In the latest piece of not Schadenfreude-related good news for ridesharing innovator Lyft, Expensify has made it easier for Lyft business riders to expense the cost of work-related travel.

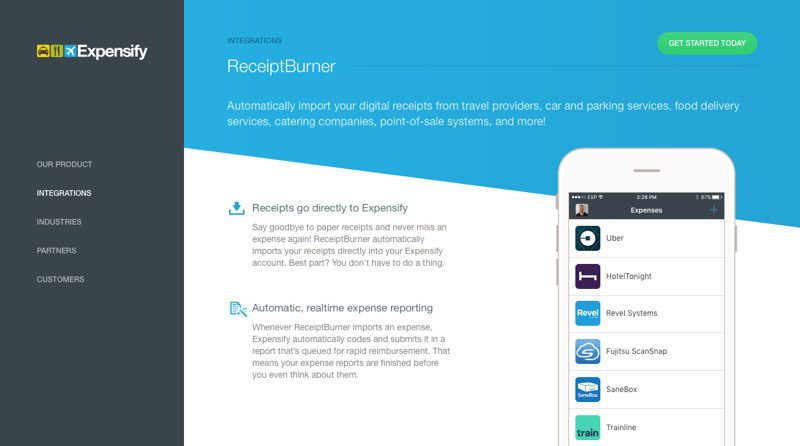

“Our goal is to make expense management something that happens behind-the-scenes, so our customers can focus on their business and not on keeping track of receipts,” Expensify CEO and founder David Barrett said. The new automatic expensing feature is available to individual Lyft riders who set up a Lyft Business Profile and choose “Expensify” in settings. Additionally, a¬†Lyft for Business account option enables administrators to set up auto expensing for entire teams or departments.¬†The new integration is a¬†part¬†of Expensify’s¬†ReceiptBurner¬†platform,¬†which¬†the company¬†debuted¬†a year ago this month, and means Lyft riders will no longer have to forward their receipts to Expensify by email for tracking and reimbursement.

“It’s always a pleasure to partner with one of our customers,” Barrett added, “especially in this case – Lyft rides are one of the five most commonly expensed items in Expensify!”

Founded in 2012, Lyft is available in 300 cities in the U.S. and supplies more than 18 million rides a month. With a valuation of $7.5 billion and $2.6 billion in funding, the ride sharing startup is often compared with rival, Uber (570 cities worldwide, valuation of more than $50 billion, $11.5 billion in total funding), which was founded three years earlier. Lyft is headquartered in San Francisco, California, and reported revenues of more than $700 million in 2016.

Founded in 2008 and also based¬†in San Francisco, Expensify demonstrated its invoicing technology at FinovateSpring 2013. The company is also an alum of our developer’s conference in Silicon Valley last fall, at which Barrett presented “Bedrock – Expensify’s Open-Sourced Infrastructure Secret Weapon.” Last month, Expensify announced exceeding the 35,000 customer mark and in May, the company partnered with fellow Finovate/FinDEVr alum Xero, which will use Expensify’s expense management technology in-house at all 21 of its offices around the world.

Expensify has raised more than $27 million in total funding, including a $17 million Series C round in 2015. The company counts OpenView, Barracuda Networks, and Redpoint among its investors.