting with the things they already know and love, whether it’s their passions, their professions, their kids, or the brands and products they use every day. The goal is to let anyone, regardless of age, experience level, or cash flow, learn by doing within the power of a community that’s there for insights, support, tips, and inspiration.

What they think makes them better: There are several virtual investing sites available, though many are private or aimed only at professionals or students. WeSeed’s biggest strengths lie in the approach we take to investing and our newly launched WeSocial features. Learning about investing with WeSeed is about building on what you already know as a consumer and a smart, motivated person, not learning an entirely new language and system built around professional trading. No other virtual investing site has the social features that WeSeed has built with WeSocial, including groups or networks, teams, and the ability to further interact with other users.

Contacts:

Bus. Dev.: Joel Reese, Content Manager, [email protected] or

Caitlin Rosberg, Community Manager, [email protected]

Sales: Bridget Horgan, Corporate Advertising Manager, [email protected]

Press: Jennifer Openshaw, President, [email protected], 203-542-7223

How they describe themselves: ZimpleMoney is a “software as a service” that enables individuals, businesses, financial institutions, non-profits, and charitable foundations to administer financial agreements in a hosted, secure and private environment. Agreements include: loans, leases, rents, billing, investments, contract collections, tithing and dedicated deposits plans. Current product offerings include a Free Loan Tracker, Family & Friend Loan Manager, and ZimpleBilling system. ZimpleMoney sends bills; receives and distributes payments; posts payments to ledgers; sends late notices and alerts; documents gifted principal and interest; and provides tax records. ZimpleMoney also provides digital document management and in-network messaging and communication.

What they think makes them better: ZimpleMoney is the only web-based financial services platform designed for white-labeling and re-branding. It is a highly flexible application adaptable to nearly any recurring billing function that requires tracking, documentation, and communication. ZimpleMoney’s database manages financial transactions, certifies payments, and facilitates liquidity. All relationships are managed in a secure, safe, and private network of known participants. Licensees and 3rd party users control rules and authorities to manage their organizations, member, and group portfolios. Consumer members have access to all financial agreement products. As we continue our product releases ZimpleMoney will offer dedicated deposits products.

Contacts:

Bus. Dev., Sales and Press: Steve Rabago, Z.E.O., [email protected], mobile: 949-375-1320, office: 949-209-9844 x510

How they describe themselves: Vidoop provides enterprise-level, multi-factor authentication solutions tailored to the unique needs of enterprise and financial institutions. Using the revolutionary ImageShield and new technologies to defend against the prevalent forms of password theft, Vidoop keeps your name out of the paper, your customers out of the support department, provides a superior customer experience and an opportunity to cross-sell to your users. The system is easily deployed and integrated and layers naturally with existing login security systems. Vidoop offers this technology to its customers at little or no cost. Vidoop’s ImageShield and other solutions secure Web sites, OWA, and Web portals.

What they think makes them better: The ImageShield can utilize sponsored images allowing Vidoop to offer this technology to its customers at little or no cost. Instead of paying millions of dollars for a secure solution, our customers get paid and their users get a smoother, hassle free engagement with your brand. These solutions offer an opportunity to improve user engagement and opportunities to up sell. Vidoop offers choices to its customers. The ImageShield, One-Time Password Via Phone and Confirmation By Phone provides your security solution with unsurpassed flexibility. Vidoop protects your users and increases security without the use of costly hardware solutions. Vidoop allows you to eliminate passwords and challenge questions from your login solution.

Contacts:

Bus. Dev.: Travis Phipps, 918-796-8558, [email protected]

Press: Elizabeth Salter, William Mills Agency, 678-781-7224

Sales: Matt Olenski, VP of Sales, 503-445-0917, [email protected]

How they describe themselves: Wesabe (www.wesabe.com) provides a free, online money management tool that lets members see all their bank and credit card balances and transactions in one place, as well as ways to get the most value for their money. The Wesabe community shares advice and information to help each other make better financial decisions and achieve money-related goals. Wesabe has well over 100,000 members, and supports more than 6,000 financial institutions in 30 countries.

What they think makes them better: Wesabe has by far the most active and engaged community in the online financial management space. In addition, the company gives its members the most choice and control when it comes to their data. Users can choose between four data upload methods, and Wesabe does *not* use a third-party aggregation vendor, believing this would be giving up too much control over member data. Our industry-leading Data Bill of Rights clearly states that member data belongs to our members. Wesabe also has an API, allowing developers to customize their own money management applications.

Contacts:

Bus. Dev. & Sales: Gabe Griego, Vice President of Marketing, [email protected]

Press: Debbie Pfeifer, Director of Communications, [email protected], 206-954-6831

How they describe themselves: WeSeed’s mission is simple: to bring the stock market to the 100 million Americans who don’t own stock by starting with what they know and making the connection between the products and brands they use every day and the companies behind them. We do it by providing stock ideas through a proprietary stock search tool based on their interests; breaking down the stock market into mini markets based on interests like cars, pets and fashion, education from 20 celebrity experts and our own in-house editors; a networking platform that allows them to connect and gain support and confidence from an online social community; and a virtual trading platform so members can ‘test-drive’ stock buying in a safe, risk-free environment.

What they think makes them better: We break down and repackage the stock market so people can engage on their own terms. We simplify and demystify the stock market in a way no one has by:

- Segmenting the market into creative mini-stock markets people understand, such as the games, fashion, or technology markets

- Serving up stock ideas based on their interests using our proprietary search tool WeSearch — and enabling users to create a PortfolioYOU that reflects who they are and what they know

- Learning through non-traditional experts — people who are experts in their field rather than finances — such as food or fashion

- Teaching through visuals, fresh, hip language and the importance of sound financial hygiene rather than technical data or Wall Street jargon

Contacts:

Bus. Dev.: Jamie Just, [email protected], 414-364-9362

Press: Jennifer Openshaw, 203-542-7223, C: 310-980-9252, [email protected]

Sales: Ed McDaries, 312-676-9095, [email protected]

How they describe themselves: Yodlee was founded on two core principles: 1) to provide consumers unprecedented convenience, insight, and control over their finances and 2) to help financial providers cut costs and increase revenues through the online and mobile channels. Yodlee’s industry-leading personal financial management, payments, and customer acquisition solutions allow consumers to consolidate their financial data from any account and manage their finances anytime, anywhere. Yodlee has not only changed the way people manage, interact with, and transact upon their accounts online, but has also made financial institutions’ websites essential to their customers and helped to generate new revenue for banks.

What they think makes them better:

- TECHNOLOGY – Pioneered “account aggregation” in 1999, Yodlee now owns 26 patents for collecting, consolidating, processing, and presenting data from multiple sources online and via mobile devices.

- EXPERIENCE – Yodlee’s scalable, secure operational infrastructure supports millions of users and accounts for 32 of the top 50 global financial institutions with industry-leading performance and accuracy.

- DATA – Yodlee’s data infrastructure is unparalleled, securely collecting data from over 11,000 sources and 100,000 different account types.

- SERVICE – Unlike other vendors, Yodlee solutions can complement or replace any existing online banking and bill payment service. Yodlee offers flexible payment options, over 3,200 eBills, and same-day and card-based payment capabilities to provide numerous advantages to financial institutions and consumers.

Contacts:

Bus. Dev.: Darren Voges, 650-980-3683, [email protected]

Press: Melanie Flanigan, 650-980-3707, [email protected]

Sales: Valerie Guillory, 650-980-3658, [email protected]

How they describe themselves: VaultStreet does what no online financial management application has attempted: makes it easy for institutions and their customers to make the move to paperless, secure online record keeping. An service of Docuthentic, LLC, VaultStreet enables financial institutions, accountants, tax preparers and other financial services providers to offer their consumers services and tools that streamline record keeping and reduce the effort and cost of acquiring financial documents from multiple web sites and online sources. VaultStreet services include automated online financial document collection, authentication of document originality, centralized secure document storage, and the ability to forward documents to a network of trusted advisors.

What they think makes them better: Unlike online personal financial management services, e.g. Mint and Wesabe, and accounting and tax preparation software, e.g. Quicken, VaultStreet makes it simple for consumers to automate the collection, organization, management, and online storage of financial documents from a variety of sources, including the top five online brokerages, nine leading online banks, and leading utilities. VaultStreet is in a unique position to provide institutions and their consumers with valuable, secure and reliable online document storage and organizational tools used mainly at tax preparation, credit loan application and financial advisement as more consumers use online banking and brokerage accounts.

Contacts:

Bus. Dev. & Sales: Paul Hutchins, VP of Bus. Dev. & Strategic Relations, [email protected], 214-500-7575

Press: Ann Dalrymple, Topaz Partners, [email protected], 781-404-2432

How they describe themselves: Vestopia is the first and only online platform that enables users to monitor in real time the actual trades of professional money managers as they invest their own money. The site provides reliable investment perspectives by providing a fully transparent view into the private portfolios of a team of seasoned money managers called “Investment Directors.” By registering free of charge, Vestopia members select an Investment Director to follow based upon their investment approach and market insight. They can then view their real time trades and analysis, receive email or sms alerts, and interact with the Investment Directors through blog postings.

What they think makes them better: Vestopia is focused around the investment decisions of professionals who have been personally vetted, and meet our rigid standards. Vestopia is the first and only service that allows you to view, in real time, actual transactions made by Investment Directors in their own portfolios. They are professionals with real names, photos and biographies. You can get to know them. They come from prestigious and reliable organizations; almost all hold CFAs or MBAs, and financial licenses. They are not anonymous. Further, Vestopia provides a rich platform, where these Investment Directors can explain their every move to members.

Contacts:

Bus. Dev.: Eric Conway, Sr. Mktg. Mgr., [email protected], 415-462-1300×707

Press: Bill Daddi, [email protected], 212-404-6619

How they describe themselves: Wesabe provides a free, online money management tool that lets members see all their bank and credit card balances and transactions in one place, as well as ways to save money. The Wesabe community shares tips and information to help each other make better financial decisions and achieve money-related goals.

What they think makes them better:

Wesabe differs from the competition in several key ways:

- Wesabe does not rely on a third-party aggregation vendor to facilitate the data upload process.

- Wesabe has the largest, most active community in the space, with more than 120 active groups and more than 1,500 member-submitted, money-saving tips.

- The company’s data bill of rights clearly gives members the most control and ownership of their data.

- Wesabe does not accept advertising.

Contacts:

Press: Debbie Pfeifer, Director of Comm., [email protected], 206-954-6831

Bus. Dev.: Jason Knight, CEO, [email protected]