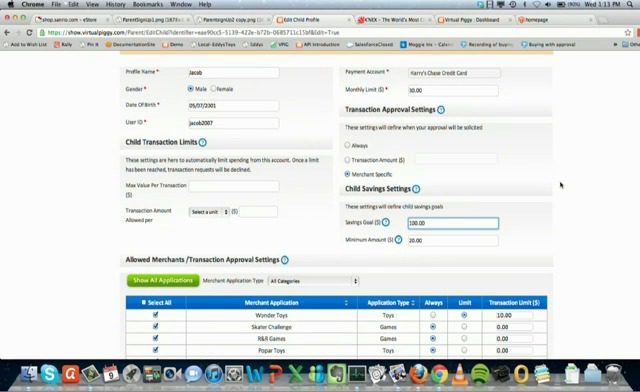

How they describe themselves: Virtual Piggy provides a unique solution to the Under 18 (U18) market. There are 80 million U18s in the USA and a billion worldwide. This generation is more proficient with internet enabled devices such as tablets, smartphones, and laptops than any previous generation, and they are getting online at an earlier age. Virtual Piggy noticed that there was no easy mechanism for this U18 group to make online purchases and all current methods involved a lot of friction and often resulted in undesirable outcomes such as fraud. Virtual Piggy provides a unique technology to allow merchants to sell to U18s in a COPPA compliant, parent-approved manner, thereby unlocking an estimated $43B in annual spending power.

How they describe their product/innovation: Virtual Piggy is the first e-commerce solution that enables kids to manage and spend money within a parent-controlled environment. The technology company delivers online security platforms designed for the Under 18 age group in the global online market, and also enables online businesses the ability to function in a manner consistent with the Children’s Online Privacy Protection Act (COPPA) and similar international children’s privacy laws. Virtual Piggy enables the Under 18 audience to play, transact and socialize in a secure online environment guided by parental permission, oversight, and control.

Contacts:

Bus. Dev.: Jo Webber, Chairman of the Board, CEO & Co-Founder, [email protected]

Press: Sabrina Khan, Account Executive – Bender/Helper Impact, 310-694-3125

Sales: Tom Keefer, EVP Global Sales, [email protected]

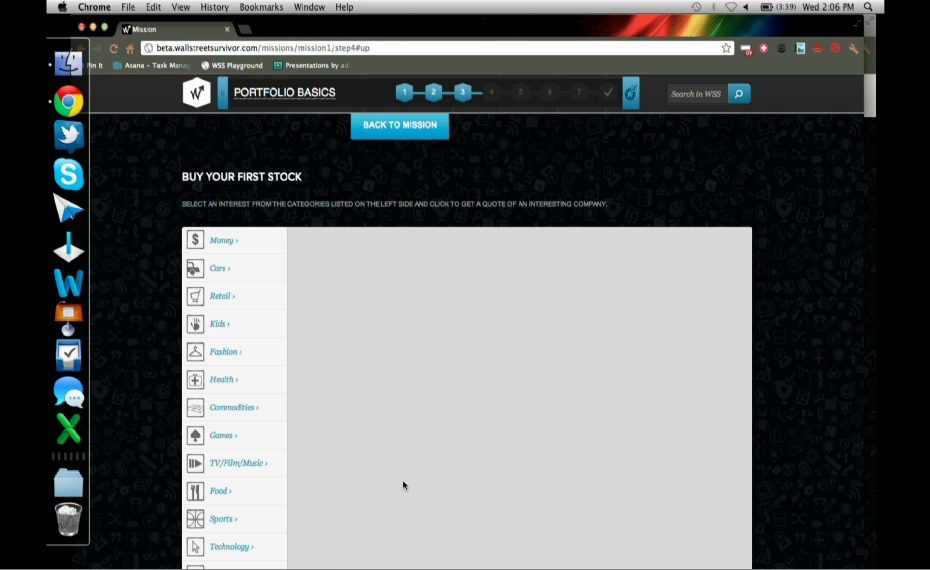

How they describe themselves: Wall Street Survivor is the best way to learn about investing. It’s interactive, fun, and you get real world rewards.

Guided missions, beginner-focused learning content, combined with the web’s best stock simulator help users effectively manage their financial future.

How they describe their product/innovation: The latest version of Wall Street Survivor appeals to today’s passive and active investors. These users are more social, have shorter attention spans, want more guidance and support, and spend more time playing angry birds. They want financial education in an easy, rewarding, and unbiased form.

Wall Street Survivor is relaunching at FinovateSpring 2012 as the first guided, mentored, and fully socially integrated financial education site.

Contacts:

Bus. Dev., Press & Sales: Jake Hirsch-Allen, Director of Business Development, j[email protected], 514-441-1194

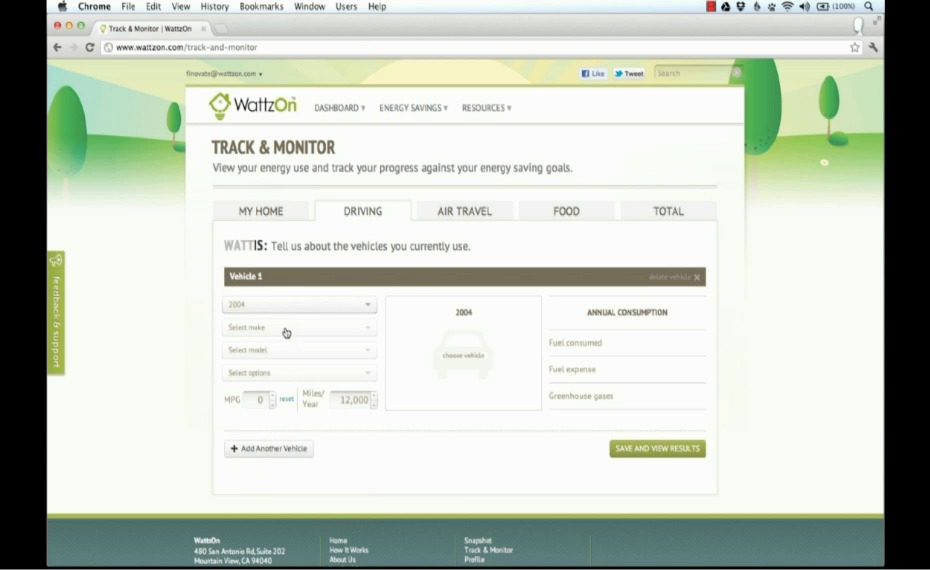

How they describe themselves: With over US$250bn spent annually on domestic energy in the US, of which more than half is wasted, and over US$50bn annually on “green home improvement,” WattzOn was founded by leaders in energy and consumer software to take advantage of the massive opportunity for personal energy savings.

How they describe their product/innovation: WattzOn is a personal energy management platform that provides tools to help people use less energy and save money on an everyday basis.

The WattzOn Marketplace: A marketplace for energy-saving products and services (such as appliances, windows, solar systems, hybrid and electric cars), to be combined with financing (loans, credit cards, savings accounts, Home Equity Lines Of Credit, mortgages) and rebates to create compelling energy and money-saving opportunities.

The WattzOn Platform for Financial Services: Increase consumer engagement and drive loyalty with our WattzOn Personal Energy Management Platform. Incorporate branded personal energy management capabilities with your website or app. Provide your consumers with more ways to save money and promote complementary financial products, such as credit cards, car and home loans. Can be undertaken as a branded experience (for example, “MyBankGreenHome.com”) or integrated into your existing website or mobile app through our web services (APIs).

Contacts

Bus. Dev. & Sales: Dan Sheehy, SVP Business Development, [email protected]

Press: Steven Ashby, Co-Founder/Chief Product & Marketing Officer, [email protected]

How they describe themselves: Wipit is a mobile payments company founded to provide financial services solutions for the under-banked consumer. The company was founded and is managed by some of the most successful prepaid wireless executives in the industry. Wipit’s leadership team includes John Tantum (Founder and former President of Virgin Mobile USA), Co-Founder Michael Lanzon (former Boost Mobile Vice President of Sales and Marketing), and Co-Founder Job Tucker (former Boost Mobile Director of National Sales and Distribution). Wipit CEO and Co-Founder Richard Kang held principal positions at VHA and Eureka!, leading Sprint Prepaid handset and airtime distribution companies.

How they describe their product/innovation: Wipit is a mobile payment service that allows users to quickly and easily make payments from their smartphone or online using cash. Users can create a free mobile wallet account via their handset or online (www.wipit.me) and can load prepaid funds by visiting over 10,000 retail locations nationwide. Loaded funds are instantly available to make payments on mobile apps or websites that accept Wipit as a payment option. Users authorize all payment transactions via a simple, single click payment process. Account information and transaction history can be viewed and managed from Wipit’s free mobile app or online.

Contacts:

Bus. Dev. & Sales: Vikram Kanodia, VP Business Development, [email protected],

626-394-3996

Press: Dennis Wiles, Director of Products, [email protected], 626-390-6580

How they describe themselves: ZipZap, Inc. is the leading global cash transaction network enabling the more than one billion cash-preferred consumers worldwide to use cash to make online purchases, pay bills, and top-up eWallets, prepaid cards and mobile accounts. Through a global network of over 700,000 payment centers, consumers can complete transactions in their neighborhood conveniently and easily using local currency.

How they describe their product/innovation: ZipZap has developed a revolutionary new suite of cash transaction solutions. CashCade provides eCommerce merchants with an automated cascading payment option ensuring every transaction is approved. No more lost revenue from card-based transactions being declined as CashCade gives consumers the option to pay cash.

CashPayment enables consumers worldwide to make payments for online purchases at offline locations using cash. Easily adapted to fit the needs of any eCommerce merchant, a consumer using the CashPayment option simply confirms the transaction online, prints the payment slip, takes it to the nearest Payment Center listed, and completes the transaction by paying the clerk with cash.

Contacts:

Bus. Dev.: Simon Nahnybida, [email protected], 201-314-3587

Press: Scott Holt, [email protected], 714-351-0443

Sales: Myles Gutenkunst, [email protected], 415-578-8358

How they describe themselves: All of ValidSoft’s products are based on telecommunications. ValidSoft’s vision from the outset was that mobile/smart phones would become the consumer device of choice. The team of people we brought together at that time helped to build on that vision, and there is nothing that mobile phones, cellphones, or smartphones cannot do today to displace the whole plethora of security devices we have to carry today to prove our identity.

How they describe their product/innovation: Our product can protect M-banking transactions from all of the attacks that affect Internet banking today, while using out-of-band, real-time voice based authentication, and transaction verification. A smart phone contains multiple channels, both voice and data. Therefore the concept of channel separation, critical for the detection of manipulated transactions caused by Man-in-the-Mobile-Browser or phone resident Trojans, is fully supported.

Our product as used for Online Banking, with all the same visible and invisible protection, including Pseudo Device Theft, is configured specifically for mobile banking usage. This means no keying of OTPs into the phone, and even a completely hands-free model using speech recognition if required. Biometric voice verification can also be layered for even greater security. Our product combines usability, portability, and security that will drive the adoption of M-banking.

Contacts:

Bus. Dev., Sales: John Petersen, Global Head of Business Development, [email protected]

Press, Sales: Emmanuelle Filsjean, Global Head of Marketing, [email protected]

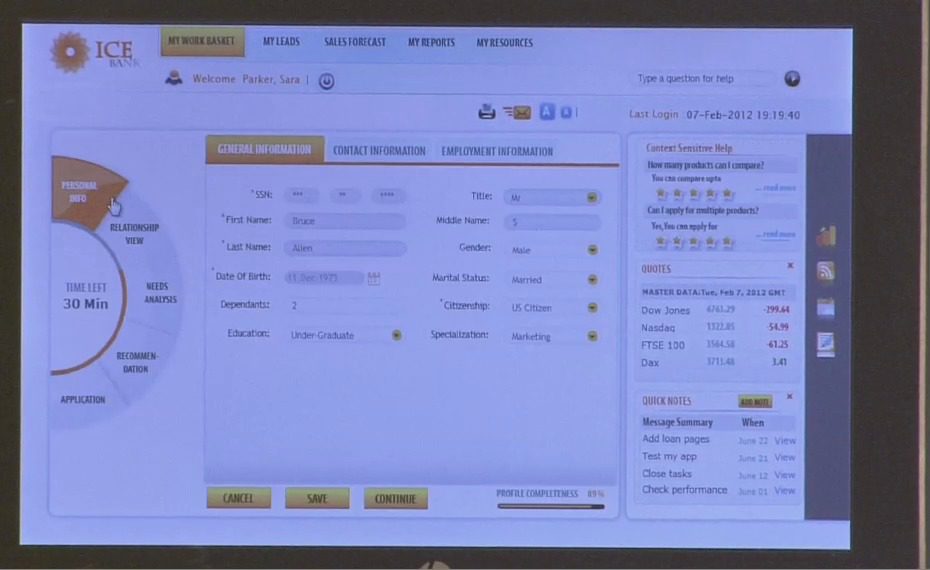

How they describe themselves: Wipro Technologies, the global IT business of Wipro Limited (NYSE:WIT), is a leading information technology, consulting, and outsourcing company, that delivers solutions to enable its clients to do business better. Wipro Technologies delivers winning business outcomes through its deep industry experience and a 360 degree view of “Business through Technology” – helping clients create successful and adaptive businesses. A company recognised globally for its comprehensive portfolio of services, a practitioner’s approach to delivering innovation and an organization wide commitment to sustainability, Wipro Technologies has over 130,000 employees and clients across 54 countries.

How they describe their product/innovation: One of the primary tools the Direct Sales Agents need is a tablet variant of unified desktop. The banking sales & service tablet application which Wipro is developing is essentially a step in this direction. As a first step, Wipro has developed a customer acquisition framework on a tablet-based device. This solution leverages mobile, analytics, and intelligent processes for on the go personalized offers and application capture. The solution is also relevant in next generation bank branches wherein a differentiated environment is created for HNI customers. In fact, boutique bank branches have been received well with the digital generations.

Contacts:

Bus. Dev.: Vivek Patil, Group Head, Business Solutions, Banking & Financial Services, [email protected], +91 9766539097

Press: Meenu Bagla, BFSI Marketing Head, [email protected], +91 9663304103

Sales: Satish Wadhwa, [email protected], +44 791 781 4999

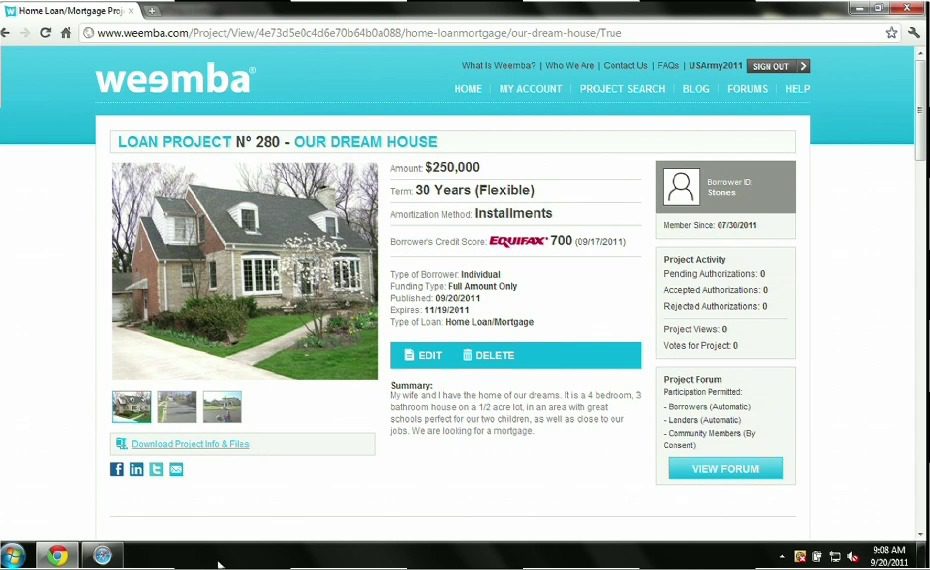

How they describe themselves: Weemba is an online financial community that revolutionizes the way that Borrowers and professional Lenders find each other and interact, using a “social network”-like format. Weemba exponentially increases the likelihood of successful financial outcomes for its members, both Borrowers and Lenders. All parties save time and money because borrowers don’t hear “no” and lenders don’t spend time on borrowers who don’t fit their needs. Borrowers never pay a fee to use Weemba; lenders pay only for access to the borrowers they want.

How they describe their product/innovation: Borrowers create a profile under a nickname, and post a project to obtain financing from one of the many professional Lenders registered in Weemba. Besides the reason for and amount of a loan, profiles may include everything from the Borrower’s income, education level and veteran status (Individuals) to their number of employees, annual sales or revenues and articles of incorporation (Businesses). Lenders will be able to search projects created by those Borrowers and narrow them down by credit score, amount needed, location, type of loan and more. When a Lender finds an interesting project, the Lender then may ask the Borrower for access to their real identity, as well as private details about the project. Professional Lenders will be able to find the exact Borrowers THEY WANT, not information that is old, recycled, uncertain or vague. If the Borrower grants access to the Lender, all further contact and any negotiations take place outside Weemba.

Contacts:

Bus. Dev. & Sales: Matthew Reid, Chief of Lender Relations, [email protected],

786-245-8042

Press: Annette Gallagher, CEO, [email protected], 786-245-8034

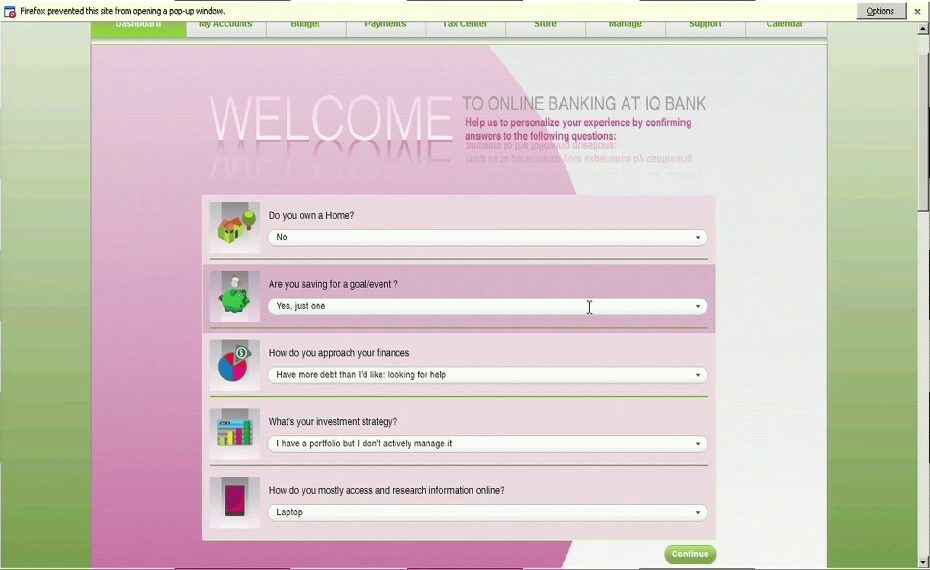

How they describe themselves: Yodlee believes that more informed consumers are better customers. Our personalized solutions help consumers manage their money, and help financial providers better understand and service their customers. Yodlee’s patented data technology platform leads the industry, powering secure and innovative money management services for 8 of the top 10 banks and more than 30M consumers globally. With a nimble technology and a collaborative approach, Yodlee enables faster development, lower infrastructure costs, reduced risk/fraud, and a more personalized and relevant consumer experience, for all user segments, driving more business value through deeper relationships and new revenue opportunities.

How they describe their product/innovation: Yodlee’s dynamic consumer banking experience is fast, flexible, and tailored to the unique needs of individuals, all in an anytime, anywhere online/mobile environment. We will be showing how financial providers can, from a single platform, enable truly differentiated consumer banking experiences that drive substantial value. We will be highlighting distinct consumer segments to demonstrate how different the experiences can be, even down to the payment vehicles. This empowers both banks and consumers while delivering exceptional functionality via a unique Yodlee FinApp architecture.

Contacts:

Bus. Dev.: Darren Voges, Director of Business Development, [email protected], 650-980-3683

Press: Melanie Flanigan, Senior Director of Marketing, [email protected], 650-980-3707 Sales: Casey Clegg, [email protected], 650-980-3634

How they describe themselves: Wikinvest demoed the first-ever portfolio tracker that syncs directly with your brokerage accounts at Finovate Spring 2010. The product allows you to see all your investment accounts in one place, pushes price data and news from 500+ sources directly to your browser (without a page refresh), calculates your true investment performance (net of dividends, fees, interest, excluding deposits and withdrawals), and is fully customizable. Nine months later, we are tracking ~ $15 Billion in verified assets for ~ 100,000 users. 65% of our users are 30-day active. They have an average of over 100 pageviews, and 18 hours time on site, every month.

How they describe their product/innovation: Because of the wealth of data we import from users’ brokerage accounts when they sign up for our portfolio service, we are in a unique position to offer specific and actionable advice.

- The entire product is powered by sync – you don’t have to enter data, we automatically analyze your historical behavior.

- If you own a bad mutual fund or ETF, and there’s a better one in the same category, we’ll recommend a switch.

- We analyze the fees your brokerages charge you — across dozens of categories — and simulate your behavior at other brokerages in our system to see how much money you could save money.

- We’ll automatically provide tax loss harvesting advice to help you optimize on taxes.

- If you have a financial advisor, we’ll automatically detect that and compare his or her performance to all others in our system and recommend a switch if warranted.

- We’ll analyze your behavior & style and recommend changes where warranted (such as too-frequent trading).

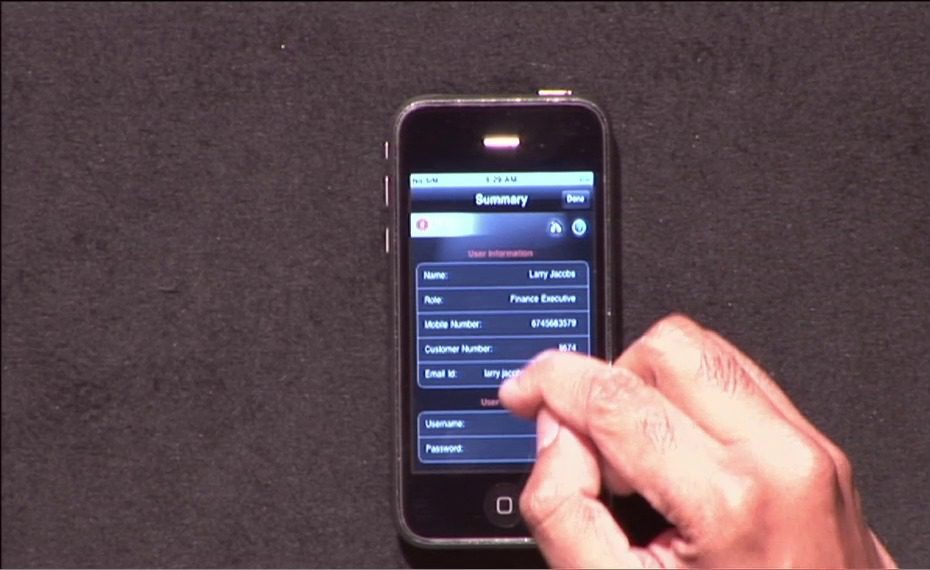

How they describe themselves: Wipro Technologies is a leading Information Technology, Consulting and Outsourcing company that delivers solutions to enable its clients do business better. Wipro Technologies delivers winning business outcomes through its deep industry experience and a 360-degree view of “Business through Technology” – helping clients create successful and adaptive businesses. A company recognized globally for its comprehensive portfolio of services, a practitioner’s approach to delivering innovation and an organization wide commitment to sustainability, Wipro Technologies has 120,000 employees and clients across 54 countries. Wipro serves the top 10 Banks, top 4 Insurers, top 2 Brokerages and supports top 5 Investment Bank’s business transformation initiatives across the globe.

How they describe their product/innovation: The small & medium business segment has been the most resilient segment for banks even during economic turmoil. But most banks have traditionally underserved the SMB segment by clubbing them with either retail or corporate segments. This has led to suboptimal experience & loss of business. Coupled with need for self-service and higher adoption of Smart Mobile amongst SMB customers, this forms the rationale for Wipro’s solution. The solution primarily enables self-service functionality critical to SMB segment on a SmartMobile channel that helps them to save time & money, manage cash flow better and handle administrative tasks with ease. It also enables banks to generate additional fee-based revenues.

Contacts:

Bus. Dev. & Sales: Sushankar Daspal, Practice Head – Banking Channels, Wipro Technologies, [email protected]

Press: Meenu Bagla, BFSI Marketing Head, Wipro Technologies, [email protected],

+91-9663304103

How they describe themselves: Xero is an innovative, fast growing company that has developed and designed a global online accounting system for SME businesses and their advisors. The company was founded in July 2006 by successful technology entrepreneur Rod Drury and specialist small business accountant Hamish Edwards, and is listed on the New Zealand Stock Exchange (NZX: XRO). Xero has strategic partnerships with banks and teleco providers in its core geographies of New Zealand, Australia, the UK and the United States. In December 2010 Xero was ranked 8th in Deloitte’s Asia Pacific Fast 500.

How they describe their product/innovation: Xero is the world’s easiest online accounting system, designed to take the drudgery out of doing the books, making it fun, simple and intuitive. It is a leader in the online accounting space and has embraced the next phase where thousands of small businesses are now on connected platforms. Xero will demonstrate a series of 7 innovations in 7 minutes. This will include fast cash coding, address verification, debtor and creditor workflow, accountants directory, final account report codes and personal goal setting.

Contacts:

Bus. Dev., Sales & Press: Rod Drury, Chief Executive/Executive Director, [email protected]