The big card companies continue to make the kind of deals that underscore the importance of fintech to the future of financial services. This week we get confirmation that international payments giant American Express has agreed to acquire SME lender Kabbage.

Terms of the deal were not disclosed. Speculation on the deal in recent days has put the purchase price between $850 million and $1 billion.

The acquisition will include Kabbage’s team, its suite of financial technology solutions, as well as the company’s data platform and IP built for small businesses. American Express also plans to leverage Kabbage’s technology and talent to offer additional cash flow management and working capital solutions to its small business customers. In the acquisition announcement, American Express highlighted Kabbage’s recently introduced business checking account, which centralizes funds for easier cash flow management.

“This acquisition accelerates our plans to offer U.S. small businesses an easy and efficient way to manage their payments and cash flow digitally in one place, which is more critical than ever in today’s environment,” President of Global Commercial Services at American Express Anna Marrs said.

A Finovate alum for more than a decade, Kabbage has raised $2.5 billion in funding, with the company’s last equity round closing in 2017 after raising $250 million. This year, in addition to the launch of its business checking account, Kabbage distinguished itself as a major conduit for small businesses seeking COVID-19 related relief funding. The company said it has facilitated 300,000 Paycheck Protection Program (PPP) loans valued at more than $7 billion. Kabbage’s participation in the program was a dramatic return to its role as a resource for small business financing after the company suspended SME lending in April in response to the global health crisis.

“At Kabbage, we have always made the success of America’s small businesses our primary objective,” Kabbage CEO and co-founder Rob Frohwein said in a statement. “We have built a technology and a data platform that provides them with the kind of capabilities and insights often reserved for larger businesses. By joining American Express, we can help more small businesses succeed with a fully digital suite of financial products to help them run and grow their companies.”

As part of the agreement, both Kabbage’s securitized SME loans and its PPP laons will be serviced by an separate entity to be established by Kabbage and American Express, the Financial Times reported.

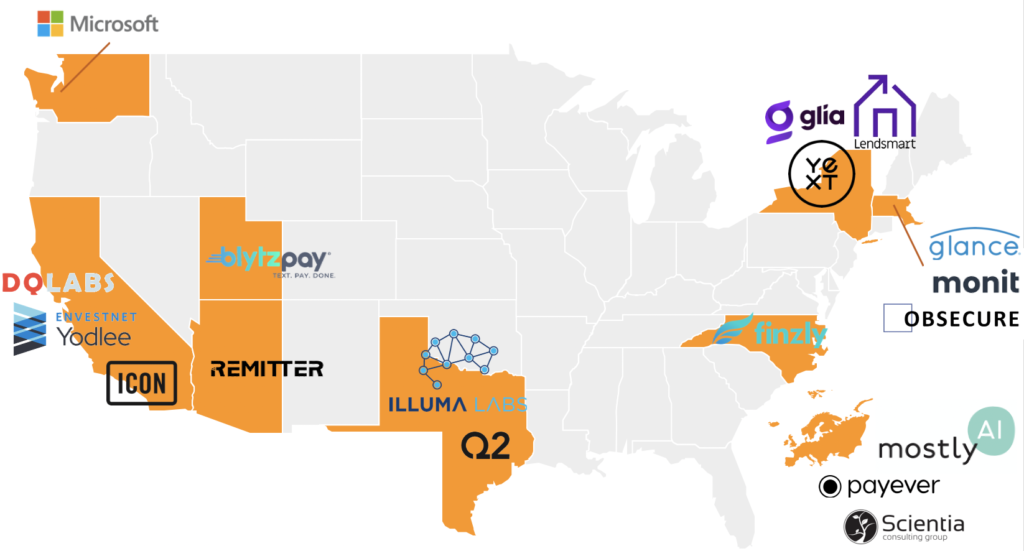

American Express’ purchase of Kabbage comes less than a month after another big acquisition in the online SME lending space: Enova International’s $90 million deal for OnDeck. For both companies, the acquisitions provide the opportunity to expand meaningfully beyond their core competencies: Enova adding to its consumer lending operations, and AMEX bringing working capital and SME financing to its commercial card business.

The acquisition is expected to close later in 2020.

Photo by Paul IJsendoorn from Pexels