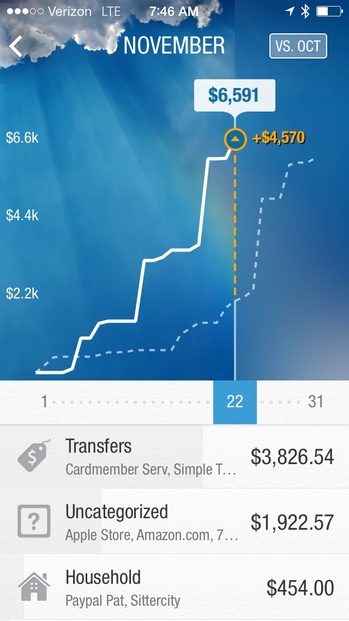

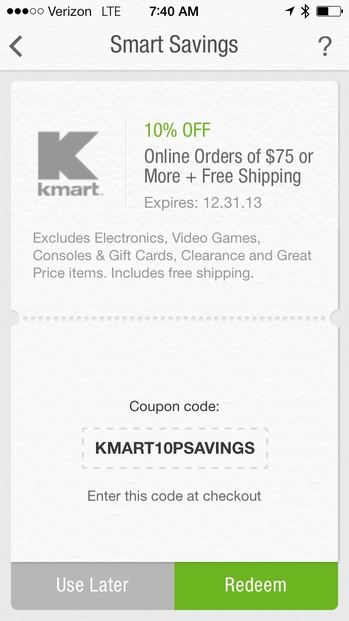

BancVue’s Kasasa 360 Financial Management platform received a bit of a upgrade recently, thanks to a partnership with PFM expert, MoneyDesktop.

By bringing together MoneyDesktop’s expertise in PFM with Kasasa’s national brand of rewards checking and savings, the two hope to drive account acquisition, account retention and increase cross-selling opportunities.

This union of two Finovate Best of Show-winning companies will give Kasasa 360 users the ability to track their finances across different financial institutions in one place and enable them to view their rewards tied to their Kasasa checking and savings accounts.

To get a better idea of the what each company has to offer, check out the live demo videos. Bancvue demonstrated Kasasa at Finovate 2009 and MoneyDesktop last demonstrated at FinovateFall 2013.

Blackhawk Network partners with Opengate to Launch New Prepaid Content in South Africa.

Blackhawk Network partners with Opengate to Launch New Prepaid Content in South Africa.

joining Emida, David worked for iSend where he helped build the company’s in-kind international payments business.

joining Emida, David worked for iSend where he helped build the company’s in-kind international payments business.