NuData Security SVP and Chief Technology Officer Christopher Bailey has been named CEO of the company, replacing Michel Giasson who is retiring after 12 years at the helm. The two men co-founded NuData Security in 2007; the firm was acquired by fellow Finovate alum Mastercard ten years later. In addition to his new role as CEO of NuData, Bailey will also serve as Mastercard’s executive vice president of EMV/Digital Devices.

“Michel has been a mentor for me and is a reference for many in the cybersecurity industry, so it is a privilege to continue his legacy,” Bailey said. He added that as CEO is focus will be primarily on maintaining “unparalleled” customer service and a professional environment “that fosters the creation of secure and innovative products.”

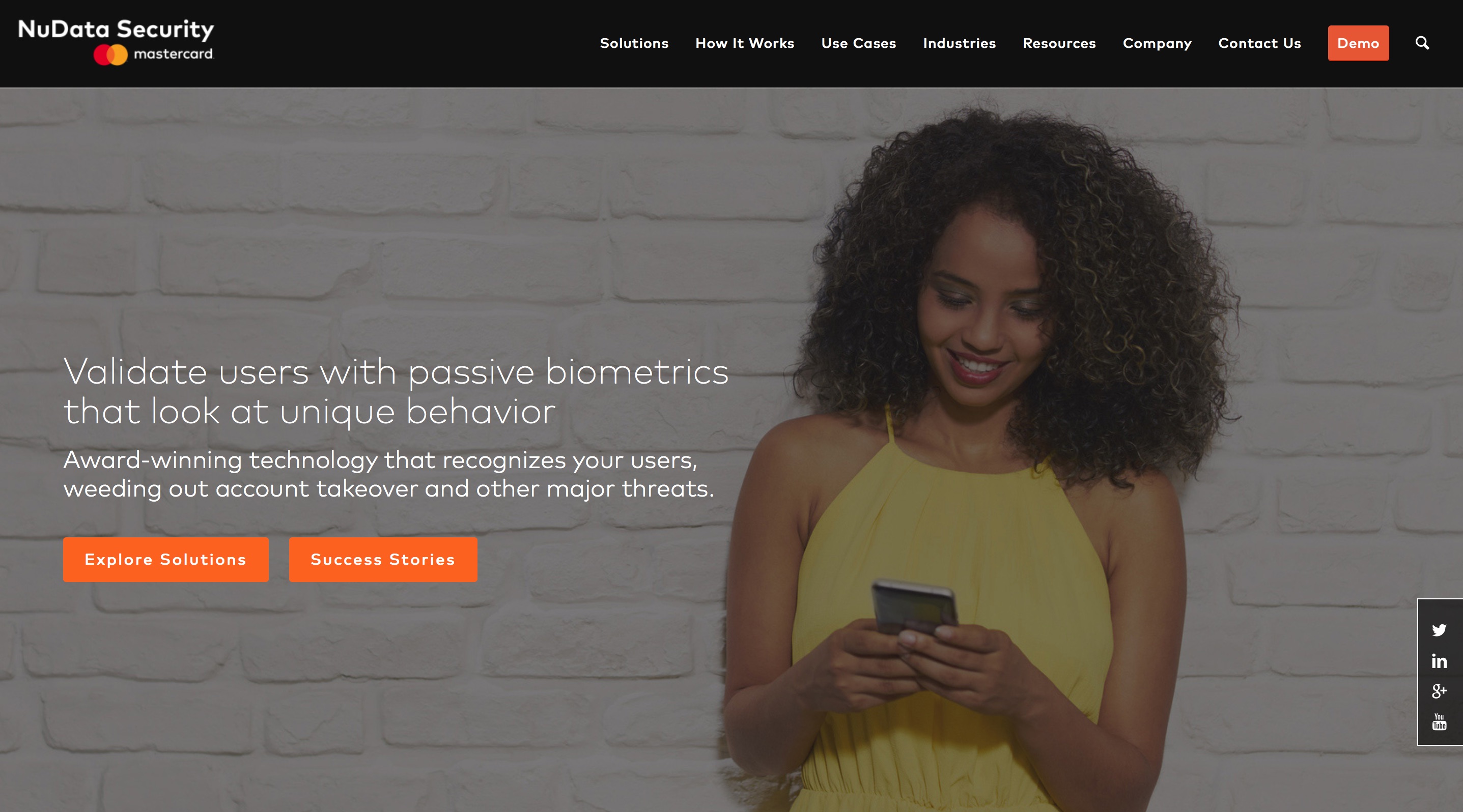

Bailey (pictured) will drive the NuData’s strategic vision and the direction of user verification intelligence. He will also, via Mastercard’s Digital Devices division, manage the creation of an integrated security path with EMV. The goal is to evolve NuData’s technology into solutions that extend beyond a specific login or device and provide user verification in different contexts and at different stages of engagement. Bailey noted in the appointment press release that he believed NuData and Mastercard are well positioned to drive adoption of technologies like passive biometrics as centralized authentication becomes more prevalent in the payments industry.

Previous to NuData, Bailey founded gaming company H20 Entertainment, which provided games for Nintendo. Hd also co-founded vulnerability assessment specialist Secure Networks, which was acquired by Network Associates in 1998.

NuData Security demonstrated its universal identity solution at FinovateSpring 2018. The technology differs from other device identification technologies by building a signal that tracks the identity of multiple users rather binding a single device to a single FI account. Passive biometrics, including the user’s own inherent behavior and data from multiple devices, are all connected to one identifier that can access the account.

NuData began the year with news that its NuDetect solution would be deployed by Mastercard to help fight payment fraud in the African payments market. The company was founded in 2008 and is headquartered in Vancouver, British Columbia, Canada.