Forbes has released the third* Fintech 50 list, which this year features 17 Finovate alums, many of which have made the list for the third time. The Fintech 50 list highlights the top private fintechs that have operations, customers or impact in the U.S. The list excludes public companies and divisions of public companies.

Forbes has released the third* Fintech 50 list, which this year features 17 Finovate alums, many of which have made the list for the third time. The Fintech 50 list highlights the top private fintechs that have operations, customers or impact in the U.S. The list excludes public companies and divisions of public companies.

Here are the alums honored in this year’s compilation:

Ayasdi

Among 22 newcomers to this year’s list.

Betterment

The company’s third time making the list.

Blend

Among 22 newcomers to this year’s list.

Blockchain

Among 22 newcomers to this year’s list.

Chain

The company’s third time making the list.

Coinbase

The company’s second time making the list.

Credit Karma

The company’s third time making the list.

Feedzai

Among 22 newcomers to this year’s list.

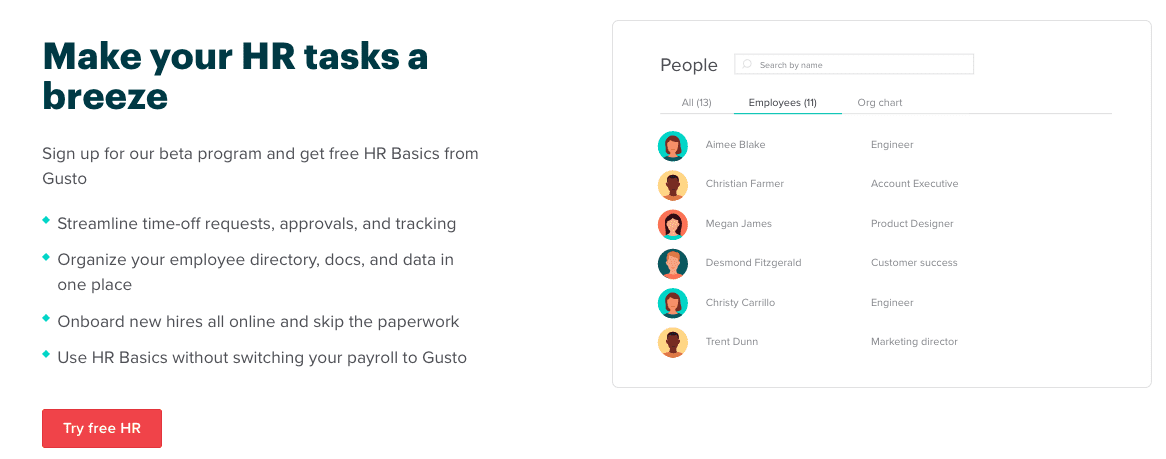

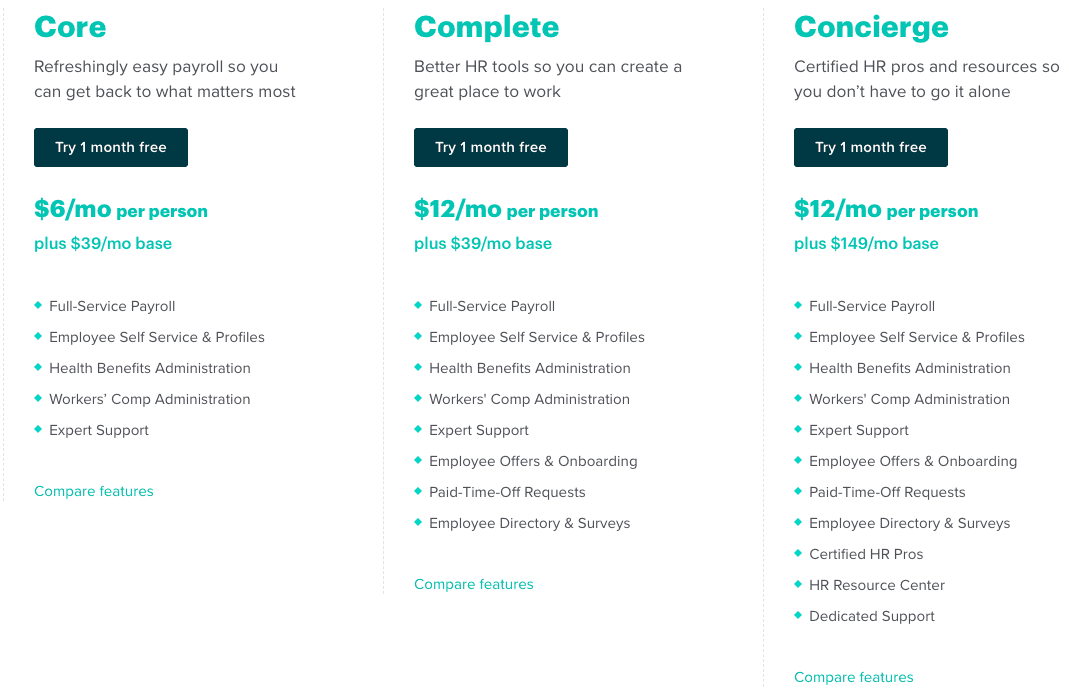

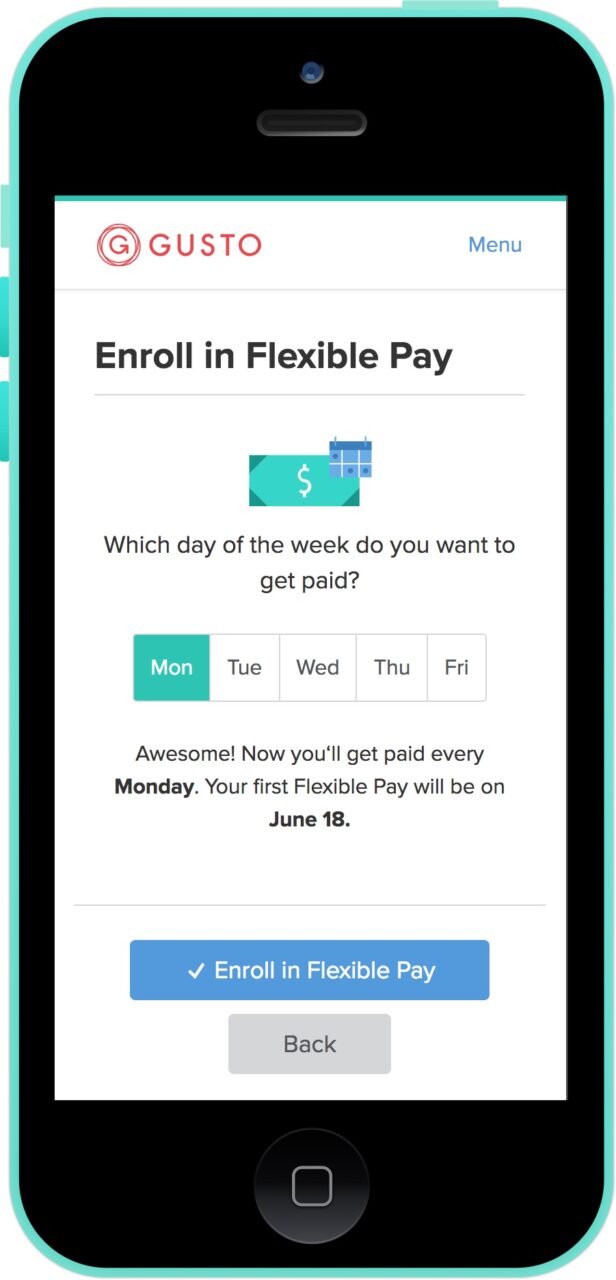

Gusto (formerly ZenPayroll)

The company’s second time making the list.

Kabbage

The company’s second time making the list.

Kensho

The company’s third time making the list.

Plaid

The company’s third time making the list.

Qapital

The company’s second time making the list.

Ripple

The company’s third time making the list.

Symbiont

Among 22 newcomers to this year’s list.

Symphony

The company’s second time making the list.

TransferWise

The company’s third time making the list.

In 2016, the list contained 20 Finovate alums, including Betterment, Chain, Coinbase, Credit Karma, Gusto, Kabbage, Kensho, Klarna, Motif, Personal Capital, Plaid, Qapital, Quantopian, Ripple, Signifyd, SoFi, Symphony, TransferWise, TrueAccord, and Xignite.

The list from three years back also contained 20 Finovate alums. Algomi, Betterment, Braintree, Chain, Credit Karma, HelloWallet, Kensho, LearnVest, Motif, Personal Capital, Plaid, Prosper, Quantopian, Ripple, Simple, TransferWise, TrueAccord, Vouch, Wealthfront, and Xignite made the list.

*Forbes skipped this compilation for 2017.

schedule. “The two-week pay schedule should no longer exist in today’s world.” Gusto co-founder and CEO Joshua Reeves said. “It’s a relic of calculating payroll taxes manually and was instituted in the U.S. almost 90 years ago. With modern technology, employees shouldn’t have to wait weeks to get paid.”

schedule. “The two-week pay schedule should no longer exist in today’s world.” Gusto co-founder and CEO Joshua Reeves said. “It’s a relic of calculating payroll taxes manually and was instituted in the U.S. almost 90 years ago. With modern technology, employees shouldn’t have to wait weeks to get paid.”