![]() In one of the more interesting investments in recent months, Chinese social network, Renren has led a $40 million funding round for investment platform, Motif Investing.

In one of the more interesting investments in recent months, Chinese social network, Renren has led a $40 million funding round for investment platform, Motif Investing.

Finovate is part of the Informa Connect Division of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC's registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

![]() In one of the more interesting investments in recent months, Chinese social network, Renren has led a $40 million funding round for investment platform, Motif Investing.

In one of the more interesting investments in recent months, Chinese social network, Renren has led a $40 million funding round for investment platform, Motif Investing.

ACI Worldwide partners with ATM provider LD Systems.

ACI Worldwide partners with ATM provider LD Systems.

![]()

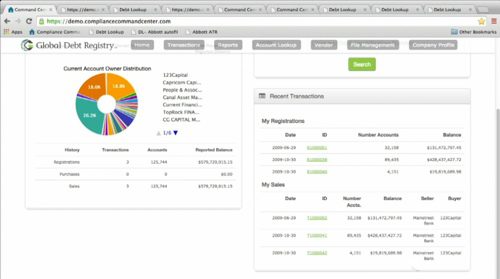

FinovateFall 2014 alum, Global Debt Registry operates in what may be the final frontier of finance: charged-off consumer debt. When consumers get into financial trouble, they find themselves not just battling debt, but struggling to deal with often aggressive – and sometimes unscrupulous – debt collectors.

Founded in 2009 and headquartered in Wilmington, Delaware, Global Debt Registry has developed technology and processes that help both individuals and financial institutions track the chain of title for charged-off consumer debts. This is key in making sure that debts are accurately connected with both debtors and debt owners, bringing transparency and efficiency to an arguably under-regulated space.

Finovate: Global Debt Registry’s primary market is charged off debt. How big is this market and what are its growth prospects going forward?

Wordline extends partnership with Kalixa.

Wordline extends partnership with Kalixa.

When you combine Lending Club’s entry into small business lending last March with its investment from Google in May of 2013, add in a successful IPO last December, what do you get?

A partnership with Google Partners.

Lending Club announced yesterday it is piloting a program that will enable Google to invest its own capital in its network of 10,000 partners by purchasing their loans. This differs from Google’s other investment arms, Google Capital and Google Ventures, as the partner investment program will offer capital without taking equity.

The partner network consists of resellers, consultants, and system integrators that help Google distribute its applications and services. To be eligible for funding, Google partners must be based in the U.S. and meet certain requirements. Qualifying partners can get loans of up to $600,000 for a two-year term.

This six figure amount is double the $300,000 cap that Lending Club typically places on qualified small business borrowers. Also, while the interest rate for SMBs borrowing through Lending Club starts at a fixed 5.9%, those who take out loans through Google Partners will pay only interest the first year, and pay back the loan on an amortized schedule in year two.

This isn’t Lending Club’s first time working with third parties. For a little over a year now, Lending Club has extended two-fold partnerships to banks and credit unions to 1) purchase loans from Lending Club to diversify their asset portfolios and 2) offer personal loans to their banking customers. It is also working with private equity companies.

Lending Club demonstrated at the first Finovate in 2007.

The new year continues to bring C-level changes to the leadership of Finovate alums large and small. Today we learn that Gremln has hired former SirenGPS founder, Paul Rauner to be its new Chief Operating Officer.

Rauner said in a statement: “I am excited to leverage my experience to accelerate Gremln’s effforts to provide secure, compliant social media to our clients.”

Linedata Capitalstream to offer e-SignLive by Silanis.

Linedata Capitalstream to offer e-SignLive by Silanis.![]()

It’s hard to believe, but it’s true: we’re less than one month away from the first Finovate show of the year.

![]() AlphaPoint’s Digital Currency Exchange Platform allows institutions to establish their own internal digital currency exchanges.

AlphaPoint’s Digital Currency Exchange Platform allows institutions to establish their own internal digital currency exchanges.

Global Debt Registry has secured $7 million in Series A financing. The company plans to use the new capital to help drive sales growth and expand operations. The latter includes both increased marketing as well as a move into new asset classes in the consumer debt market.

The individual investors were not immediately disclosed.

Fiserv launches its mobile card management app, CardValet.

Fiserv launches its mobile card management app, CardValet. With the presenter roster set for FinovateEurope, we’ve begun our global search for the financial technology innovations that will be showcased at FinovateSpring in Silicon Valley on May 12 & 13.

With the presenter roster set for FinovateEurope, we’ve begun our global search for the financial technology innovations that will be showcased at FinovateSpring in Silicon Valley on May 12 & 13.

Last year, FinovateSpring welcomed a record crowd of 1,300 executives who witnessed 70+ new fintech innovations debut via our signature demo-only format.

This year, based on the early interest, we expect the event to grow significantly and to showcase even more great innovations than last year.

If your company is interested in debuting your latest and greatest at the premier event for fintech innovation, please email us at [email protected] for more details.

If you’re interested in attending FinovateSpring to watch the future of fintech unfold live on stage, tickets are on sale for the event at the affordable super early-bird price through this Friday only.

We’ll see you in Silicon Valley in May (or London in a few weeks)!

FinovateSpring 2015 is sponsored by: The Bancorp, CapitalSource, Envestnet, Financial Technology Partners, Hudson Cook LLP and Life.SREDA.

FinovateSpring 2015 is partners with: Aite, Bank Innovators Council, BankersHub, Bobsguide, BreakingBanks, California Bankers Association, Canada, Celent, Fin-tech.org, Filene Research Institute, Hotwire PR, Javelin Strategy, Mercator Advisory Group and Western Independent Bankers.