Student loan repayment platform Tuition.io has landed a major client this week. The Los Angeles-based startup has partnered with Estée Lauder, offering a platform where the beauty company can help its employees pay down debt from their student loans.

Through their employee benefits package, Estée Lauder’s 46,000 employees will be eligible to receive up to $10,000 in student loan contributions. The repayments will be distributed in $100 increments each month to eligible employees’ loans. These parameters were put in place by way of insurance, since Estée Lauder isn’t aware of the value of its employees’ outstanding student loan debt. To receive Estée Lauder’s match of 100% on the first 3% and 50% on the next 4% of repayments, employees must contribute at least 7%.

Estée Lauder is one of many large U.S. companies to partner with Tuition.io for student loan repayment benefits for employees. Other companies include Live Nation, Staples, Children’s Hospital & Medical Center, HP, and Fidelity Investments.

One of the intentions of Tuition.io’s student loan repayment benefit offering is to attract millennials to the workforce. Millennials make up 61% of Estée Lauder’s workforce and, since the benefit took place in October of last year, about 65% of employees who have signed up are aged 35 or younger.

In a statement, Latricia Parker, executive director of global benefits for Estée Lauder, said that “student loans are an increasing burden for current and potential talent at The Estée Lauder Companies.” Parker went on to explain that the implementation of Tuition.io’s benefit program “is an example of how the company is executing its goal of being the best home for talent — offering benefits that relieve the stresses of everyday life and allow employees to focus on their careers and passions.”

The company’s former CEO Brendon McQueen debuted Tuition.io at FinovateFall 2012. The company has since transitioned into a strict B2B business model in which it helps businesses pay down student loan debt on behalf of their employees. Last September, Tuition.io raised $7 million in Series B funding, bringing its total capital to more than $15 million. At FinovateFall 2017, we interviewed Tuition.io CEO Scott Thompson about the state of the student loan crisis.

Presenters

Presenters Quentin Colmant, Co-founder

Quentin Colmant, Co-founder

Presenters

Presenters

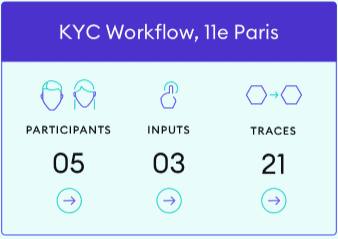

Dubbed IndigoTrace, it’s a user-friendly API that allows business administrators to create a workflow and invite participants, giving them each a role designated by a public/private key. Users can add inputs to the workflow and all changes can be monitored and traced in real time. This traceability offers visibility into who did what, when, where, and why, allowing for easy audits throughout the process. All information is secured by Stratumn’s Proof of Process (PoP) technology and public blockchains.

Dubbed IndigoTrace, it’s a user-friendly API that allows business administrators to create a workflow and invite participants, giving them each a role designated by a public/private key. Users can add inputs to the workflow and all changes can be monitored and traced in real time. This traceability offers visibility into who did what, when, where, and why, allowing for easy audits throughout the process. All information is secured by Stratumn’s Proof of Process (PoP) technology and public blockchains.

Presenters

Presenters Vitor Barros, Pre-Sales Director

Vitor Barros, Pre-Sales Director

Presenters

Presenters

Presenter

Presenter