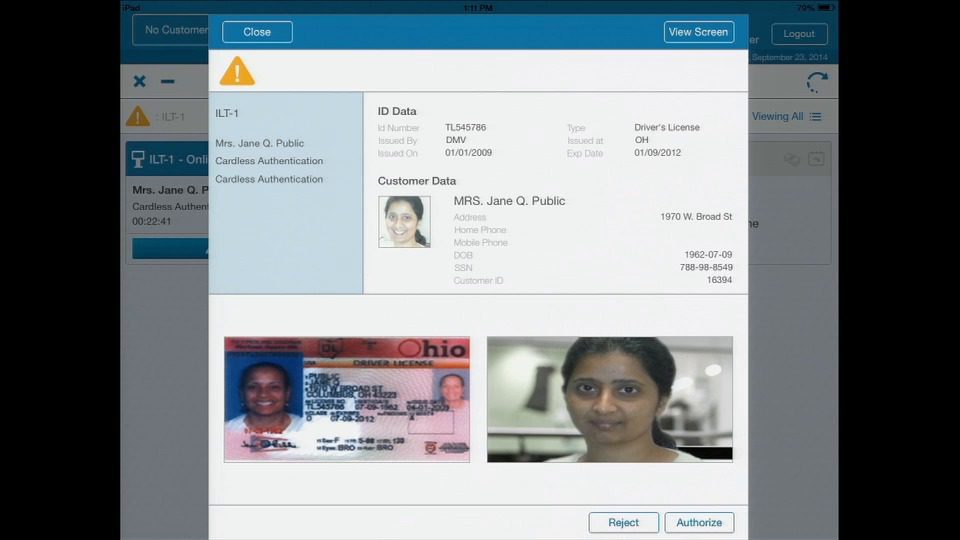

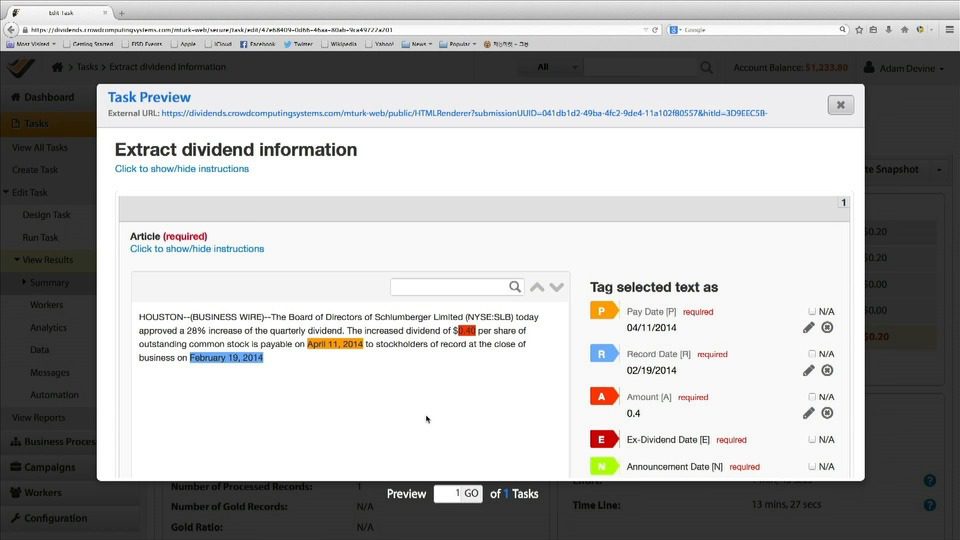

How they describe themselves: VerifyValid™ is giving the paper check, the world’s most-used payment transaction, an online makeover for the 21st century. VerifyValid eChecks allow users to make check payments to anyone from anyplace they have access to the Internet. Using an unprecedented secure platform and patented fraud prevention technology, VerifyValid can lower an organization’s costs while increasing efficiency, sustainability, and financial security. VerifyValid is an IBM Business Partner, a member of the SoftLayer Catalyst Program, and a proud example of the Reinvention of Michigan as it reinvents the payments industry from its home in Grand Rapids, Michigan. For more information, visit verifyvalid.com.

How they describe their product/innovation: The VerifyValid Mobile Checkbook is the first ever general purpose checkbook for the smartphone, allowing users to write, approve, send, and deposit check payments from their iPhone. Now, VerifyValid has created a consumer-focused mobile app that replaces transaction fees with sponsored content. Users are able to send and receive checks at no charge while advertisers can speak directly to consumers at the moment that they write or receive a check payment.

Product distribution strategy: Direct to Consumer (B2C), Direct to Business (B2B), through financial institutions, through other fintech companies and platforms

Contacts:

Bus. Dev.: Patrick Lethert, CMO, [email protected]

Steve Lassig, VP, [email protected]

Press: Patrick Lethert, CMO, [email protected]

Stephen Sprayberry, William Mills Agency, [email protected]

Sales: Tom Reuter, [email protected]