Dutch digital banking technology provider Five Degrees has teamed up with BillPro, an international business payments solutions specialist. Together, the two companies will launch a new cross-border banking service in Europe with Five Degrees’ core banking solution Matrix at the center.

“We are very happy to unite forces with BillPro, a leading provider of payment solutions in Europe and beyond,” Five Degrees CEO Martijn Hohmann said. “As a result, we are able to expand our customer base and enhance our position in the European market for Digital Banking platforms. Through this partnership, we can shape our idea of marketplace banking even more.”

Five Degrees Director of Sales Santosh Radhakrishnan and Prospery Product Owner Andrew Trythall demonstrating the company’s wealth management solution at FinovateEurope 2018.

BillPro will use Matrix as its core digital banking platform, and will offer it to its partners as an additional service option. The partnership will enable Five Degrees to expand its presence in the European market and give BillPro the ability to launch new banking services for its international business clients and support fintechs as they develop their own innovative solutions.

Matrix is an intelligent digital banking platform that supports customer onboarding, transactions, documents, and all customer interactions. The platform can be connected to legacy core banking systems, helping banks offer a broader range of customer-centric services including SME and retail lending, robo advisory and wealth management, as well as mortgages, FX trading, and current, savings, and deposit accounts.

“This will add significant value to both current and future clients as well as partners,” BillPro CEO Daria Rippingale said. “Our partnership with Five Degrees will enable BillPro to issue IBANs and Bank Accounts to people around the world.”

A member of the FinTech 50 and winner of the Banking & IT category at the Dutch Fintech Awards, Five Degrees has partnered with a variety of banks and fintechs including top three Netherlands consumer lender Credit Agricole Consumer Finance; robo advisor and fellow Finovate alum Munnypot; and GarantiBank, a European bank with more than $91 billion in assets.

At FinovateEurope 2018, Five Degrees demonstrated how Matrix served as an “orchestrating hub” for ABN AMBRO’s wealth management offering Prospery. Founded in 2009 and headquartered in Amsterdam, the Netherlands, Five Degrees has raised more than $11 million (€10 million) in funding from investors including Karmijn Kapitaal and Velocity Capital.

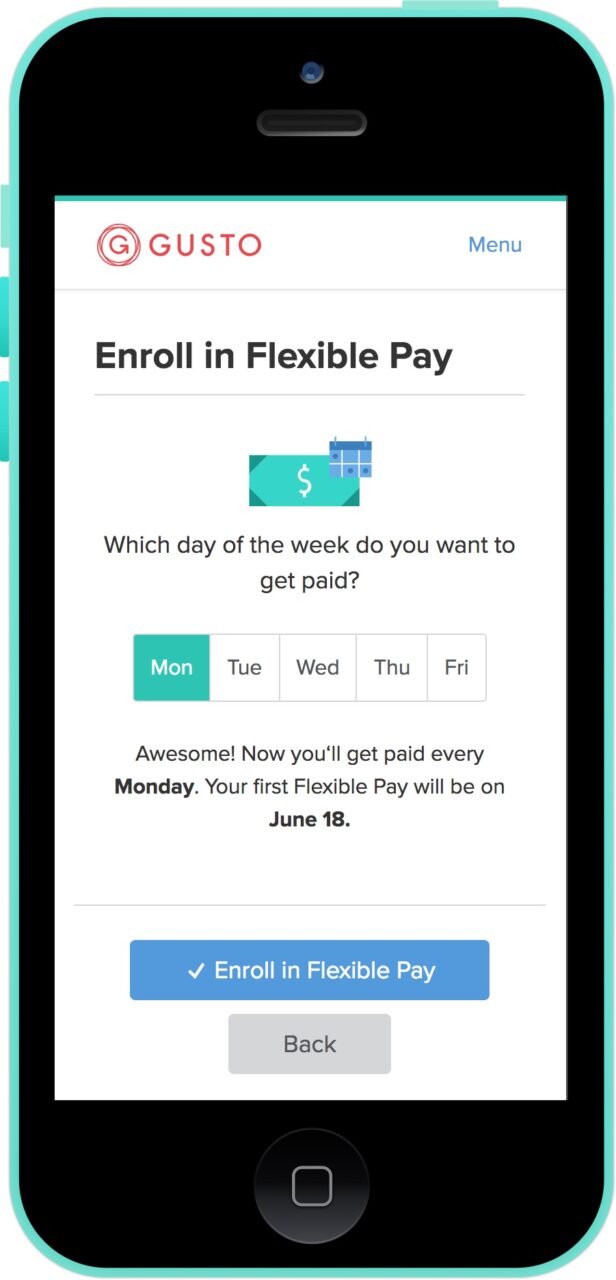

schedule. “The two-week pay schedule should no longer exist in today’s world.” Gusto co-founder and CEO Joshua Reeves said. “It’s a relic of calculating payroll taxes manually and was instituted in the U.S. almost 90 years ago. With modern technology, employees shouldn’t have to wait weeks to get paid.”

schedule. “The two-week pay schedule should no longer exist in today’s world.” Gusto co-founder and CEO Joshua Reeves said. “It’s a relic of calculating payroll taxes manually and was instituted in the U.S. almost 90 years ago. With modern technology, employees shouldn’t have to wait weeks to get paid.”