Euro Exim Bank has signed up for Ripple’s payment network RippleNet – putting its digital currency XRP on a potential path to replace correspondent banking, reports Antony Peyton of Fintech Futures (Finovate’s sister publication).

The bank was one of the 13 new financial institutions that have signed up for RippleNet. The others comprise SendFriend, JNFX, FTCS, Ahli Bank of Kuwait, Transpaygo, BFC Bahrain, ConnectPay, GMT, WorldCom Finance, Olympia Trust Company, Pontual/USEND and Rendimento. With these additions, there are now more than 200 customers signed up for RippleNet.

JNFX, SendFriend, Transpaygo, FTCS and Euro Exim Bank will use the XRP to source liquidity on-demand when sending payments on behalf of their customers.

For Euro Exim Bank, which operates in the worlds of trade finance, corporate banking and wire transfers, it offers some interesting prospects.

Kaushik Punjani, director, Euro Exim Bank, said: “Our customers – whether big corporates or individual remitters – have historically been restricted from obtaining suitable funds or settling transactions in a cost efficient and timely manner. Working collaboratively with Ripple and selected counterparts, we have designed, tested and are implementing both xCurrent [payments processing solution] and xRapid [on-demand liquidity solution] in record time.”

Let’s not the forget the views of the others as David Lighton, founder of paytech SendFriend, described the existing correspondent banking system as “slow, inefficient and costly”.

According to Ripple, using XRP for liquidity when sending a cross-border payment helps financial institutions avoid the hassle of pre-funding accounts in destination currencies.

Ripple is doing pretty well. In 2018, CEO Brad Garlinghouse said nearly 100 financial institutions joined RippleNet, and it also saw a 350% increase last year in customers sending live payments.

Meanwhile, its rival Swift has been thinking about correspondent banking as well.

Working alongside 34 banks, including Deutsche Bank, Swift completed a proof of concept (PoC) for nostro reconciliation using distributed ledger technology (DLT).

In an interview, Andreas Hauser (from Deutsche Bank) said the mandate for Swift to explore DLT usage in the correspondent banking space originated from the global payments innovation (gpi) community with the aim of fostering collaborative innovation.

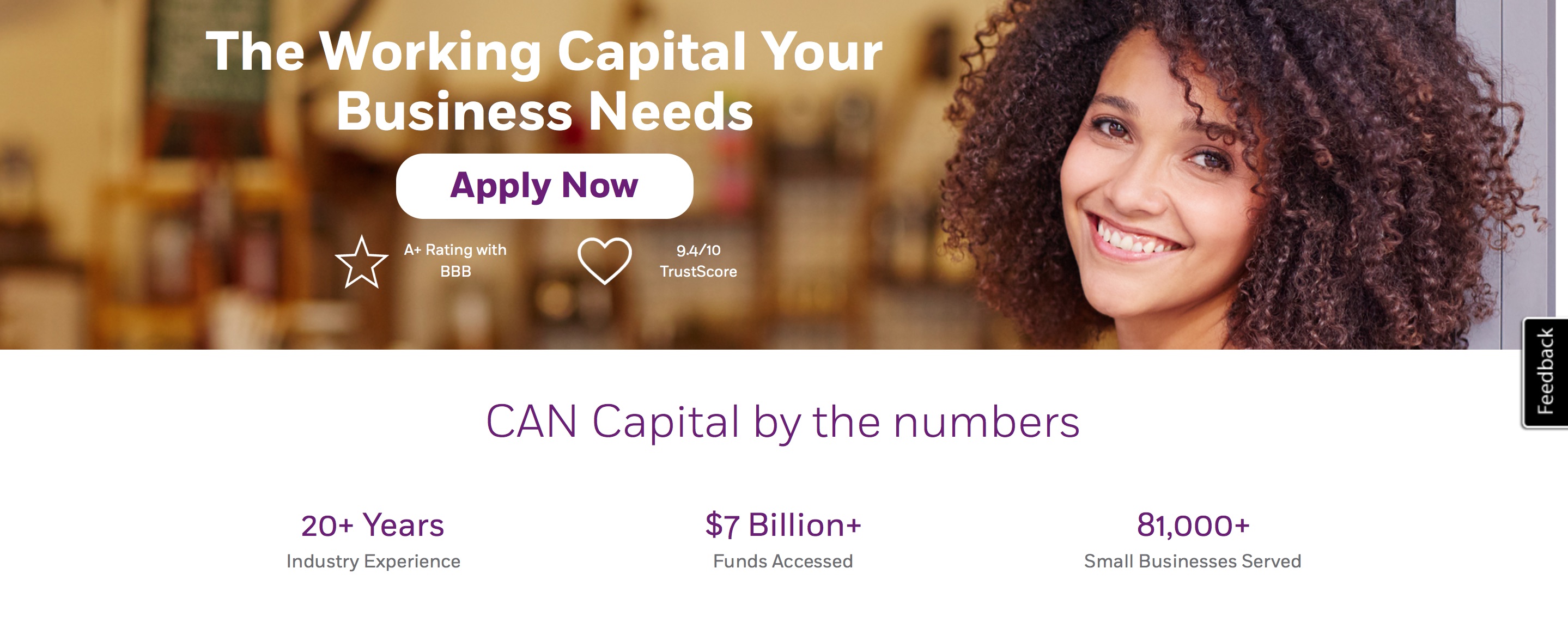

Corporation, and ALK Technologies. CAN Capital’s Executive Chairman praised Siciliano as a “proven leader” who has “served the needs of small businesses while building loyal teams that deliver innovative products and a great customer experience.”

Corporation, and ALK Technologies. CAN Capital’s Executive Chairman praised Siciliano as a “proven leader” who has “served the needs of small businesses while building loyal teams that deliver innovative products and a great customer experience.”