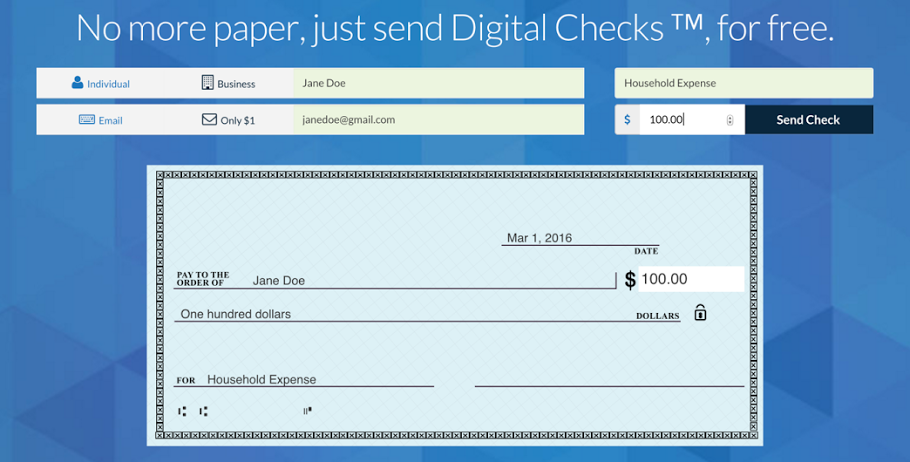

Ever wonder what’s on the other side of some of the fintech we showcase on the Finovate blog? That’s the entire premise of our FinDEVr conference series. To get an idea of what I’m talking about, check out this interview from PJ Gupta, CTO and founder of Checkbook.io.

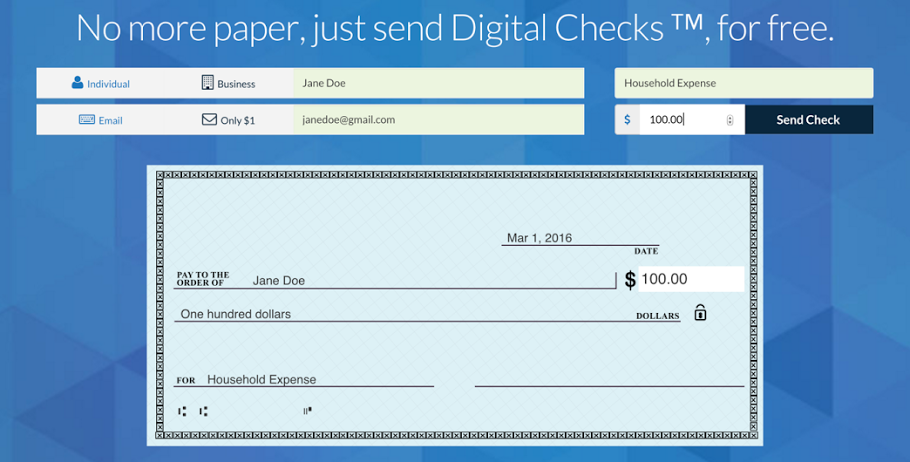

We recently interviewed Gupta, who founded Checkbook.io in 2014, about the company’s digital check platform. You can try out a digital check at checkbook.io/?type=finovate

Finovate: Where did you start your career and how did you gain experience needed to found Checkbook?

PJ: My most recent corporate role was Chief Network Architect at VISA, where I was responsible for the VISA USA commercial and corporate network. From the outside, the VISA network works seamlessly; however, on the inside, the payments ecosystem is very inefficient, both from a business as well as technology perspective. Things move slowly at large established bureaucracies—while fundamental changes always come from the outside—so I decided to leave my cushy job to venture out on my own.

Finovate: What has been the most important technological development in your field in the past few years, and how has it impacted/influenced your work at Checkbook?

PJ: There have been quite a few, but I would say that the two key tech developments for our work at Checkbook are:

Access to bank APIs which allow us to verify bank account credentials and balances in real-time

Ability to use front-end technologies (i.e., tokenization) to seamlessly complete a payment transaction without payment information having to be shared with the merchant’s web servers.

Finovate: What is the most difficult aspect of Checkbook from a compliance standpoint and how do you simplify it for developers and merchant clients?

PJ: Our API has tokenization built into it, so that whether accepting a payment or making one, the user’s sensitive payment information is not shared with the merchant. This allows the merchant to bypass compliance altogether. Furthermore, we are audited and maintain compliance on our side thus reducing the compliance burden for our developers/merchants.

Finovate: Tell us about your favorite integration of Checkbook’s API.

PJ: We have numerous integrations of our API, so it’s hard to give you just one example. Here are a handful of my favorites:

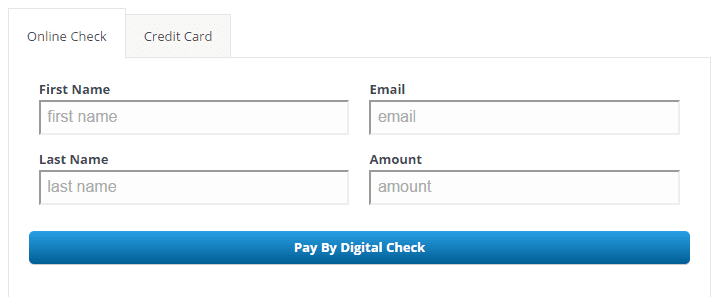

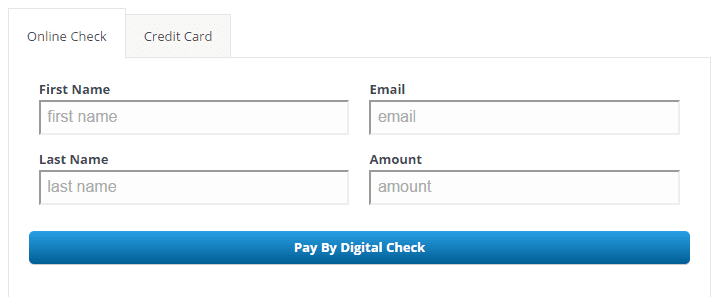

A) We have an Accounts Receivable plug-in available for Shopping Cart platforms, and other private-label applications. Below, you’ll see a screenshot of one of our corporate customers who uses our APIs to receive payment from their shopping cart (in this case they use WooCommerce/Word Press).

B) Cleanly, which is the ‘Uber’ of dry cleaning, is another one of our clients that uses our Direct API. Cleanly uses it to support both accounts receivable and accounts payable to their contractors/workers. Here is a testimonial from them:

“Checkbook has been a huge help for us in providing a scalable solution for sending out payments with an elegant look, easy integration, and one-click payments. It is by far the most cost-effective and easiest way to get payments taken care of, whether you’re reimbursing customers or paying vendors. We’re happy we made the switch.”

– Alex Prober, VP Engineering

C) Another client, Suretrader.com, was able to easily integrate our iframe for accounts receivable using less than 10 lines of code.

D) We are integrated with Quickbooks, which allows business customers to send digital checks through their QB account with the click of a button. Check out the integration video.

E) We also support accounts payable with SalesForce’s Accounting Seed, where our UI/UX is especially user-centric. Furthermore, we have been able to work closely with their product team to make further enhancements (like invoice reconciliation). Check out the integration video.

Finovate: How do you respond to people who claim that checks are dead?

PJ: Completely agree. Paper checks are dead. They are inefficient, slow, and very costly; however, there is no alternative available. ACH has multiple issues namely: payee/payor bank account verification, 3-day settlement delay and not all DDA accounts are ACH enabled. Using our digital checks obviates all of the above problems while also offering a modern user experience that people expect nowadays.

Finovate: What are some upcoming initiatives from Checkbook that we can look forward to over the next few months?

PJ: Think of seamless integrations with major accounting packages. If you’re a user of one of these packages, your bank account will already be verified so you’ll be able to send a digital check with a single click, and the recipient will get it delivered instantly by email. And the next step would be going international!

Finovate: Aside from the major players, what company do you admire for its approach to technology?

PJ: I like the upstarts. Privacy.com is a very early stage startup that has a cute business model and simple problem to solve. It has a browser plugin which allows the user to pay using a disposable credit card number and they, in turn, withdraw money from the user’s account. The business model is interesting because they share the interchange with the issuer. I don’t know how successful it’ll be, but it’s good to see startups coming up with completely new ways to solve persistent problems.

Finovate: What do developers love most about Checkbook’s API?

PJ: To describe this in two words: simplicity and versatility, illustrated by our flexibility in doing the following:

1. Using Checkbook.io for A/P and/or A/R

2. Sending one check or a million with the click of a button

3. Using Checkbook.io’s APIs for shopping cart integration

4. Using Checkbook.io infrastructure as a private-label solution for your payroll needs

5. Sending digital checks through your existing accounting software platform like Quickbooks (integration video) and AccountingSeed (integration video)

For more information on Checkbook, visit the company’s Facebook page, follow them on Twitter, and watch PJ Gupta’s FinDEVr Silicon Valley presentation, API for Digital Checks.

For more developer content, check out FinDEVr Silicon Valley this 18/19 October 2016 in Santa Clara.