It’s hard to believe, but it’s true: we’re less than one month away from the first Finovate show of the year.

FinovateEurope 2015 is returning to

Old Billingsgate Market Hall in London for what promises to be our biggest event in Europe yet. We hope you will be able to

join us as 70 companies from across Europe and around the world demonstrate some of the latest in financial technology.

To that end, here’s the second part of our Sneak Peek series to give you a taste of what some of this year’s innovators will be showing on stage in February. (Part One available

here.)

AlphaPoint’s Digital Currency Exchange Platform allows institutions to establish their own internal digital currency exchanges.

AlphaPoint’s Digital Currency Exchange Platform allows institutions to establish their own internal digital currency exchanges.

Features

- 24-hour run-time capabilities

- Military-grade security practices

- New order types, improved scalability, and an even faster processing speed

Why it’s great

AlphaPoint’s secure, scalable, and customizable exchange platform is easing the adoption of digital currencies across the globe.

Presenters

Joe Ventura, CTO

Ventura has over 15 years of software architecture experience specializing in secure, scalable, and high performance financial systems for companies such as Deutsche Bank, UBS, and Merrill Lynch.

Scott Bambacigno, VP of Sales

Bambacigno joined AlphaPoint at the start of 2014 and has led the acquisition of over a dozen global clients.

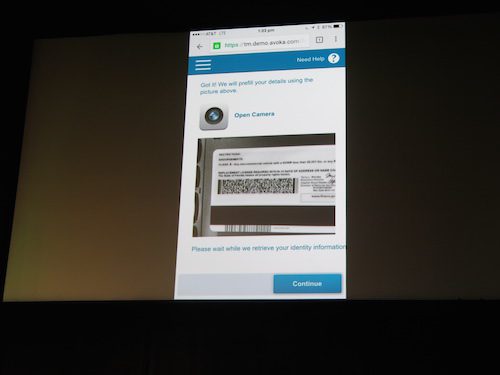

Avoka enables your omni-channel digital banking business with frictionless account openings.

Features

- Fast time to market – deploy digital applications in weeks

- True Omni-Channel solutions – responsive design on any device

- Improve conversion with reporting and analytics – make changes and publish

Why it’s great

Create an engaging digital loan application from any device in 3 minutes or less.

Presenters

Derek Corcoran, Chief Experience Officer

Corcoran has over 20 years experience in financial services globally, delivering frictionless customer experiences for digital sales and service transactions.

Kevin Mortimer, Technical Director

Encap Security will demonstrate how financial institutions can use Touch ID and Encap’s authentication platform to provide access to and authenticate high-value financial services transactions.

Features

- Easily integrate Apple Touch ID into financial services applications

- Utilise smart device capabilities to improve authentication

- Enable proportional security to drive adoption and use

Why it’s great

Authentication works best when a number of factors are used – and the factors used are contextually appropriate to the risk of the activity taking place.

Presenters

Thomas Bostrøm Jørgensen, CEO

Jorgensen has over 10 years experience in the mobile financial services, identity management, and mobile application security sectors.

John Burman, Sales Director, Europe

investUP is the crowdfunding supermarket, allowing you to lend & invest across all your favorite P2P, debt, and equity sites.

Features

- Discover more deals – use m

ore sites and find more great deals

- Saving you time – invest on all your favorite sites through UP

- Keep track – have just one account and one portfolio with UP

Why it’s great

Only with UP can you enjoy one account and one portfolio, yet still lend and invest across all your favorite crowdfunding sites.

Presenters

James Tuckett, CEO and Founder

Tuckett is a full-time crowdfunding evangelical from an aerospace engineering and accountancy background. Founded UP in 2012.

Nostrum Group is pioneering digital lending – providing customers with the ability to service their own accounts where and when they want.

Features

Why it’s great

Loan technology that re-imagines what a customer wants from banks and how they can interact with financial products.

Presenters

Richard Carter, CEO

Carter leads the organization and is responsible for setting the company. He is passionate about customer experience, innovation, and technology – inside and outside financial services.

StreetShares connects businesses with retail and institutional investors who compete to lend to businesses. Business lending meets social affinities.

Features

- Blends social and affinity group loyalty with traditional bank underwriting

- Small businesses pitch their loan request at no cost or obligation

- Investors compete through online auction technology

Why it’s great

StreetShares borrowers get funded at competitive rates while investors get the returns they’re looking for. Everyone wins.

Presenters

Mark Rockefeller, Chief Executive Officer and Co-Founder

Rockefeller’s goal is to breathe new life into the American dream for a new generation of small business owners.

Smartphone checkbook app MagicMony

Smartphone checkbook app MagicMony  Rippleshot

Rippleshot  FinDEVr award winner Yodlee

FinDEVr award winner Yodlee