This article was first published on FinTech Futures on June 27th 2017.

Part of our #WomenInFinTech series, we chat to Christina McGeorge – chief product officer and VP of product ownership for D3 Banking – about how she only became aware of her success within fintech a few years ago. She shares some words of inspiration and motivation to the next round of successful women in tech.

Part of our #WomenInFinTech series, we chat to Christina McGeorge – chief product officer and VP of product ownership for D3 Banking – about how she only became aware of her success within fintech a few years ago. She shares some words of inspiration and motivation to the next round of successful women in tech.

How did you start your career?

I began my career nearly thirty years ago as a software engineer at ACI Worldwide. I was still in college, working on my degree in management information systems at the University of Nebraska at Omaha. After two years, I switched my focus to solutions architecture because I wanted to broaden my skillset. I went on to work for ACI for 20 years, eventually becoming the lead design engineer for ACI’s point of sale product.

What sparked your interest in fintech?

Computer sciences had always been an interest of mine, so it was a natural fit to study in college. However, my curiosity and passion quickly grew beyond just computer sciences, and I found myself pursuing some exciting opportunities in the fintech space. I’ve been hooked ever since.

What was your lightbulb moment?

I’ve always enjoyed my work, but my lightbulb moment didn’t come along until a few years ago. While I was designing front-end authorization systems at ACI and back-office solutions for BHMI, I was assembling pieces of a puzzle, gaining more knowledge of particular niches within the fintech space. It wasn’t until I joined D3 Banking and gained a new perspective that the broader picture came into focus. Suddenly, the trajectory of my career made sense. Without my previous experiences and the perspectives gained from them, I would not have been positioned to contribute to D3 Banking as I have, helping to design our platform. The pieces of the puzzle just fell into place; I had been on this path all along.

What inspires you?

I’ve always been inspired by the notion of providing people with the opportunity to better themselves financially. This is why when I had the chance to join a start-up digital banking company more than five years ago, there was no hesitation. I was employee number 15 at D3 Banking, which allowed me to help build our platform from the ground up in a way that helps both banks to reduce complexities in their systems, and end users to better understand their financial situations and enhance communication with their banks.

Why is the #WomenInTech movement important?

Culturally, we struggle with the idea that it’s normal or even acceptable for girls to be good at math or sciences. In fact, I remember being one of few girls in my computer science classes. The #WomenInTech movement spreads the message that anyone in the world, even a young girl in grade school, can be good at science at math, and that the world is open to you. This is so important for future growth and progress.

What piece of advice would you give women starting their careers in fintech?

When I was younger, my grandfather used to quiz me on my math. I remember one day he told me, “it’s not whether you can; it’s whether you want to.” That’s something that really resonated with me, and is something I think is important for not only women, but all people to know. You are capable, if you’re willing to put in the effort necessary to achieve your goals.

Throughout the year we will be profiling women in fintech, not simply to celebrate their success but also to hear what has worked for them during the course of their careers. Click here to read more inspirational stories from fintech’s leading women >>

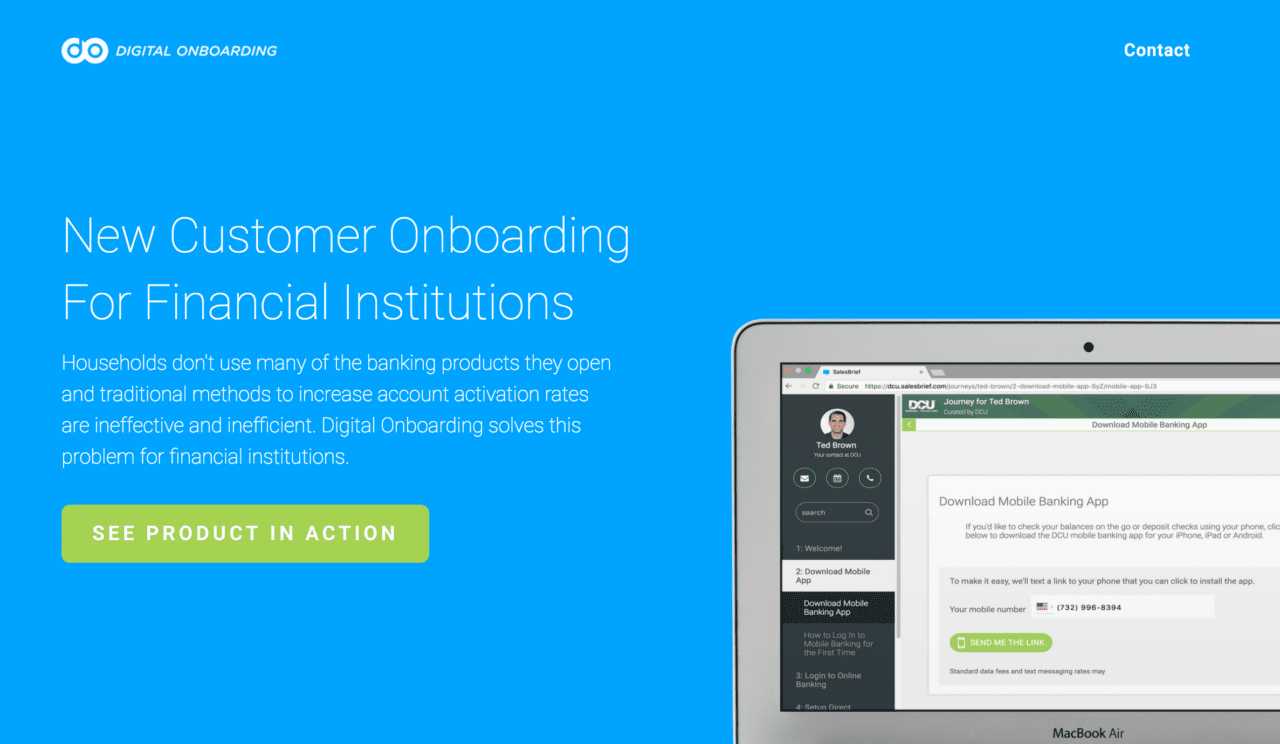

A look at the companies demoing live at FinovateFall on September 11 through 14 in New York. Pick up your tickets today and save your spot.

Presenters

Presenters

Wojciech Zatorski, CEO & Co-Founder

Wojciech Zatorski, CEO & Co-Founder

John Binda, Enterprise Account Executive

John Binda, Enterprise Account Executive

Jessie Morris, Director of Engineering

Jessie Morris, Director of Engineering