Right now, over three dozen leading fintech companies, both hot young startups and established players, are gearing up to demo their latest innovations at the second annual FinovateEurope next February 7th in London.

To whet your appetite, we asked each handpicked company to provide a sneak peek of what it will be demoing on stage. Below is the first installment. We’ll have another installment next week.

Don’t miss your chance to see fast-paced demos of the newest ideas from each company and meet the execs responsible for the cutting-edge of innovation in financial and banking technology. Plus get your FinovateEurope ticket before December 23rd and you’ll lock in the early-bird price!

____________________________________________

AcceptEmail will launch a revolutionary way of billing and collecting. The inventor of billing and payment via email will introduce AcceptSMS, the world’s first Short Invoice Service.

With this technology, AcceptEmail users will be able to send payment requests to a smartphone or PDA via SMS, WhatsApp Messenger or social media in an easy and clever way. Improve your customers’ payment behavior by offering multi-channel and customer friendly payment methods.

Innovation type: Communications, mobile and tablet UI, payments

Find out more about a solution that Raymond James has already adopted to give its investment advisors authenticity on social networks. It also generated a $1 million prospect for another wealth management firm after just 96 tweets.

Actiance will also demonstrate how you can measure and analyse your network growth to accurately plot your social graph.

Innovation type: Communications, marketing, security

Brokertainment combines the fun and thrill of stock market trading with a reduced risk due to extremely low minimum investments (1 euro) and ultra-short term durations of derivatives (around 5 minutes).

Brokertainment will present a new product called STOCKBATTLE.

Innovation type: Investing and asset management

Business Centric Services Group (BCSG) will present an exciting new credit management tool to the SME market, which will break down the traditional barriers of cost, complexity and awareness.

BCSG has identified a customer need for this product through research, which highlighted that over half of small businesses never run credit checks on new customers, and just under half do not monitor their existing customers and suppliers.

Its innovative tool allows complex information to be delivered in a simple and usable format, ensuring the best possible end-user experience.

Innovation type: Banking products, online UI, small business

Almost all banking today is being done in digital space. Why not communicate with computers in a natural way, as we do in the real world?

Imagine a financial application that recognizes your face, congratulates you, analyzes your voice to identify you, and navigates you in online banking. You choose what is most convenient for you at that time: using your voice, gestures, keyboard, or a mix of all the approaches. You are smiling.

Motion and speech belong to the game world or laboratory geeks– not to online banking solutions that refer to a serious, unshakable, respectable realm. ETRONIKA wants to challenge this point of view by introducing a new UX approach to financial online services.

Innovation type: Banking, identity, online UI

InvestorBee puts data at consumers’ fingertips so they can make smart, confident investments.

- It’s fact, not opinion. Users can tap into the database to learn from the experiences of over a million UK investors.

- It’s an investment health check. Users can compare themselves to their peers to set realistic saving targets and investment goals.

- It’s simple investing without guesswork. In a few easy steps, users can choose an objective risk-based strategy that’s right for them.

InvestorBee users extract wisdom from the crowd to make better, simpler investment decisions.

Innovation type: Investing and asset management, PFM

Fiserv will demonstrate its next generation mobile P2P, small business an

d eCommerce merchant payments. As an international provider of digital banking and payment solutions, Fiserv delivers market-proven capabilities with innovations in both the mobile and online channels.

Innovation type: Mobile and tablet UI, online UI, payments

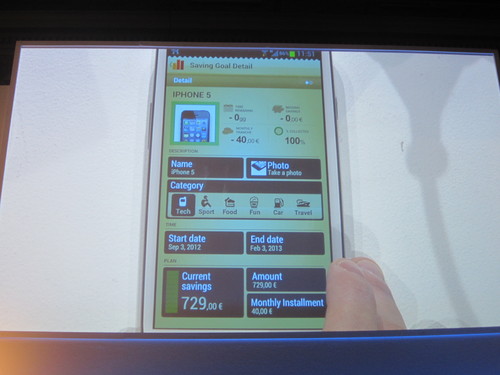

IND Group gamified its white-label Internet Banking and Personal Finance Manager. It added these methods to its new Banking-Front Office. The solution is based on the fact that customers love to do almost anything if they are rewarded for it.

With the two-level point system, banks can give points for things like function use, transactions, and product or service purchases. Customers can collect points and badges for dedicated actions. The system is closely connected with Facebook, where users can post their results and badges. With its strong visualization features and real rewards, the gamified IND Internet Banking and Personal Finance Manager creates a compelling, engaging user experience.

Innovation type: Online UI, PFM, rewards

Luup will launch a mobile payment service for corporations and governments that is set to bring them cost-savings, efficiency and productivity gains. The service solves one of the biggest daily challenges that organisations face worldwide.

Through an interactive live demo from various mobile devices, Luup will showcase how the new service is a fast, convenient and secure way to optimise processes. Attendees will experience how Luup solutions are unique in being universally deployable, bank-grade, live and proven– as well as scalable and easily managed.

Innovation type: Mobile and tablet UI, payments

miiCard, My Internet Identity, is the first service that allows a consumer to prove their identity to the AML/KYC standard purely online.

Through miiCard, a vendor can identify an individual to a level of assurance that supports real-time online sales of regulated financial products, and replaces the need for a ‘wet signature’ reducing operational costs and increasing conversions.

miiCard creates trust, protects consumers and fights against fraud. It helps realize the full potential of the digital economy by enabling higher value online business.

Innovation type: Identity, payments, sales and customer service

Sandstone will be showcasing its next generation mobile banking app that contains sophisticated money management/ OFM tools, the latest anti-fraud and security measures, and user experience capabilities that enable financial institutions to better engage with their customers.

Using the latest HTML5 technology, the app can be developed once and then delivered seamlessly across all smart phone app stores to run on any smart phone mobile device. The registration process for the app locks the user to the device while the page-fingerprinting technology ensures that fraudulent users will not be able to connect to the secure server.

Innovation type: Banking, PFM, security

Service2Media and Rabobank will introduce mobile payments via a banking app for all webshops. Customers of Rabobank that have installed the Rabobank Mobile Banking app can now pay for their mobile purchases as easily as their online purchases by using a mobile version of the online payment method IDEAL.

The new mobile IDEAL payment is facilitated by starting the Rabobank Banking app on an iPhone once a payment request is issued on the merchant’s mobile site. The user then authorizes the transaction in the app with his account number and access code before being redirected to the merchant’s mobile site. Mobile banking is now possible without an e-reader as long as the balancing account is known.

Innovation type: Banking, mobile and tablet UI, payments

Securing M-Banking

The advancement of technology is making our lives easier. Mobile banking, or m-banking, is here and with 800,000,000 smartphones already in circulation globally, it is going to grow. But how do we make m-banking safe and practical to use? You can’t hold your smartphone in one hand and your bank secure key in the other when walking down the street – that’s not “making our lives easier”.

A much simpler solution is using out-of-band, real-time, multi-factor authentication and transaction verification. ValidSoft will demonstrate how its products can do just that.

Innovation type: Identity, payments, security

One of the primary tools direct sales agents need is a tablet variant of the unified desktop. Wipro has developed a customer acquisition framework on a tablet-based device, which is a step in this direction.

CAMS on Tablet leverages mobile, analytics and intelligent processes for on-the-go pe

rsonalized offers and application capture. The solution is also relevant in next generation bank branches where a differentiated environment is created for HNI customers.

Innovation type: Mobile and tablet UI, PFM, sales