- Google Pay is adding Afterpay and Klarna to its checkout flow, complementing its existing partnerships with Affirm and Zip.

- Adding more BNPL options at the point of sale will help increase conversion rates and average order values.

- By offering four BNPL options, Google Pay solidifies its edge over Amazon, which currently provides Affirm as its sole BNPL provider at checkout.

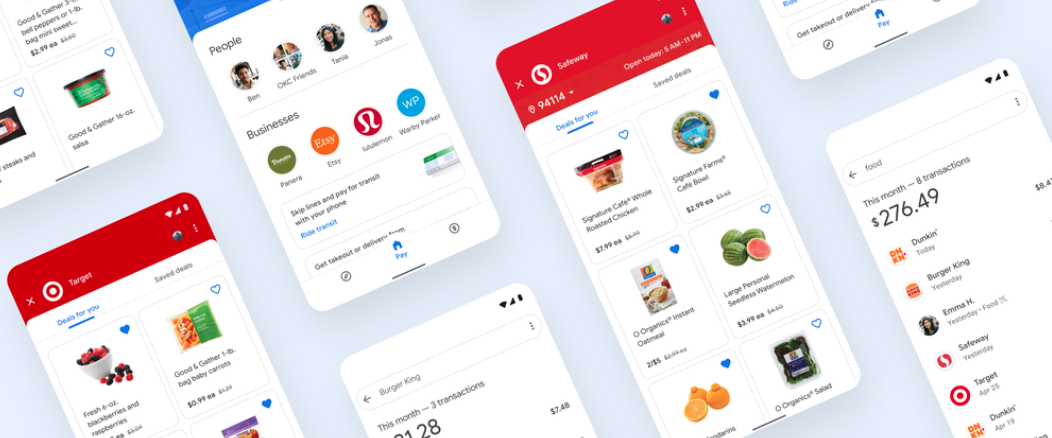

Google Pay is doubling down on buy now, pay later (BNPL) options at checkout. The company announced today that it is adding Afterpay and Klarna to its checkout flow at select merchants. The move will offer consumers more flexible payment options when they use Google Pay.

“People shop on Google more than a billion times per day, and consumers are increasingly looking for more choice and flexibility when it comes to their payment options,” said Google Pay Senior Director Drew Olson. “By teaming up with pay over time providers like Klarna, we are able to give Google Pay users more payment options when checking out, while providing merchants with another tool to drive growth.”

Adding Afterpay, which has 24 million active users, and Klarna, which has 85 million active users, will not only offer more ways to pay but may also lead to increased conversion rates and higher average order values. Customers are more likely to make larger purchases when offered flexible payment solutions.

“Afterpay’s integration with Google Pay comes at the perfect time as next-gen shoppers are fueling mainstream use of BNPL, mobile commerce, and digital wallet use,” said Afterpay and Cash App Head of Global Partnerships Tanuj Parikh. “We are excited to expand our BNPL to Google’s network, creating the best and most streamlined customer shopping experience that meets all the needs of this younger consumer set.”

While Afterpay is now available on Google Pay, Klarna will launch with select merchants in 2025. The company aims to expand the BNPL options to more merchants in the future.

Today’s news comes about a year after Google unveiled that it partnered with Zip and Affirm, two other major BNPL players, to offer Google Pay users BNPL options. While offering four BNPL options at the online point of sale sounds excessive, not all merchants offer every BNPL option at checkout. The selection of BNPL providers is dictated by the agreements between Google Pay, the BNPL services, and the individual merchants.

By expanding its roster of BNPL options, Google Pay strengthens its competitive edge against Amazon, which currently limits point-of-sale BNPL offerings to Affirm. While the exclusivity agreement between Amazon and Affirm ended last year, Amazon has yet to collaborate with additional BNPL providers. Google Pay’s strategic decision to double its BNPL offerings may prompt Amazon to diversify its own consumer payment options.