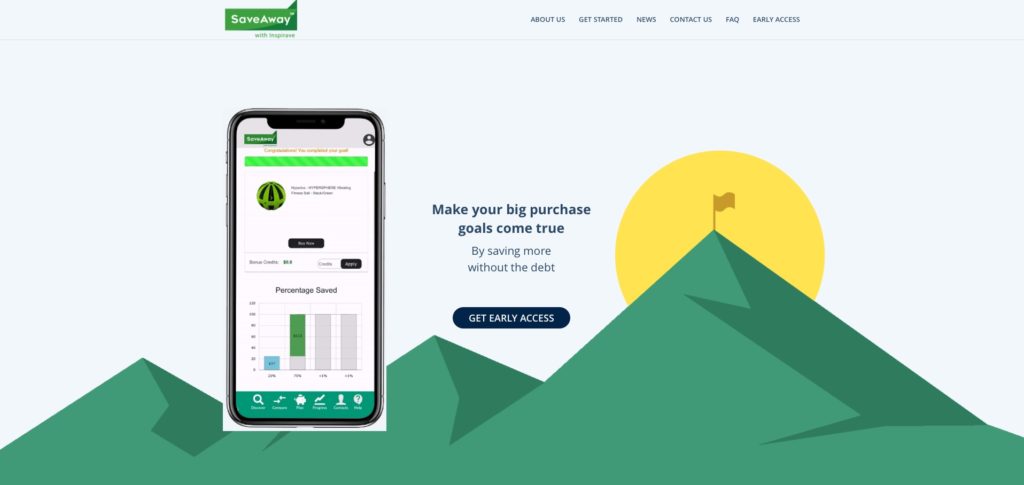

“Buy Now Pay Later” may be the e-commerce rage du jour. But if you check in with the team from Inspirave, then you’ll hear about a better way for consumers to spend and save. The New York based company – which we profiled last fall – unveiled its SaveAway platform this week, enabling consumers to benefit from its unique blend of “financial planning with the path-to-purchase.”

“There has never been a better time to see Inspirave’s economically sustainable blueprint, propelled by greater purchasing power, striking such an inimitably strong chord with our growing community of SaveAway users and partners who recognize that what inspires our new-to-market innovations enabling greater financial wellness and social mobility is our steadfast mission to further human potential and prosperity for all,” Inspirave founder and CEO Om Kundu said in a statement.

SaveAway’s unification of micro-saving and social commerce offers consumers a way to save for the things they really value and avoid purchasing these same items with credit and accumulating unnecessary debt in the process. Aided by the insights, advice – and even material support – of friends and family, consumers using the SaveAway platform can leverage the collective wisdom of those who know them best and care about them the most to help them make financial decisions that are as responsible as they are affordable.

Miguel Sanchez and Philip Shearer, co-founders of diversity-focused accelerator MetaBronx, praised both the Inspirave’s innovation and its approach to spending and saving. “What made the SaveAway platform stand out in the top six companies chosen in 2020 derived from the breakthroughs in Inspirave’s patented technology as much as its novel operating model, pointing to the massive impact SaveAway is moving forward to uniquely deliver,” they said.

The company noted in its statement that those who signed up for Early Access to the SaveAway platform are eligible for a variety of bonuses, including referral credits and entry into a sweepstakes for a $1,000 contribution toward the winner’s SaveAway purchase-goal to be paid by the company. More than 12,000 people have signed up for Early Access to date.

Named a a Top Fintech Forward Company to Watch by American Banker and BAI, and A Finovate alum since 2016, Inspirave is headquartered in New York City.

Photo by Suzy Hazelwood from Pexels