W.UP (pronounced whup) provides digital banking software to offer a “happy banking experience” to customers who expect fast and simple online and mobile banking. At FinovateEurope in London last month, the company launched Sales.UP. In the demo, W.UP’s Tamás Braun, Head of International Sales and Business Development, explained how, with Sales.UP, banks, “don’t need to deal with the challenge of defining complex behavioral insights in [their] data.”

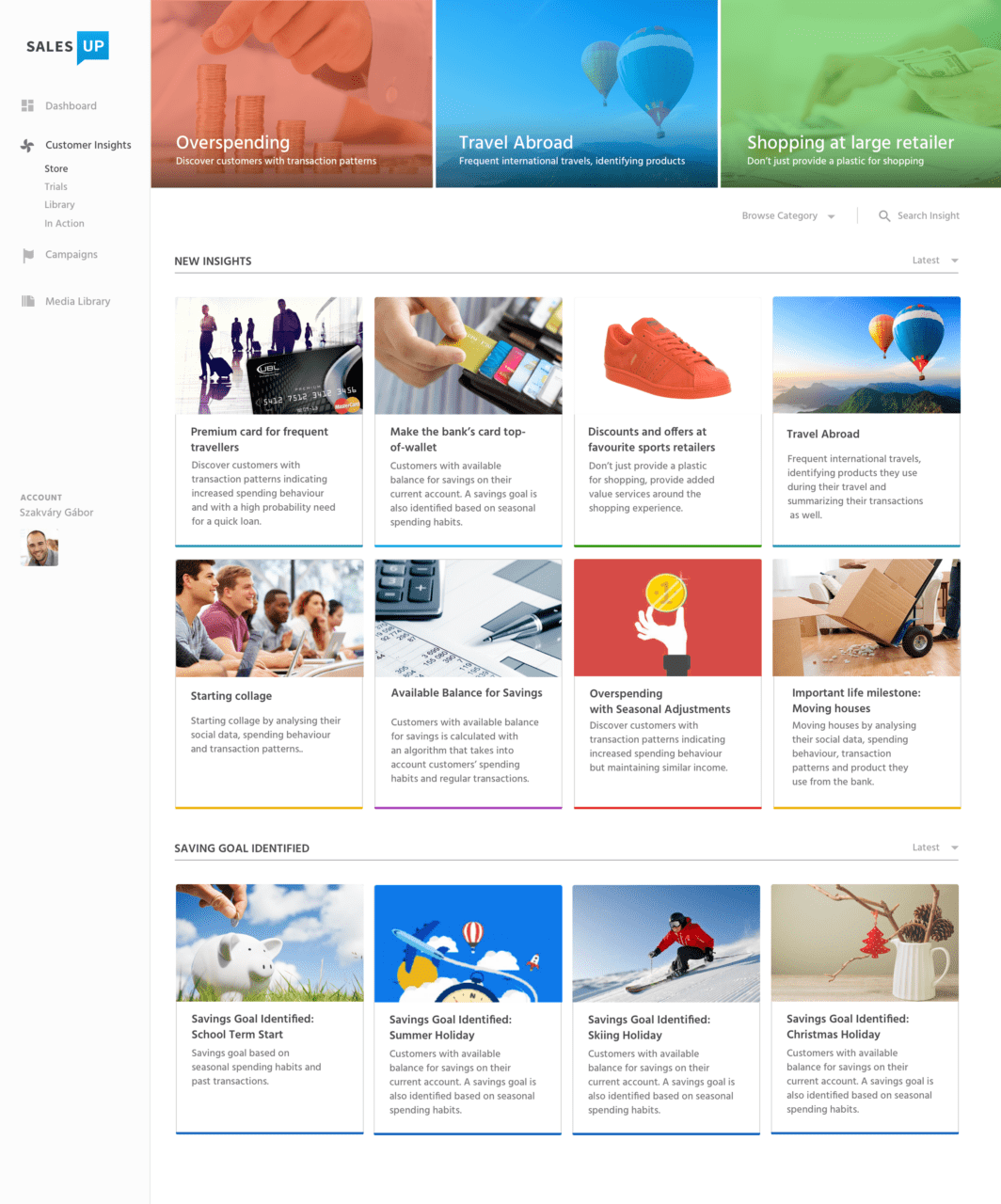

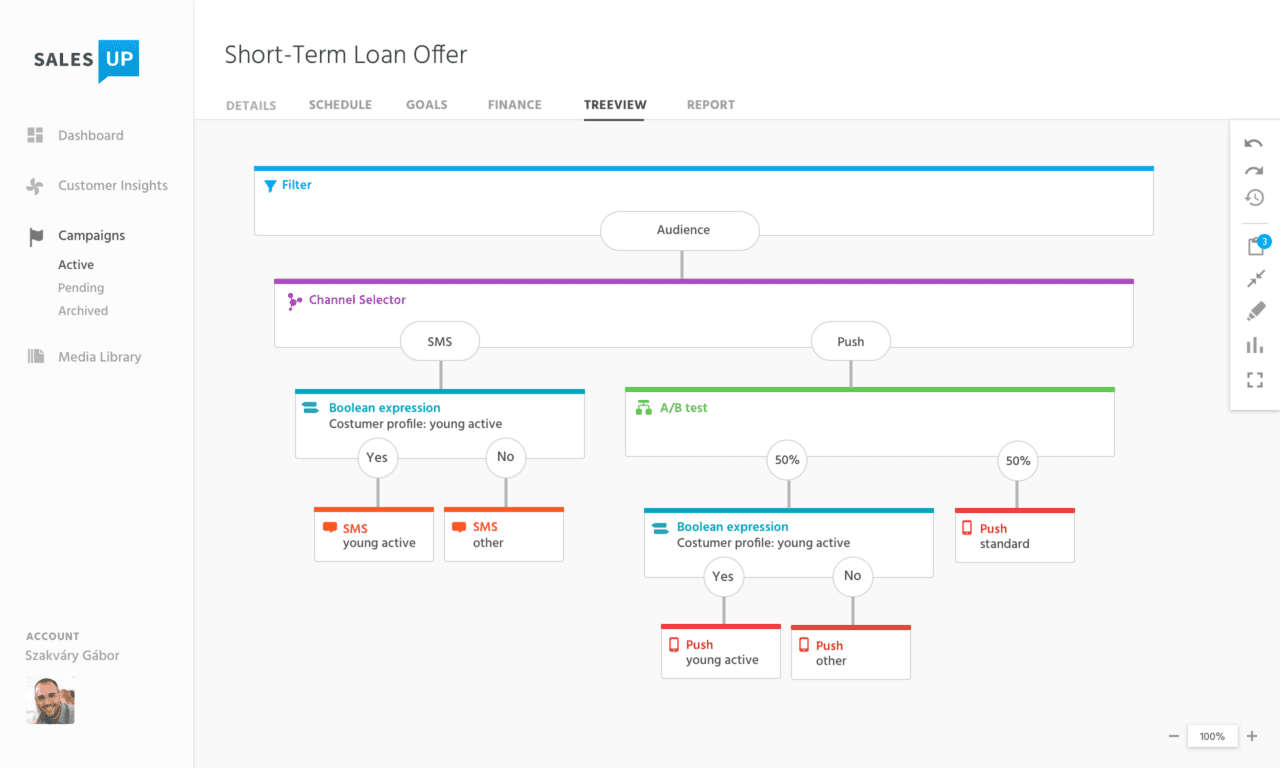

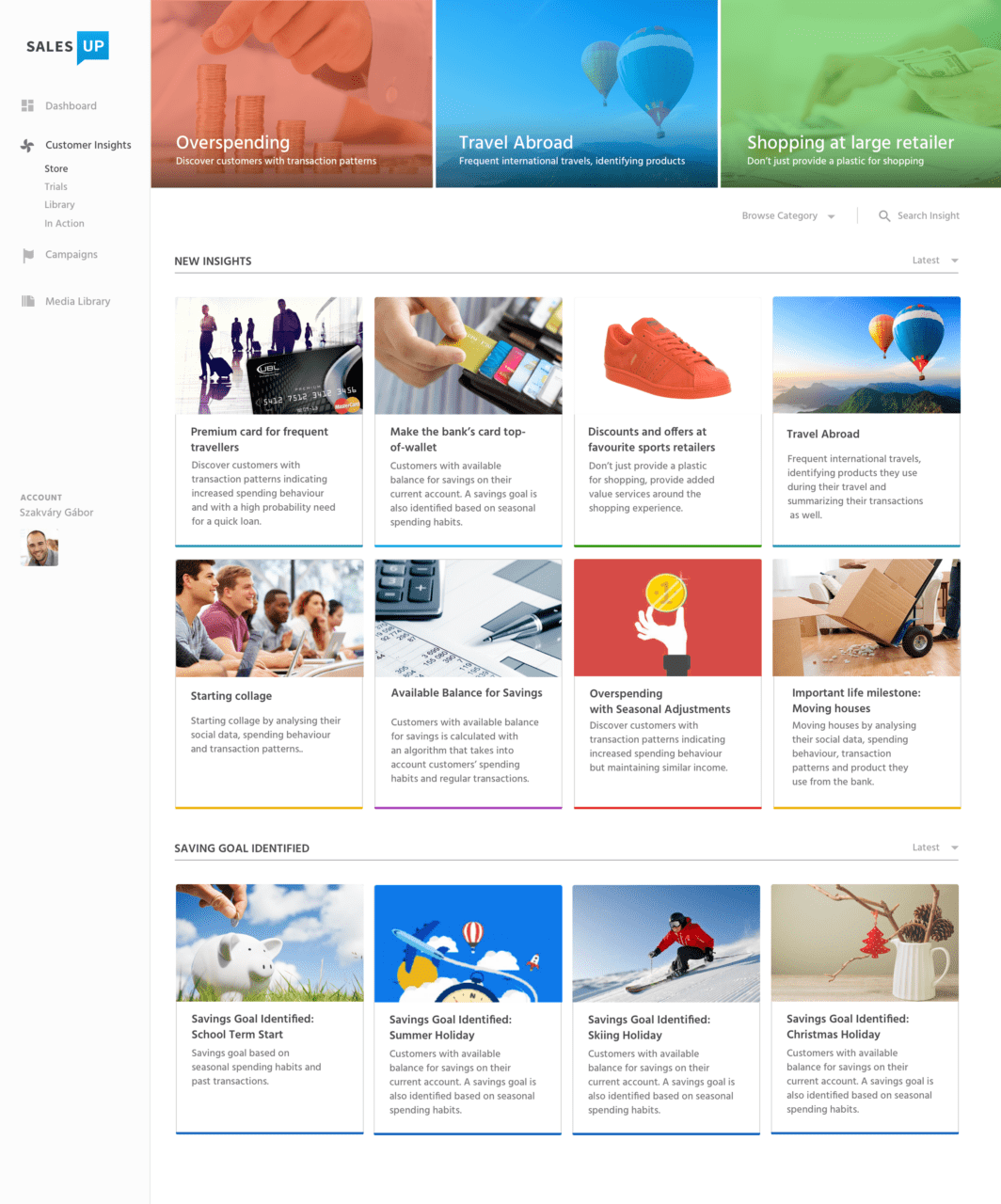

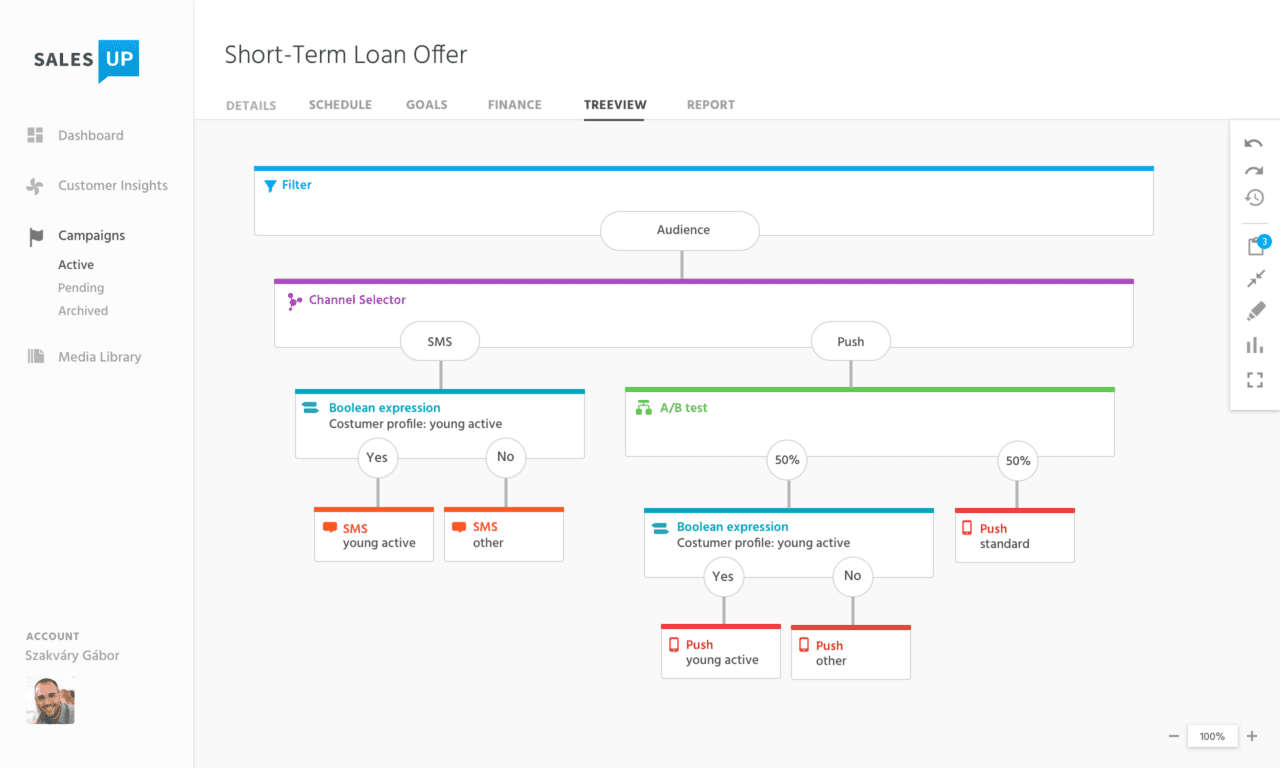

Sales.UP is a library of customizable, pre-packaged customer insights, along with a built-in marketing automation tool, which empowers marketers to build their own marketing campaign. The insights are derived from customer data and designed to help banks cross-sell and up-sell products using relevant, tailored messaging. Braun continued, “some insights will forecast life events such as expecting a baby or moving house. Other insights are about digital behavior, like connecting your online customers with call center agents when assistance is required.”

Company facts:

- Headquartered in Budapest, Hungary

- 100+ employees

- 4 offices across Europe

W.UP’s Tamás Braun (Head of International Sales & Bus. Dev.) and Balázs Zotter (Head of Product Line)

After FinovateEurope, we interviewed Tamás Braun (pictured), Head of International Sales and Business Development at W.UP.

After FinovateEurope, we interviewed Tamás Braun (pictured), Head of International Sales and Business Development at W.UP.

Finovate: What problem does W.UP solve?

Braun: Banking customers today are used to always-on, real-time sales and services, which are personal, predictive, and contextual. This trend is mainly driven by other industries and companies such as Google/Amazon. Banks are lagging behind in the area of predicting customers’ financial needs and making actionable recommendations that are integrated seamlessly into an end-to-end everyday experience. W.UP’s new SALES.UP product, which has been launched at FinovateEurope 2017, is a digital sales and engagement tool which uses pre-defined customer insights to enable banks to understand behavioural patterns of customers and to use these insights to predict opportunities for relevant and timely interactions.

Sales.UP’s Customer Insights Library

Sales.UP’s Customer Insights Library

Finovate: Who are your primary customers?

Braun: Banks and other financial institutions who would like to improve their digital sales capability without expensive and lengthy big data projects.

Finovate: How does W.UP solve the problem better?

Braun: Many financial institutions use a marketing automation system that lacks focus on customer insights, making it difficult or impossible to provide real-time, personal and relevant messages to their clients. W.UP’s solution comes with its own Data Universe with all the necessary, real-time data gathered from internal and external (3rd party) sources. The SALES.UP Insight Store provides pre-defined customer insight templates that enable banks without a deep understanding of data modeling and predictive data analytics to use actionable insights within their marketing campaigns. The solution is designed specifically for financial institutions, using behavioral analytics and providing out-of-the-box, configurable insights for marketing campaigns.

Above: Customer insight tool for frequent travelers

Finovate: Tell us about your favorite implementation of your solution.

Braun: SALES.UP has recently been launched and there is currently one early adopter bank in Hungary who will be announced publicly following the first phase of the implementation.

Finovate: What in your background gave you the confidence to tackle this challenge?

Braun: W.UP was established in 2014 by private individuals who worked in digital banking for the past 15 years. We have worked with many financial institutions throughout our careers and believe that still too many of them fail to understand customer behavior and provide relevant, timely, predictive and context-aware service to their customers. We help bridge the gap between what banks can do and what customers wish they could.

Above: Marketers can build their own campaigns with W.UP’s automation tool

Above: Marketers can build their own campaigns with W.UP’s automation tool

Finovate: What are some upcoming initiatives from W.UP that we can look forward to over the next few months?

Braun: There are several other financial institutions currently evaluating SALES.UP so we are expecting a number of implementation projects in the following months. We are also keeping our MOBILE.UP product in the loop, a pre-built mobile banking product, which is also a development framework, shrinking the implementation process down to only three months. With the upcoming PSD2 directive there is a lot of interest from clients to help them move towards open banking.

Finovate: Where do you see W.UP a year or two from now?

Braun: We aim to become a leader in digital sales and mobile banking software development in the financial industry to brighten up the world of traditional banking with happy digital banking experiences.

Check out the video of W.UP’s Tamás Braun (Head of International Sales & Bus. Dev.) and Balázs Zotter (Head of Product Line) at FinovateEurope 2017:

After FinovateEurope, we interviewed Tamás Braun (pictured), Head of International Sales and Business Development at W.UP.

After FinovateEurope, we interviewed Tamás Braun (pictured), Head of International Sales and Business Development at W.UP. Sales.UP’s Customer Insights Library

Sales.UP’s Customer Insights Library

Above: Marketers can build their own campaigns with W.UP’s automation tool

Above: Marketers can build their own campaigns with W.UP’s automation tool