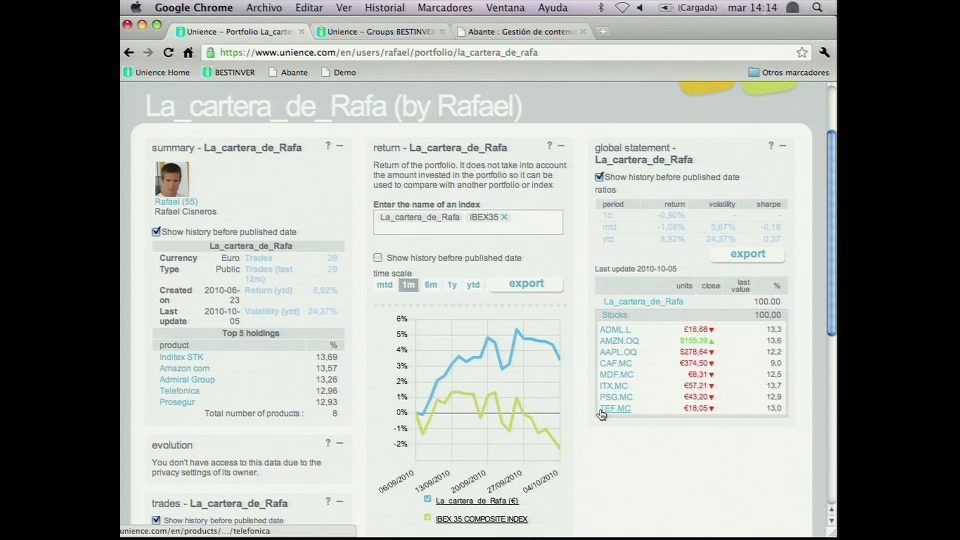

How they describe themselves: Unience is the global financial services social network that brings together direct investors and professionals such as wealth and asset managers. Unience targets:

- Direct investors who seek reinforcement from other sources. Unience helps them contrast their investment decisions with those of other real investors with whom they share real affinity, as well as with advisors.

- Financial institutions, wealth advisors and asset managers. Unience helps them build their independent reputation among investors, fostering transparent relationships. It also helps them exploit social networking concepts applied to financial services in an affordable manner.

- Advertisers from any industry. Unience connects them with a valuable niche client segment.

How they describe their product/innovation: Unience mobile helps investors stay online with their advisors, other investors that share similar interests and their own real investments. It also helps advisors to be closer to their customers, anytime, anywhere. The mobile experience of the global financial social network evolves around the feed of events that may be of interest to you as a member of the community. By means of immediate alerts, it helps you keep track of more than 100 events related to your real investment portfolios, personal or group blogs and changes in your community. It also lets you closely follow your favorite stocks and funds, exchange private messages with other community members and use a powerful search engine to ask for the knowledge of the entire community.

Unience mobile is the first application that uses Unience API, a complete and powerful set of functionalities that will help third parties develop their own applications on top of the global financial services social network.

Contacts:

Bus. Dev.: Nicolas Oriol, Founder & CEO, [email protected], +34647683851

Press: Vicente Varo, Community Manager & PR, [email protected], +34663109391

Sales: Juan Antonio Roncero, Online Manager, [email protected], +34618328319

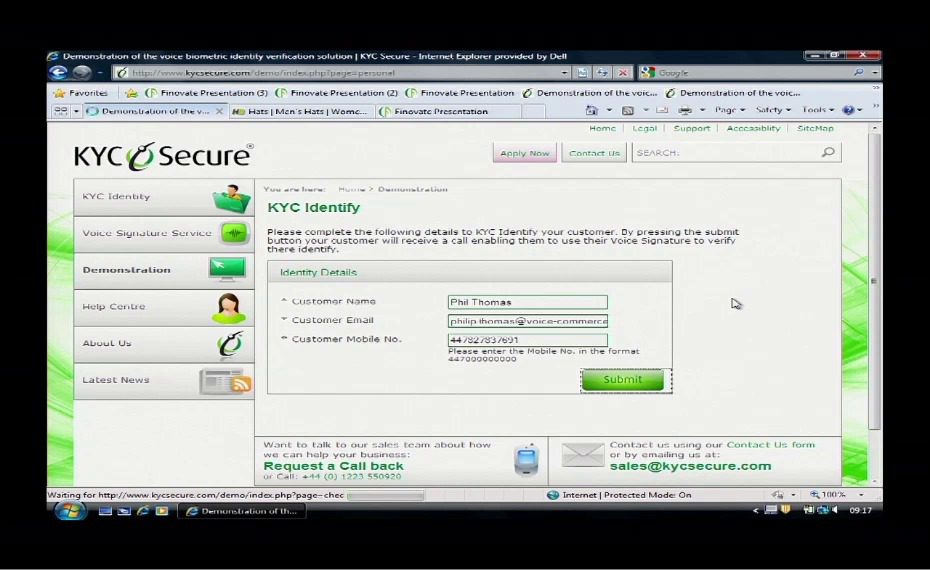

How they describe themselves: Voice Commerce is a regulated Financial Service Group which operates and delivers mobile financial, payment, identity and verification services and solutions to consumers and businesses. Companies within the Voice Commerce Group are authorized by the UK Financial Services Authority under the Payment Services Regulations and provide a range of payment, e-commerce and mobile money services. Many of the innovations and standards used in online, mobile and emerging e-money payment systems since the emergence of the commercial Internet in 1994 were developed by the team at Voice Commerce Group, including the creation of the Internet and Mobile Payments Guarantees, in 2001 and 2010 that protect businesses and cardholders from fraud.

How they describe their product/innovation: KYC Secure is a federated database from Voice Commerce developed to secure and authenticate a consumer’s identity over their mobile phone. It provides any company or financial institution with the means to verify a customer’s identity based on their unique biometric Voice Signature™ in order to significantly reduce exposure to online, credit and identity fraud. KYC Secure® brings together Voice Commerce’s regulated VoicePay® and Cashflows® payment systems and ensures Voice Signatures™ are verified before being stored in the secure VoiceTransact™ database.

Contacts:

Bus. Dev.: Paul Coxwell, Business Development, [email protected],

+44 (0) 1223 550920

Press: Cat Lenheim, PR Executive, [email protected], 020 7608 4699

Sales: Shaun Lavelle, Managing Director, [email protected], +44 (0) 1223 550920

How they describe themselves: Xero is the world’s easiest accounting system with 27,000 small business customers and accountants using its award winning online accounting application around the world. Xero has strategic partnerships with banks and telecoms providers in its core geographies. Founded in July 2006 by successful technology entrepreneur Rod Drury and specialist small business accountant Hamish Edwards, Xero is listed on the New Zealand Stock Exchange (NZX : XRO) and is a fast growing company with teams in New Zealand, Australia, the UK and the United States. In December 2010 Xero was ranked 8th in Deloitte’s Asia Pacific Fast 500.

How they describe their product/innovation: Xero’s SaaS accounting application is revolutionizing small business accounting globally. As well as being the first global online accounting app for small businesses, Xero’s tight integration with customer banking data represents the first real innovation in accounting software in years.

Contacts:

Bus. Dev., Press, Sales: Gary Turner, Managing Director, [email protected],

+44 7590 560561

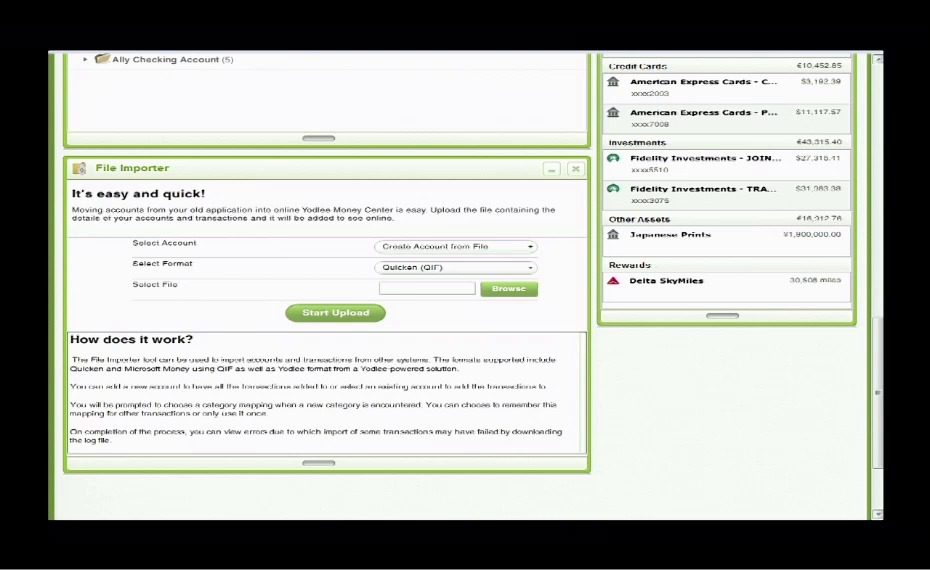

How they describe themselves: Yodlee is changing the face of online banking with a powerful platform that enables new innovation quicker than ever before in a personalized, interactive, and actionable consumer web/mobile experience. Yodlee PFM and payments solutions are designed to generate revenue, lower costs, decrease risk, and deepen customer engagement and satisfaction. The Yodlee FinApp Store is the first consumer-driven, global marketplace for personalized financial applications. By securely unifying all personal financial account information, Yodlee empowers consumers to take control of their finances, anywhere, anytime. More than 300 leading financial institutions and portals today offer Yodlee-powered solutions to millions of consumers worldwide.

How they describe their product/innovation: Personal Financial Management (PFM) is rapidly becoming the de-facto online banking experience in the U.S. The Yodlee 10 Platform is driving much of the innovation, removing the barriers of separate, silo’d financial activities and systems to create a consolidated and actionable experience: what we call personalized finance. The Yodlee FinApp Store further extends the innovation with a new marketplace of financial apps for unprecedented consumer flexibility and control. We will demo the Global Edition of Yodlee 10 with new international language and currency support, developer tools and enablement to create global FinApps, image and document support, and a new user interaction experience for the ~95M online banking users in Europe.

Contacts:

Bus. Dev.: Darren Voges, Director of Business Development, [email protected],

650-980-3683

Press: Melanie Flanigan, Senior Director of Marketing, [email protected], 650-980-3707

Sales: Casey Clegg, [email protected], 650-980-3634

How they describe themselves: Unience is the global financial services social network that, even in turbulent times, empowers investors to contrast their investment decisions with those of other investors.

Contacts:

Bus. Dev.: Nicols Oriol, Founder & CEO, [email protected], (+34) 647683851

Sales: Juan Antonio Roncero, Online Mgr., [email protected], (+34) 670338600

Press: Vicente Varo, Community Manager and PR, [email protected], (+34) 663109391

VideoWonga.com would like to keep their demo confidential. Please visit their website for more information.

Contacts:

Bus. Dev.: Errol Damelin, +44 (0)7733 266 767

Press: John Moorwood, Communications Dir., +44 (0)7872 198 128, [email protected]

How they describe themselves: WorkLight is a leading mobile application platform for smartphones, tablets and beyond. Many of the world’s largest financial institutions rely on the WorkLight Mobile Platform to create and run optimized cross-platform applications with unmatched flexibility, secure connectivity and full lifecycle management to drive more business while radically reducing development cost, time to market and ongoing maintenance. WorkLight was recognized as one of the best demos at FinovateSpring by TrendCaller.

What they think makes them better: WorkLight enables unique, sophisticated applications for banking, payments, securities, trading, insurance and more:

- Development Flexibility – Choose between standard web and native languages and tools to create highly capable financial applications

- Cross-platform Portability – Optimize and extend your applications to multiple environments without compromising user experience

- Enterprise Connectivity – Establish secure and scalable integration and delivery with an adapter framework and server-based architecture

- Centralized Management – Monitor and control the entire lifecycle of cross-platform applications from a single web-based console

- Investment Protection – Leverage fast support of new devices and environments while preventing client-side and vendor lock-in

Contacts:

Bus. Dev.: Kurt Daniel, COO, [email protected], 646-696-1559

Sales: Karim Tarmohamed, Senior Account Executive, [email protected], 646-677-8178

Press: Yonni Harif, Marketing and Online, [email protected], 646-696-8213

How they describe themselves: Yodlee’s flexible, component-based Platform helps financial institutions and portals innovate and engage customers online. Only Yodlee offers integrated PFM and payments solutions that generate revenue, lower costs, decrease risk/fraud, and deepen customer engagement and satisfaction across all segments. For 11+ years, Yodlee’s patented technology has been changing the face of online banking. This year, the evolution continues with Yodlee 10 and the Yodlee FinApp Store – the first consumer-driven marketplace for personalized financial applications. Through its unique and patented Data Platform, Yodlee empowers consumers to take control of their financial lives, anywhere, anytime. More than 200 financial institutions and portals today offer Yodlee-powered solutions to millions of consumers worldwide.

What they think makes them better: Yodlee has created the first web platform for financial services, redefining the way online banking services are delivered and the way financial providers will interact with customers in the future.

Differentiators include:

- The Data and Payments Platform powering more than 85% of all online PFM users today

- Innovative, patented PFM solutions with proven retention levels 5x better, and activity levels 2x higher, than legacy online banking

- Fully integrated, revenue-generating payments and risk management solutions

- Flexible APIs that facilitate easy integration of all, or any, Yodlee capabilities, on demand

- The first consumer-driven marketplace for financial applications – the Yodlee FinApp Store™

- Industry leading security and operations

- Flexible SaaS-deployment models, suitable for customers of any size

Contacts:

Bus. Dev.: Darren Voges, Director of Business Development, [email protected], 650-980-3683

Sales: Casey Clegg, Business Development Manager, [email protected], 650-980-3634

Press: Melanie Flanigan, Senior Director of Marketing, [email protected], 650-980-3707

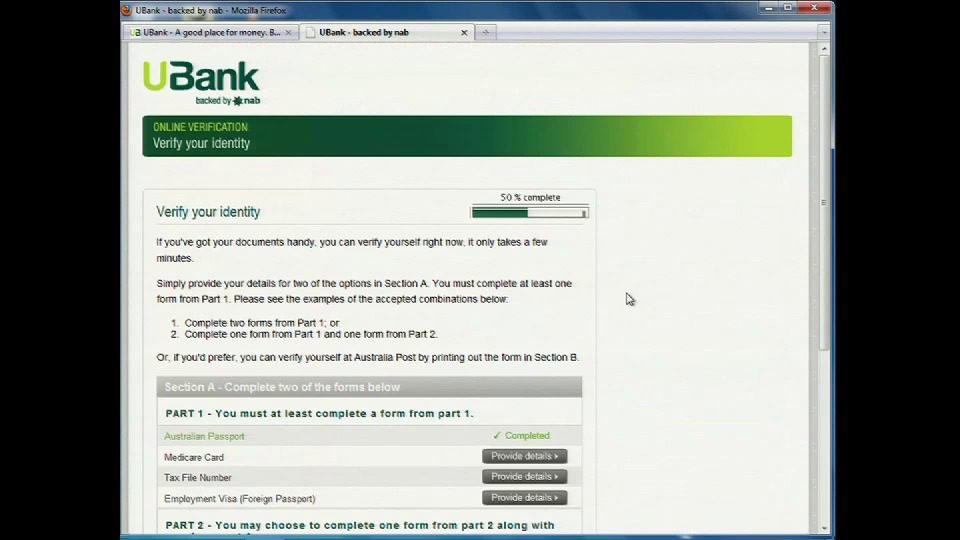

How they describe themselves: A new direct bank aimed at self-directed consumers in

Australia. We deliver core banking products and services through high service direct channels

(online, telephone, mobile).

What they think makes them better:

- 100% online straight through application process (incl. for new-to-bank customers)

- High service 24/7 onshore call centre

- User-centric website

- Values-based staff culture & brand

Contacts:

Press: Gerd Schenkel, General Manager UBank, [email protected]

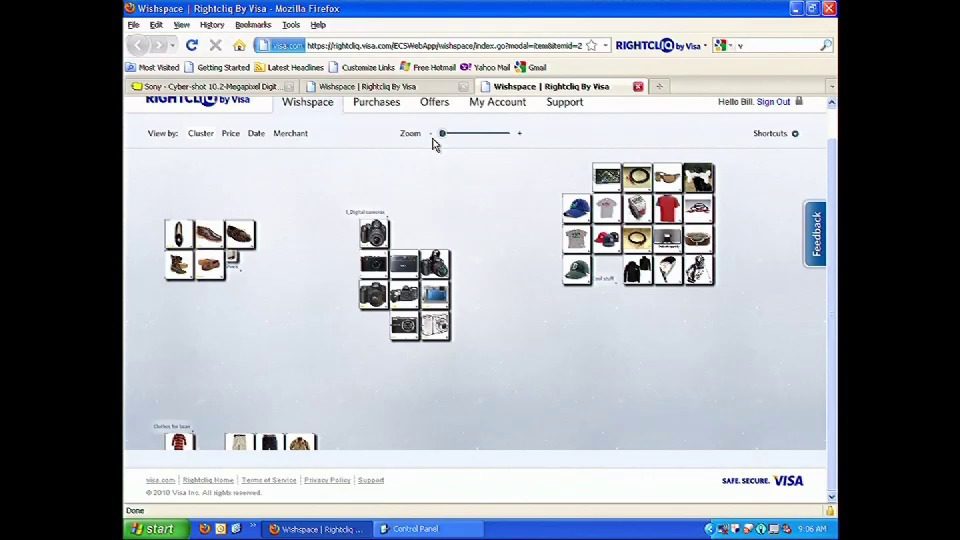

How they describe themselves: Visa is a global payments technology company that connects consumers, businesses, financial institutions and governments in more than 200 countries and territories to fast, secure and reliable digital currency. Underpinning digital currency is one of the world’s most advanced processing networks – VisaNet – that is capable of handling more than 10,000 transactions a second, with fraud protection for consumers and guaranteed payment for merchants. Visa is not a bank and does not issue cards, extend credit or set rates and fees for consumers. Visa’s innovations, however, enable its financial institution customers to offer consumers more choices: pay now with debit, ahead of time with prepaid or later with credit products.

What they think makes them better: Rightcliq is a new online tool from Visa that improves the way online shoppers collect and organize products, seek advice from friends, checkout on many merchant sites and track packages.

Rightcliq has several key features that address consumer needs before, during and after checkout. These features include:

- Browse & Consider

- Wishspace: organize and compare products via a visual wish list

- Get Advice: ask friends what they think about products via email and Facebook

- Merchant offers: save money with discounts from popular brands

- Buy

- Auto-fill: streamline the checkout process on many merchant sites by auto-filling

personal and payment information

- Digital wallet: store account information for any credit, debit, prepaid or gift card for maximum choice and control

- Track

- Package tracking: store tracking information in one convenient place

Contacts:

Bus. Dev., Sales, & Press: Paul Wilke, Visa Inc., Sr. Business Leader, Product, Innv. & Marketing PR, [email protected]

How they describe themselves: Wikinvest is a new kind of finance portal. We are a group

of retail investors who are dissatisfied with the investing information resources that were already available to us – sites like Yahoo! Finance. So we decided to build the site that we wanted to use. There are many things that make us unique, but at a high level, we want to deliver Insight and Understanding for our users – most of our competitors provide users with a lot of data, but their users have few tools to make sense of it all.

We reach around a million unique visitors every month on wikinvest.com (Comscore, March `10), and we are the fastest growing of the top sites in Comscore’s “financial news and information” category.

We have a robust licensing business. Among others clients, we power all the stock charts for Forbes.com, all of the financial information on NPR.org, much of the financial information on USAToday.com, and a complete suite of research tools for several brokerage clients.

What they think makes them better: Finance portals have been slow to innovate — the interface and functionality for the largest sites is virtually unchanged over the last 8 years. The large finance portals that Wikinvest competes with are first and foremost data aggregators — they pull in financial data from 3rd party sources (Thomson Reuters, Capital IQ, and others) and simply redisplay it to users. The model is data in, data out.

We offer our users Insight and Understanding instead of merely a wall of financial data. For example, our community-generated articles are the best place on the web to get a concise overview of what you should know if you’re considering an investment in a particular company, and our fundamentals data is accompanied by rich visualizations and analytics that compare a company to its peers — so you know whether each metric for that company is good or bad.

Contacts:

Bus. Dev., Sales & Press: Parker Conrad, [email protected]

How they describe themselves: WorkLight is a global leader in multi-channel software and

services that power mobile, desktop and web applications for banking, e-commerce and the enterprise.

The WorkLight Solution enables businesses to reach and engage their customers, partners

and employees on the iPhone, Android, Windows, Mac, Facebook, Google and more. Using WorkLight, a focused user experience can be efficiently created and delivered to drive more business while reducing cost of development and time to market.

What they think makes them better: Customers today expect easy access to their financial information. Yet, financial institutions seeking to engage customers on mobile devices, desktops and websites face a multitude of channels to address, which can prevent a uniform user experience or drive costs out of control. To meet this challenge, WorkLight enables banks and other financial institutions to reach multiple smart phones, desktops and websites in a single effort. The WorkLight Solution for Mobile powers secure, transactional applications for banking. WorkLight is changing the way financial institutions drive business with the mobile channel, as well as online and desktop channels.

Contacts:

Bus. Dev.: Yonni Harif, Marketing & Alliances, 646-696-8213, [email protected]

Sales: Kurt Daniel, COO, 646-696-1559, [email protected]

Press: Glenn Rossman, Baker Communications Group, 914-623-8354, [email protected]