For all of the innovations in the world of investing, fractional investing—which involves enabling investors to buy and sell portions of a single share of stock—is among the most significant. Fractional investing has helped democratize access to investments that historically have been out of reach for many individual investors. Fractional investing enables both lower minimum investment requirements as well as micro-investing to help investors with limited capital create diversified portfolios.

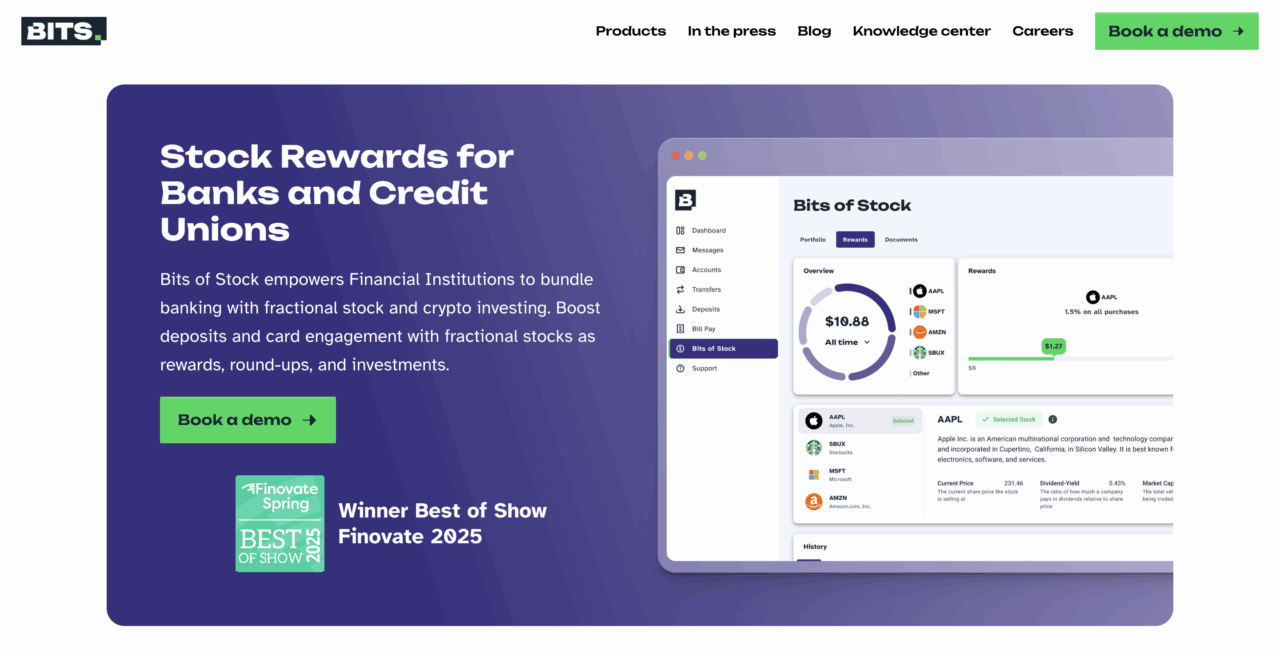

Bits of Stock, a New York-based fintech that won Best of Show in its return to the Finovate stage earlier this year at FinovateSpring in San Diego, is an example of a company that is bringing the benefits of fractional investing to a wider range of investors, including members of credit unions like Cardinal Credit Union. Last month, the not-for-profit cooperative announced a partnership with Bits of Stock to offer a new stock rewards program for Cardinal CU checking account holders aged 18 to 28.

The program enables these young adult investors to automatically earn stock rewards with every Visa debit card purchase. These rewards can then be redeemed into fractional shares in select publicly-traded stocks. The program leverages fractional stock ownership to help young adults begin to build wealth, develop good investing habits, and expand their understanding of finance.

This age range may be key to the successful adoption of stock rewards programs based on fractional investing. In their statement, Cardinal CU cited industry research that indicated that 67% of those in Generation Z (individuals aged 13 to 28), believe that the ability to invest with smaller amounts is a major factor in their decision to begin investing.

“We are helping student and younger members build a strong foundation while making investing accessible and rewarding,” Cardinal CU CEO Christine Blake said. ” There is tremendous value in this program as it encourages investors to learn about accumulating assets and building wealth in early adulthood.”

Mentor, Ohio-based Cardinal CU has integrated Bits of Stock into its digital banking platform, which is powered by Lumen Digital. Bits of Stock’s dashboard provides a brokerage account-like experience for users, helping them become more familiar with the standard tools used by traders and investors to buy and sell stocks in the market.

“Bits of Stock is redefining how people think about rewards and investing,” Bits of Stock CEO Arash Asady explained. “This initiative is a game-changer for younger investors, allowing them to start building wealth through everyday spending and to watch their investments grow.”

More recently, Bits of Stock announced that it had forged a strategic alliance with fellow Finovate alum Jack Henry. As with Cardinal CU, the partnership with fintech solution provider Jack Henry will involve embedding Bits of Stock’s fractional share-based stock rewards capability into a digital banking platform—in this case, Jack Henry’s Banno Digital Platform.

In their alliance announcement, the companies underscored the success that Credit Union One of Oklahoma experienced after launching a comprehensive three-tier checking account with embedded Bits of Stock capabilities. This enabled the institution to test a variety of offerings, from free accounts with round-ups to premium accounts that provided 1% stock rewards on all purchases.

“We were so impressed with member response during testing that we integrated stock investing capabilities into every checking account tier,” Credit Union One of Oklahoma President and CEO Tyrel McCain said. “It creates a natural progression where members can start with free entry points and graduate to earning stock rewards as they deepen their relationship with us. It’s driving both new account openings and fee income while helping our members build wealth through everyday spending.”

Founded in 1949 to serve employees working in a handful of state agencies, Credit Union One of Oklahoma became a community chartered credit union in May 2003. The institution today boasts more than 3,700 members and $48 million in assets.