In an era when BYOD is not just a fad, but a need, CellTrust SecureLine helps businesses manage their enterprise’s mobility while keeping operations secure and compliant.

Company facts:

- Founded: 2006

- HQ: Scottsdale, Arizona

- Offices in Canada, London, Australia, and Singapore

- Funding: $10.1 million

CellTrust SecureLine creates a work phone and a personal phone on the employee’s existing device by issuing a unique mobile business number for professional communications.

In 2014, CellTrust partnered with Good Technology to leverage the Good Dynamics SDK and create CellTrust SecureLine for Good, a containerized version of the solution that offers a full ecosystem of encrypted business apps.

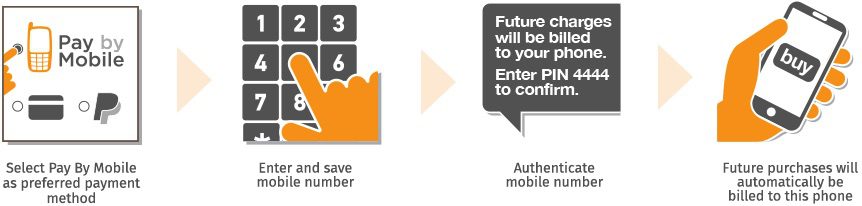

How it works

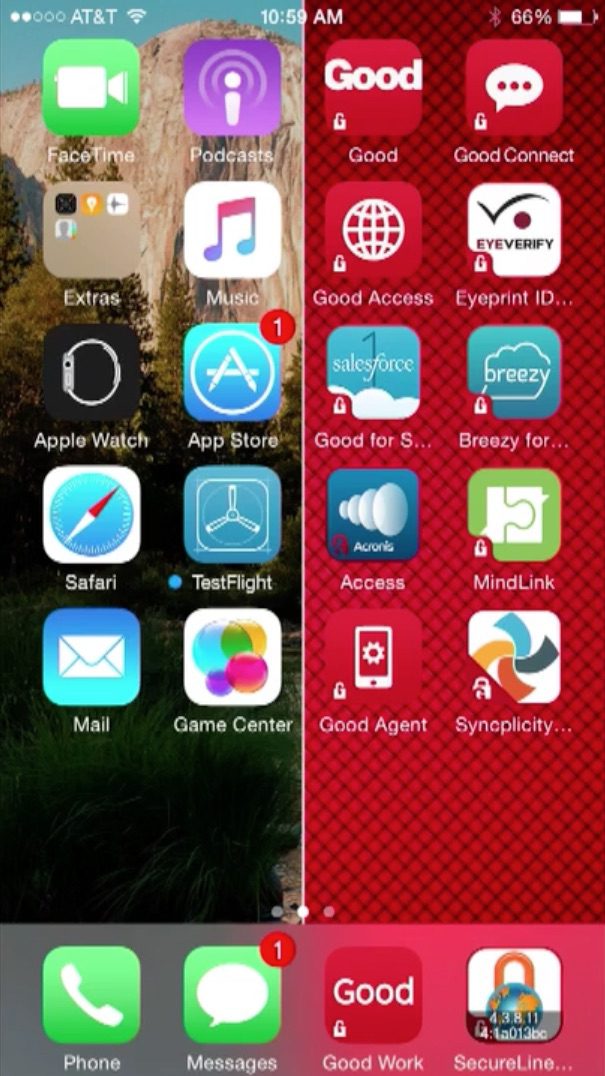

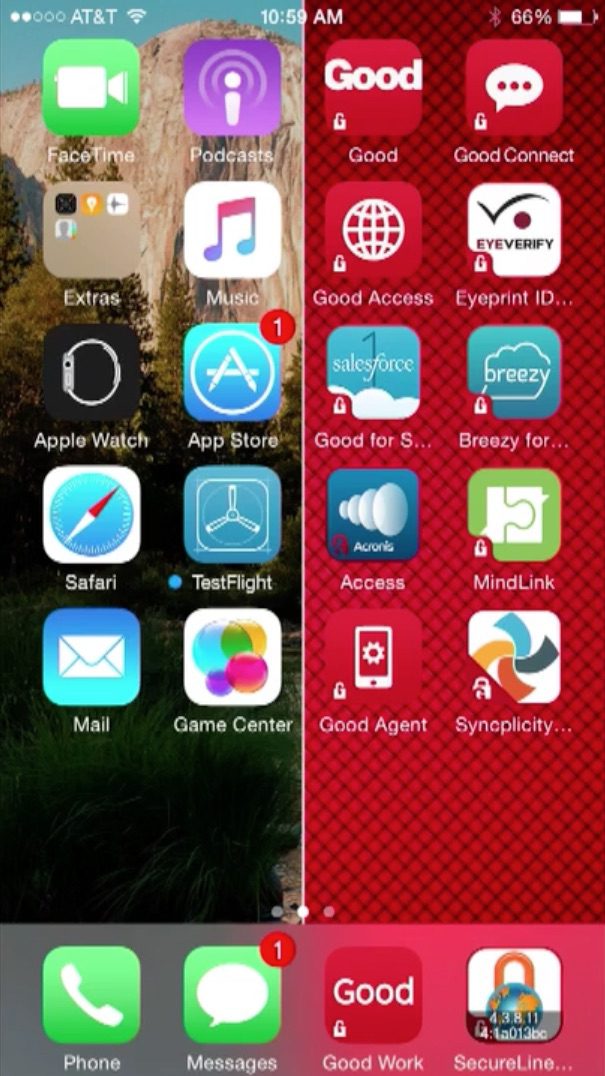

Companies without mobility-management containers can use CellTrust SecureLine, although it will track only phone and text-message communications. The example below shows the containerized version, integrated with apps in the Good container such as email, Salesforce, and EyeVerify.

As you can see, the employee has placed all of their business apps on the right side. All work-specific apps are designated by a lock icon.

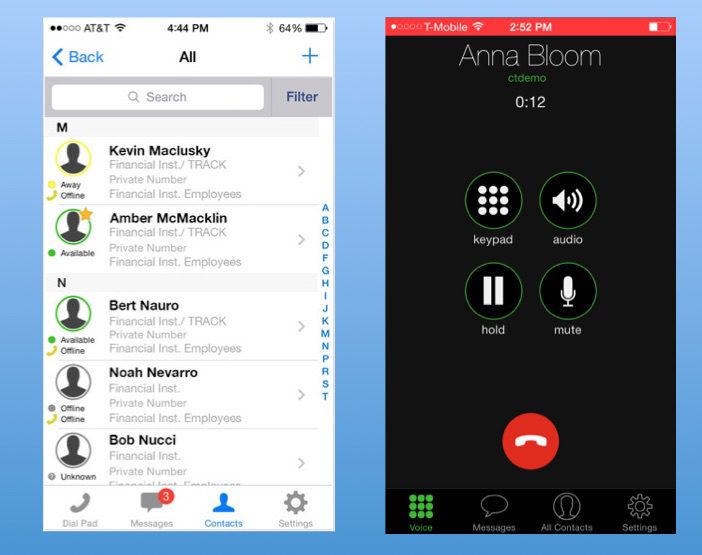

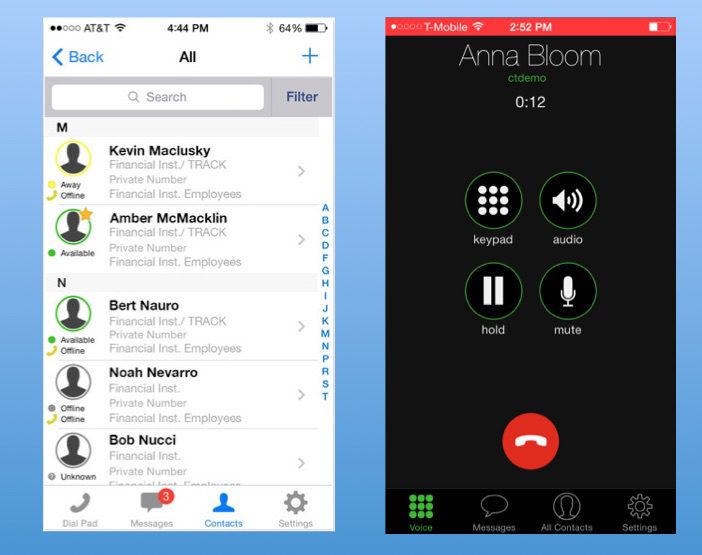

When placing a business call, the employee selects the Good for Work app to access contacts.

CellTrust is fully integrated with the device and pulls in the user’s existing contacts (see below left). No additional steps are needed; the employee proceeds with the call as they naturally would.

The recipient receives the call normally, with no special app or additional steps; however, after answering, CellTrust plays a recorded disclosure customized by the bank.

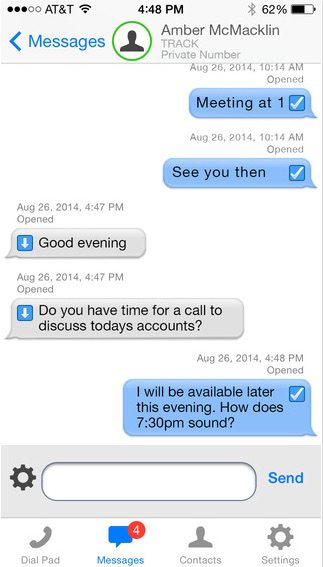

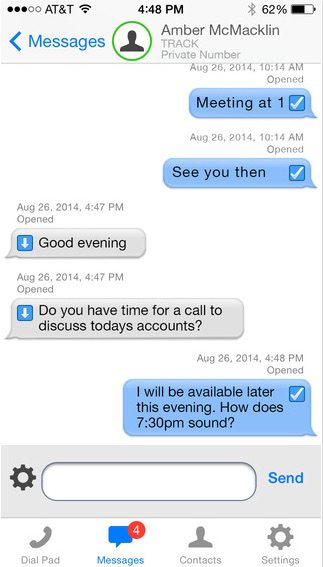

The technology works similarly when sending and receiving text messages:

Compliance

Because all work communication takes place under a business number, CellTrust enables corporations to dig into business conversations while offering privacy for personal ones.

CellTrust archives work communications in real time on its server. To respond quickly to compliance requests, the company partners with Actiance and GWAVA to offer:

- Reporting

- Audit trails

- Traceability

- Archiving

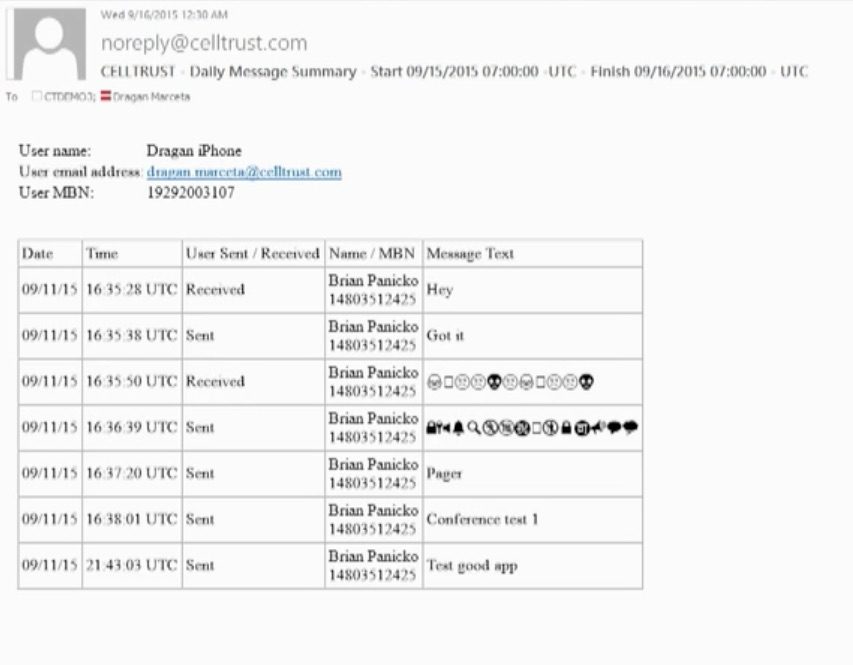

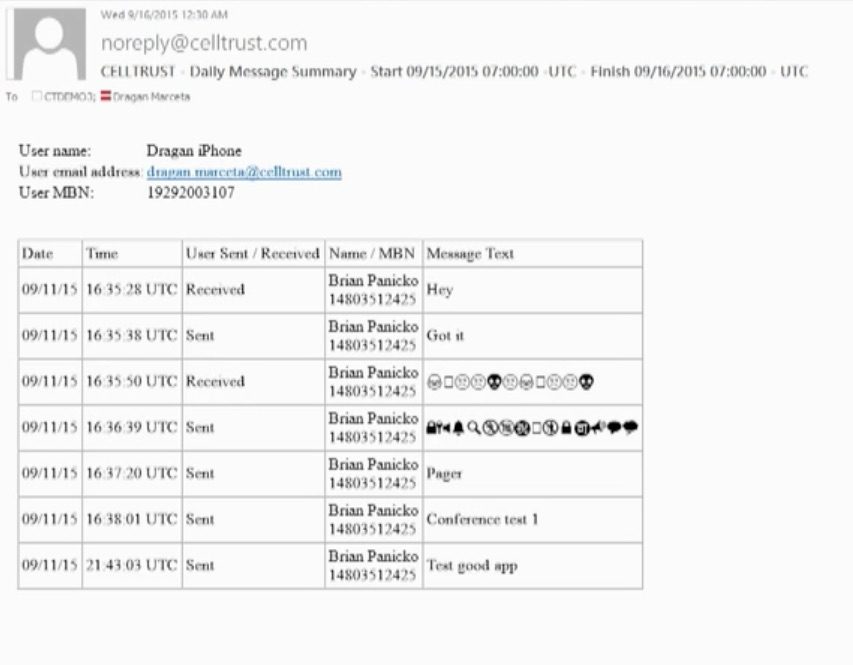

At the end of every business day employees receive a recap of all work conversations.

What’s next?

CellTrust is working on tools to keep employees and clients compliant by prohibiting the sending of personally identifiable information (PII) across insecure channels. The company is also working on integrating with CRM apps.

Brian Panicko, SVP, global sales strategy, and Dragan Marceta, director, sales engineering, presented CellTrust SecureLine at FinovateFall 2015 in New York:

![]() A look at the companies demoing live to 1,500 fintech professionals. Get your tickets to join us in London!

A look at the companies demoing live to 1,500 fintech professionals. Get your tickets to join us in London! Presenters

Presenters

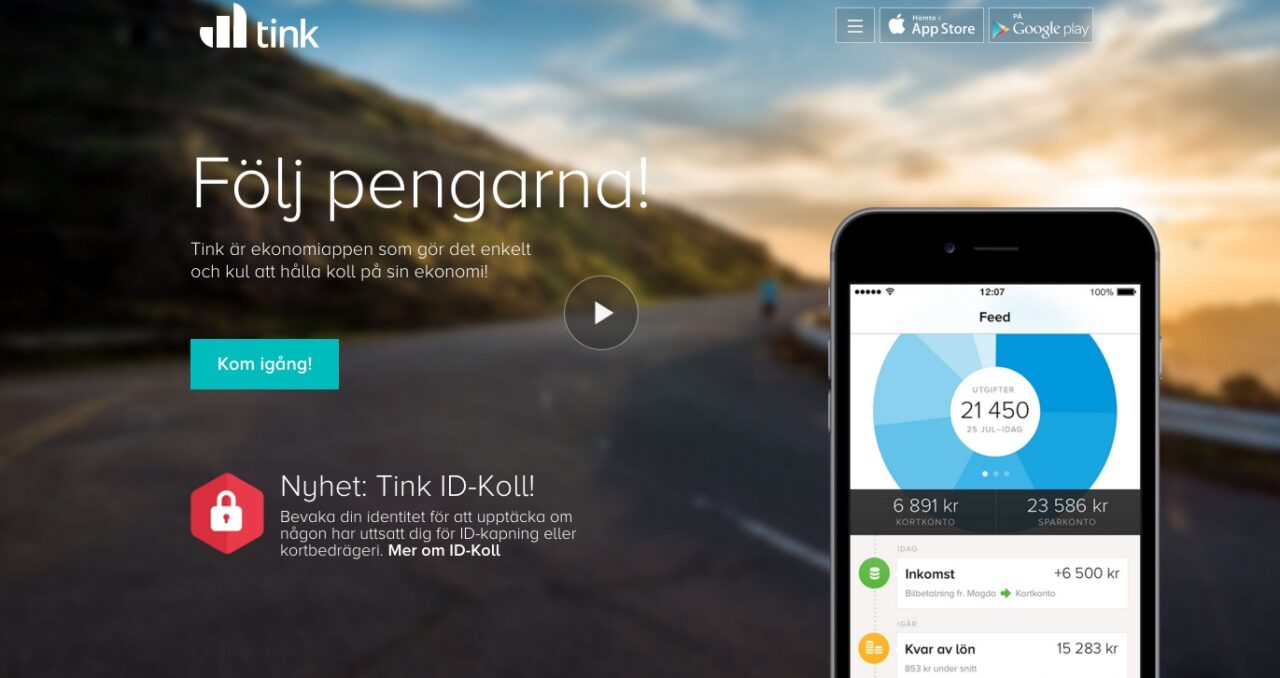

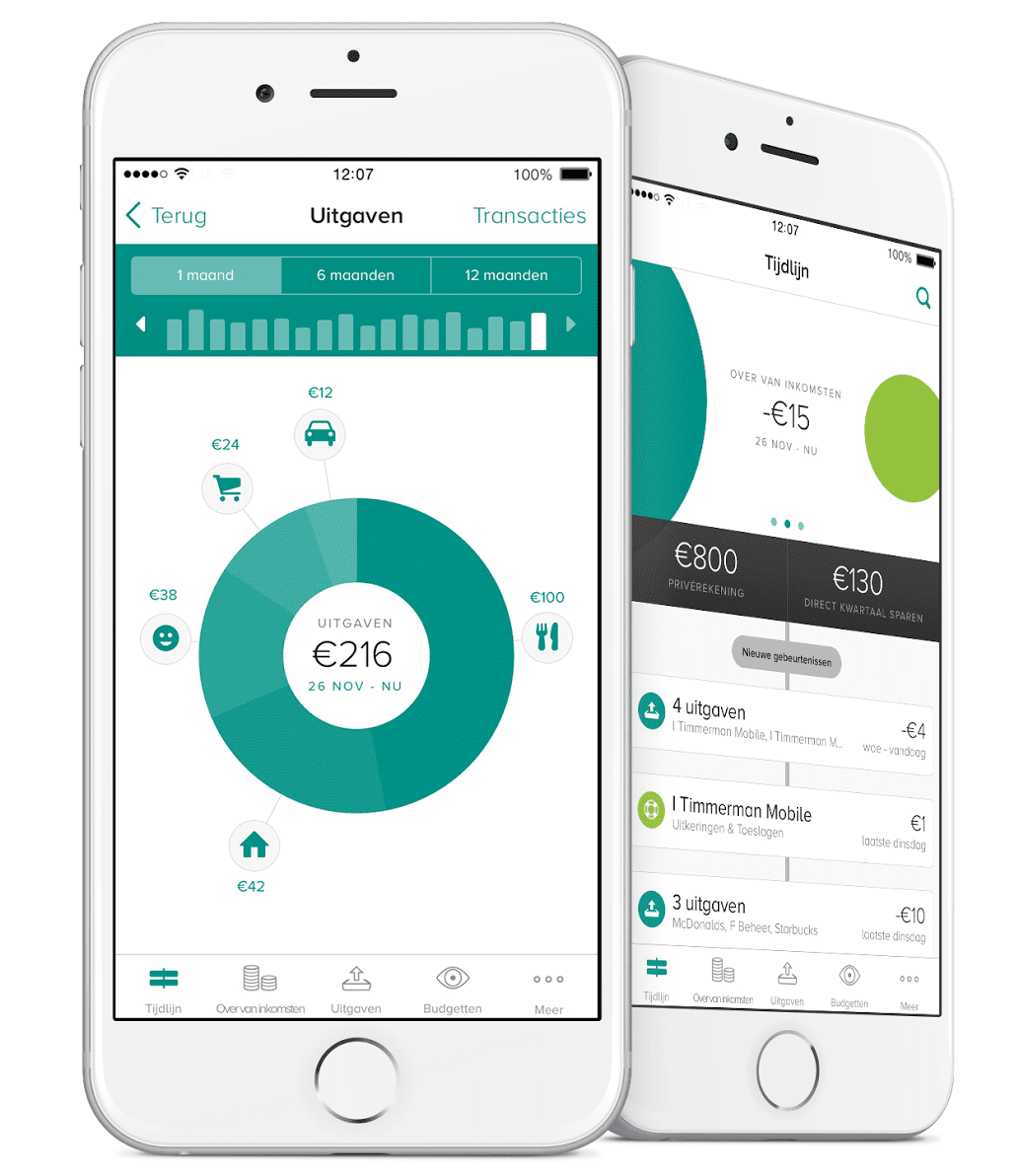

As a part of the partnership, ABN AMRO has worked with Tink to launch Grip, a budgeting and expense-management app that aims to help users control their spending.

As a part of the partnership, ABN AMRO has worked with Tink to launch Grip, a budgeting and expense-management app that aims to help users control their spending.