Consumer data contextualization company Flybits pulled in $6.5 million this week, bringing the Toronto-based company’s total funds to $14 million.

The Series B funding was led by Information Venture Partners. New investor Portag3 Ventures LP also participated along with existing investors Robert Bosch Venture and Trellis Capital. As a part of the agreement, Information Venture Partners’ co-founders Robert Antoniades and David Unsworth will join Flybits’ board of directors.

“This funding will allow us to ramp up our sales efforts in the United States and Europe, reinforce our existing global presence and expand our product and engineering teams to strengthen Flybits’ unique machine learning capabilities,” said Dr. Hossein Rahnama, Founder and CEO of Flybits. “Our product focus now is simplifying how our customers leverage their data ecosystem and drive customer engagement.”

Jordanne Pavao, Product Manager (left) and Hossein Rahnama, CEO & Founder (right) demo Flybits Experience Studio at FinovateSpring 2017

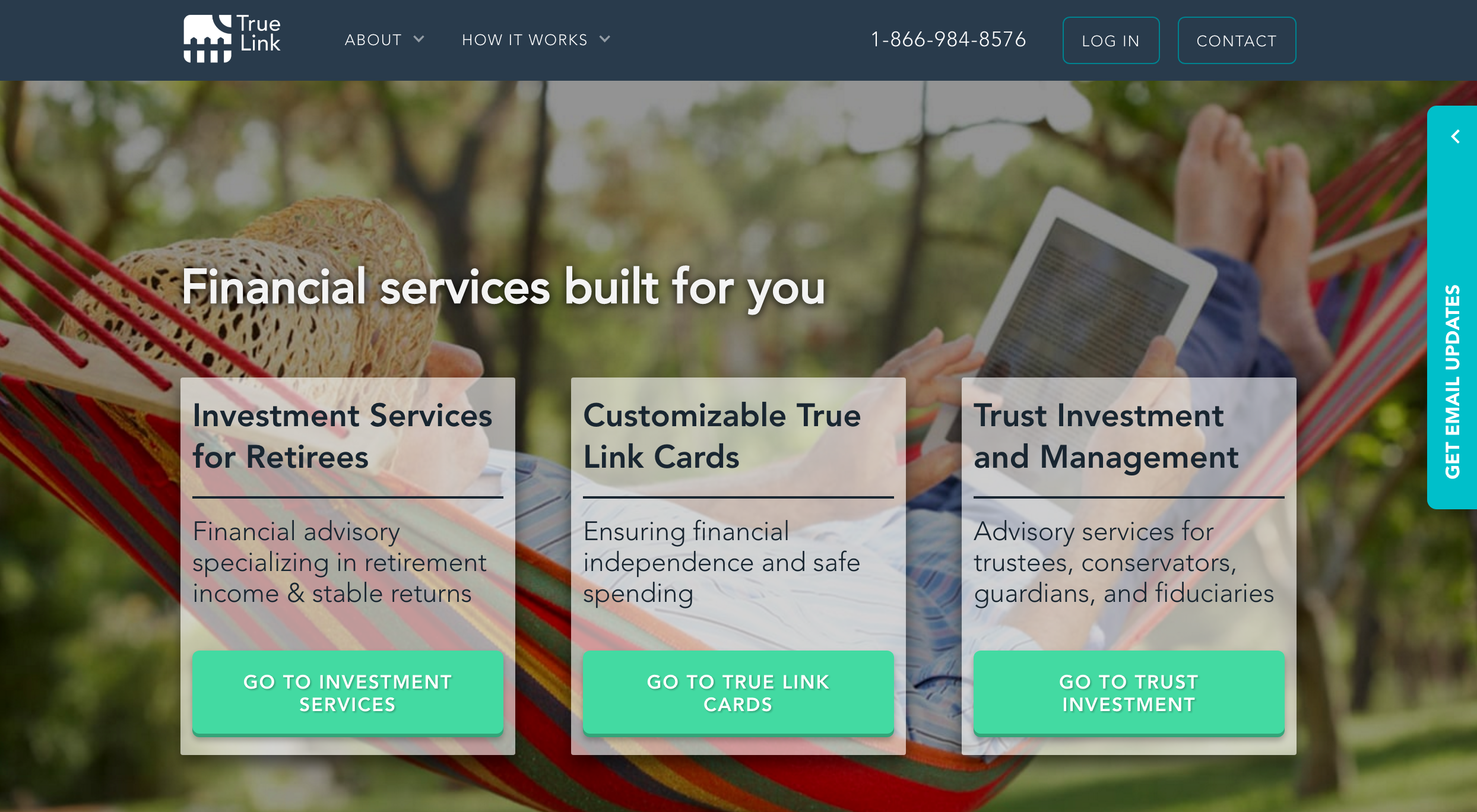

Founded in 2013, Flybits helps banks convert big data into business intelligence to offer consumers personalized experiences, promotions, and product recommendations. Earlier this year, the company debuted its Flybits Experience Studio at FinovateSpring 2017. The Experience Studio helps banks create and deliver personalized, digital experiences for their clients at scale. This helps banks waste fewer resources on IT complexities such as machine learning, semantic processing, and data contextualization and instead focus on delivering an exceptional user experience.

Rahnama was recently named to Forbes’ Top 40 under 40 for 2017. In 2016, the company earned recognition as a cool vendor in Gartner’s Platform-as-a-Service report and in 2015 received Deloitte’s Technology Fast 50 Canada award as a “Company to Watch.” With offices in Toronto, the San Francisco Bay Area, London, and Singapore, Flybits not only serves the financial services industry, but also travel and hospitality, retail, and events.

Services needed:

Services needed: