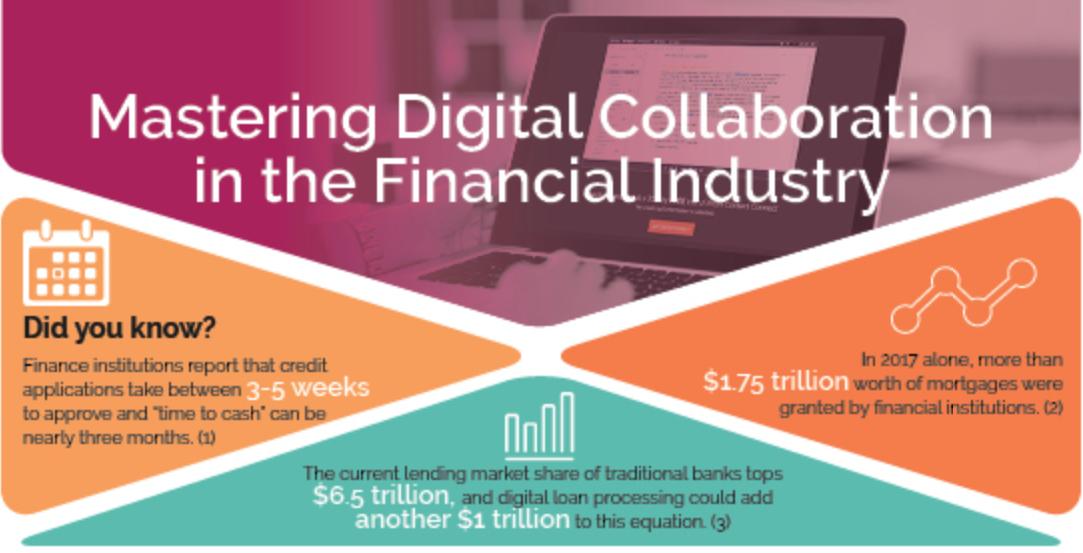

If digital transformation is sweeping financial services – and this trend has been accelerated by the global public health crisis, as we are often told – then what’s up with the huge and enduring demand for cash?

“I certainly would have expected, if you’d asked me prior to COVID: would COVID put a big dent in cash? I would have said “absolutely” because not only are people not going out, it has a dirty connotation to it,” Fiserv Senior Vice President David Keenan said during the Q&A portion of his recent webinar presentation, Looking Under the Hood of Today’s Payments Ecosystem.

“And yet if you look at the data,” he added, “that’s not what’s happening.”

This was one of many fascinating takeaways from Keenan’s research on payment trends in the COVID-19 era. That research was presented this week in a webinar that also looked at the rise of digital enablement in financial services and the inevitable transition to real-time payments. Keenan’s presentation is now available for viewing on an on-demand basis.

Toward the end of his discussion, which explained how and why companies need to be able to provide “the right options at the right time to create a winning payment experience,” we asked the Fiserv SVP why he began his presentation, which featured insights on digital enablement and real-time payments, with a discussion on the importance and endurance of cash.

Keenan said the decision to start with cash was deliberate – and given the program’s theme of “safe, fast, convenient payments” it is perhaps easy to understand why. For all of cash’s drawbacks – including the fact that paper money increasingly is seen as “dirty” in an ever-more touchless world – Keenan showed research from the Federal Reserve indicating that cash remains a preferred payment method in the U.S. – only trailing debit. Moreover, for about 85% of those surveyed, cash usage over the past 12 months had remained the same, or increased.

But perhaps most interestingly, this data also revealed that cash’s most passionate champions are under the age of 25. And this preference for paper money does not take away from GenZ’s appreciation of debit, which is on par with 25-to-34 year old, 35-to-44 year old, and 45-to-54 year old cohorts. Nor was credit usage impacted by GenZ’s preference for cash; GenZ credit usage was comparable with both 25-to-34 year old and 35-to-44 year old age groups. The main difference between GenZ and other cohorts was in the use of electronic payments, where its usage was typically half that of other groups surveyed.

A further note on the enduring preference for cash: while cash usage patterns have returned to trend after a brief, coronavirus-induced drop in March, the amounts of cash being used – which began increasing in March – have remained elevated.

Keenan speculated that what might blunt these accelerating cash trends could be a major response to the coronavirus – such as a vaccine. He said, “as long as we’re living in this one-step-at-a-time, back-to-the-new-normal, we believe cash is going to be an important part (of payments).”

Photo by Karolina Grabowska from Pexels