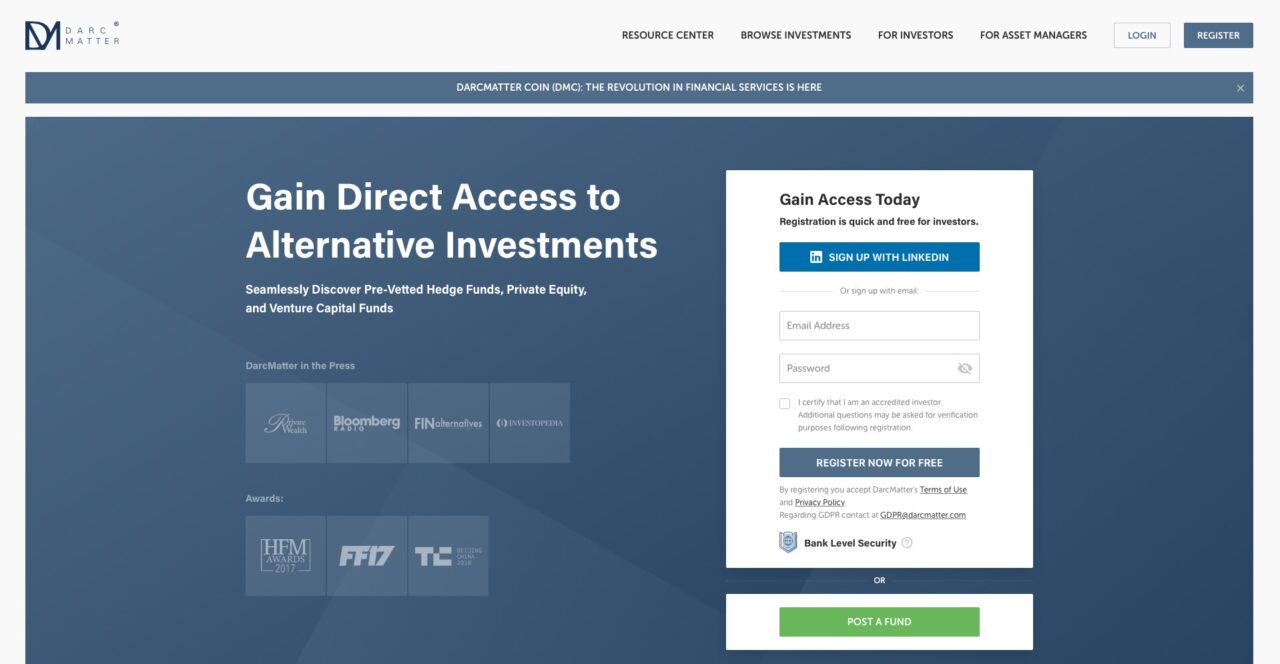

Alternative investment platform DarcMatter has teamed up with South Korean crypto investment fund and accelerator, #Hashed. The partnership will enable DarcMatter, which specializes in providing direct access to pre-vetted hedge funds, private equity, and venture capital funds, to extend its reach into the Asian market and gain insight into the crypto investment industry.

And as a blockchain-based investment fund and an incubator with an emphasis on community-building and impact investing, #Hashed will benefit from DarcMatter’s connections with both the traditional and alternative investment worlds.

Discussing the news in an interview with Tech Bullion, DarcMatter CEO Sang Lee pointed out that both companies share experiences and a vision that are “very aligned and rooted in the core premise of increasing transparency and efficiency throughout financial markets globally.”

Simon Kim, CEO of #Hashed, called DarcMatter a “great partner and a leader in the fintech industry that can utilize blockchain and cryptocurrency to accelerate the industry towards the next level.”

With offices in Seoul, South Korea, and San Francisco, #Hashed was founded in 2017 and has become the largest blockchain fund in Korea. The company has accelerated the largest wallet provider in South Korea, CoinManager, as well as a number of startups applying distributed ledger and blockchain technology to cybersecurity, social networking, and payments – among other areas.

This week’s news adds to the blockchain and crypto-based headlines DarcMatter has been making of late. Last month, the company’s blockchain project, DarcMatter Coin, revealed in April, announced its first strategic investment and partnership with trade.io. The firm’s seed and venture arm will invest $2 million into the coin’s public presale. Aside from blockchain news, the company won the Retail Investment Innovation Award at the 2018 FinTech Breakthrough Awards in May.

New York City-based DarcMatter was founded in 2014 and made its Finovate debut one year later at FinovateSpring 2015 where it demonstrated its decentralized alternative investment platform.

Finovate: Not every company has a Chief People Officer. When does a company know it’s time to hire one?

Finovate: Not every company has a Chief People Officer. When does a company know it’s time to hire one?