FinDEVr returns to Silicon Valley next week on 18/19 October, and we’re preparing for the wave of fintech by examining the companies, their presentations, and the audience in more detail. In the past few weeks, we’ve showed off highlights of each company’s presentation in our Preview series and showcased content from their slide deck in a special Deep Dive feature. Don’t miss out on this year’s FinDEVr Silicon Valley. Register today to join us.

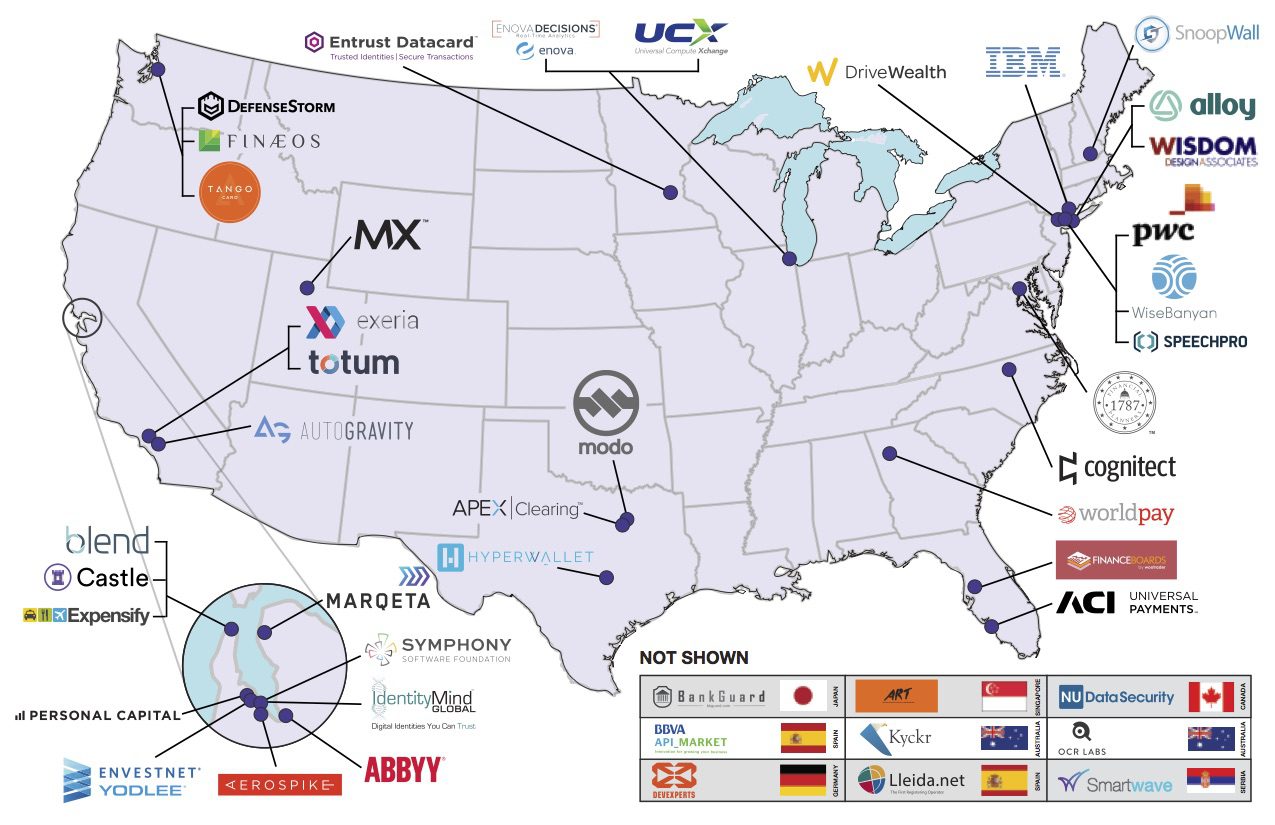

During the dual-track show, each company will give a 15 minute presentation and the audience will have multiple networking opportunities to get a closer look at the tech and talk with the developers involved. Here’s a look at the headquarters/locations of the 46 presenting companies we’ll see on stage next week.

While 10 companies call the Bay Area home, nine will cross national borders to come into the U.S. and showcase their technology at FinDEVr. The two companies traveling the farthest are Kyckr and OCR Labs, which are both based in Australia.

Stay tuned later this week for more about what to expect at FinDEVr, who else will be in attendance, and last-minute conference details.

FinDEVr Silicon Valley 2016 is sponsored by The Bancorp.

FinDEVr Silicon Valley 2016 is partnered with Acuity Market Intelligence, BankersHub,BayPay Forum, BiometricUpdate.com, Bitcoin Magazine, Bitoinist.net, Breaking Banks, Byte Academy, California Bankers Association, Celent, The Cointelegraph, Colloquy, Emerging Payments Association, Empire Startups, FIDO Alliance, Fintech Finance, Global Platform, Hack Reactor, Harrington Starr, Juniper Research, Mercator Advisory Group, Next Money, Payment Week, Payments & Cards Network, SecuritySolutionsWatch.com, SIMAlliance, Swiss Finance + Technology Association, and Women Who Code.

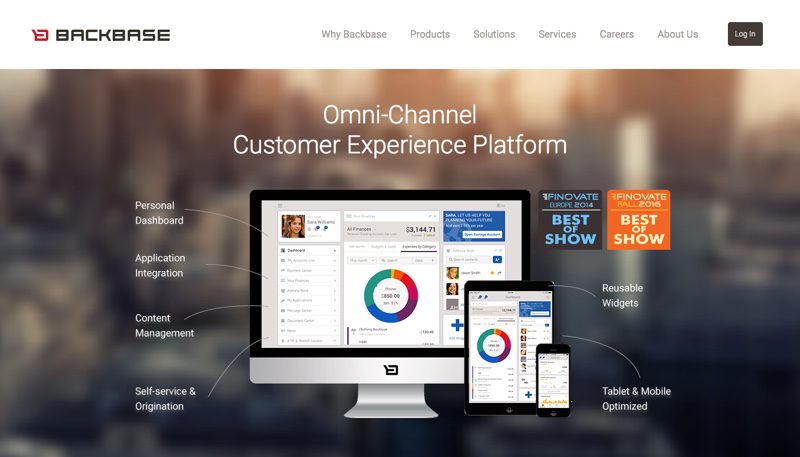

Panowicz (pictured) is credited for helping lead the digital transformation of the third largest bank in Poland, mBank. A multiple Best of Show winner at Finovate conferences, partnering with companies like Accenture (

Panowicz (pictured) is credited for helping lead the digital transformation of the third largest bank in Poland, mBank. A multiple Best of Show winner at Finovate conferences, partnering with companies like Accenture (