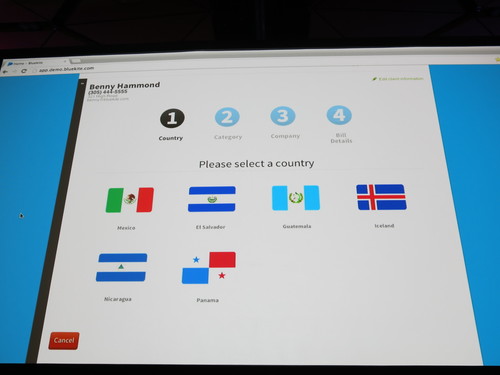

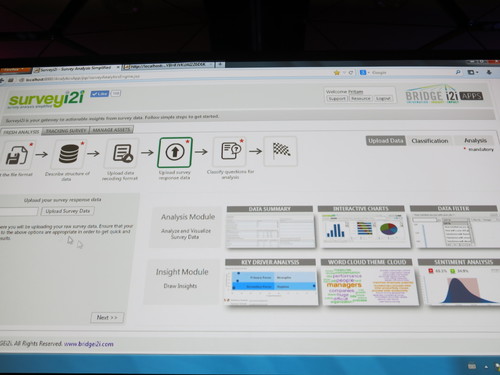

Finovera, the platform that serves as a single place where consumers can manage their online bills and accounts, is launching out of private beta this week.

The free platform aggregates consumers’ bill payments from more than 10,000 billers to provide a single place where they can access and pay their bills. Some of the features include:

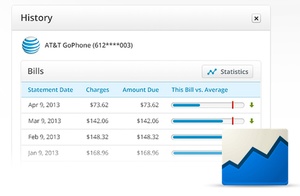

- Track payments

- Set payment reminders

- View metrics from up to 12 months of historical data

It also provides users with a view of trends and analytics from their accounts and will alert them when bills are higher than average.

The service is similar to doxo and Manilla.

Finovera debuted at FinovateSpring 2013. Check out the live demo here and sign up for your own account here.