Enterprise blockchain solution Ripple has joined the likes of 231 organizations who belong to the Hyperledger blockchain consortium.

Hosted by The Linux Foundation, Hyperledger is an open source group consisting of leaders in finance, banking, IoT, manufacturing, and technology that seeks to advance cross-industry blockchain technologies. Other Finovate alum members of the group, which launched in 2015, include Tradeshift, AlphaPoint, BBVA, Blockchain, PWC, Sberbank, SecureKey, and Wipro.

After teaming up with NTT Data last year, Ripple and the Japanese system integration company submitted Hyperledger Quilt, a Java-based Interledger Protocol (ILP), to Hyperledger. Through the partnership with Hyperledger, said Ripple CTO Stefan Thomas, “developers will be able to access Interledger Protocol in Java for enterprise use.” Thomas added that Hyperledger Quilt “connects Hyperledger blockchains with other ILP-capable payment systems such as XRP Ledger, Ethereum, Bitcoin (Lightning), Litecoin, Mojaloop, and RippleNet, helping us to deliver on our vision for an internet of value – where money moves as information does today.”

Ripple was among 14 companies to join the consortium last week. Hyperledger Executive Director Brian Behlendorf explained that this growth is beneficial to the future of the blockchain. “The accelerating pace of growth and adoption of Hyperledger across industries and geographies underscores the power of our community and the technologies it is building,” he said. “It also reflects a global awakening to the impact of blockchain for business.”

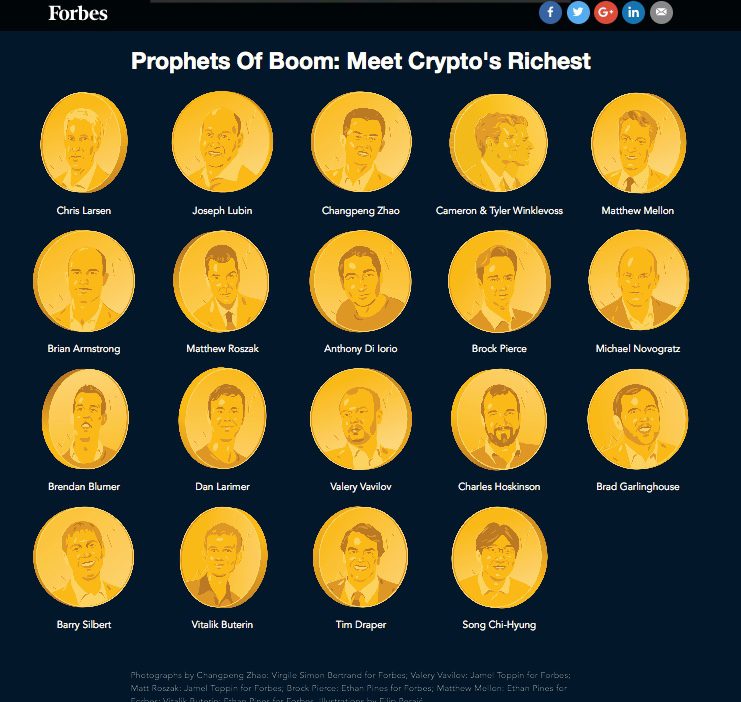

With more than 100 customers across the globe, Ripple has offices in San Francisco, New York, London, Luxembourg, Mumbai, Singapore and Sydney. At FinovateSpring 2013, company co-founder Chris Larsen debuted Ripple (originally known as OpenCoin).

Last week, the company funded every project on DonorsChoose.org, a platform where school teachers crowdfund classroom needs and special projects. Ripple fulfilled all 35,647 open campaigns with a $29 million donation. Earlier in March, Ripple began piloting blockchain-based payments with FLEETCOR. The company was founded in 2012 and has since raised $93 million.