- Savings app Plinqit has raised $5 million in Series A funding, bringing its total capital to nearly $10 million.

- The technology helps users save safely and efficiently, and offers rewards for users who improve their financial literacy by engaging in educational content via the app.

- Plinqit was founded in 2015 by CEO Kathleen Craig

Michigan-based savings app Plinqit has secured $5 million in funding this week. The company, which made its Finovate debut in 2019 at FinovateFall in New York, will use the new capital to help scale the business to meet growing demand. The Series A round brings Plinqit’s total capital to just under $10 million.

“Financial wellness is crucial for all of us in financial services,” Plinqit founder and CEO Kathleen Craig said. “We created Plinqit to help builders create solutions that truly help people in a way that is engaging and rewarding. It was critical for us that it was technology that they would want to use – and they are.”

The round was led by Nashville, Tennessee-based Fintop Capital and New York’s JAM FINTOP. Also participating in the investment were Invest Detroit, Michigan Rise, and Michigan’s 4Front Credit Union.

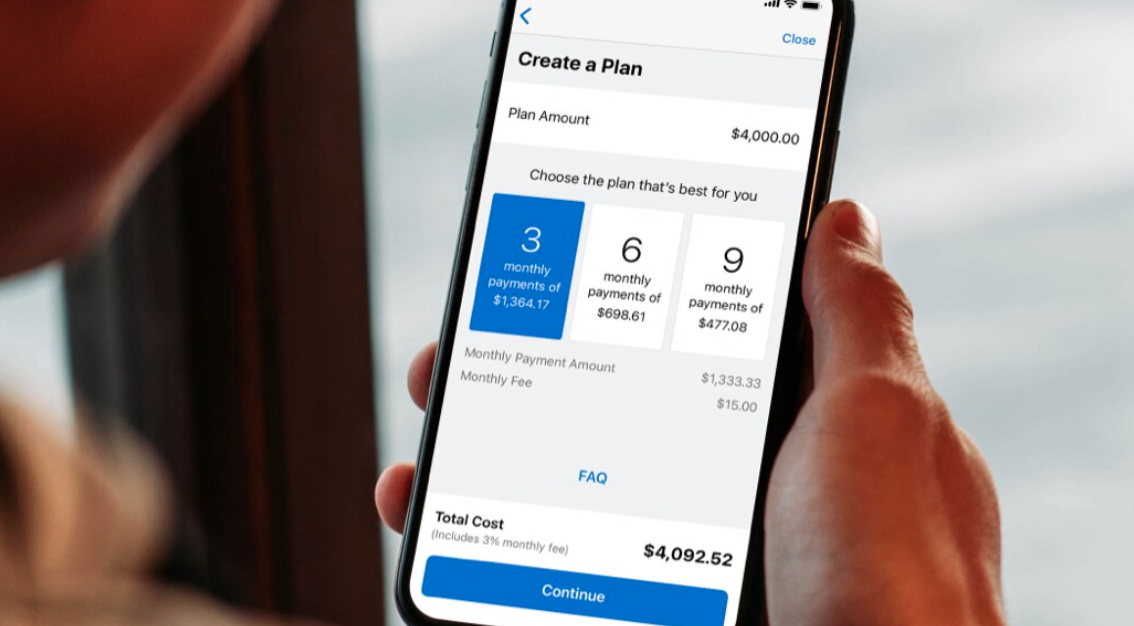

Plinqit is a brandable, mobile-first savings app – built by Millennials for Millennials. The platform empowers users to create up to five savings goals, and begin setting aside funds for each goal while earning rewards. The app’s Build Skills feature not only helps users develop financial literacy, it also pays them for doing so, rewarding users for engaging with content which boosts user engagement for financial institutions that offer the technology. Plinqit also offers a virtual account management system – Vi.Ledger – which enables financial institutions to build their own custom savings programs using virtual accounts within the app.

Launched in 2015, Plinqit is one of the leading solutions offered by app development company, HT Mobile Apps (HTMA). The technology has been adopted in recent years by a number of community financial institutions including The Milford Bank ($482 million in assets), ChoiceOne Bank ($244 million in assets), and First Arkansas Bank & Trust ($760 million in assets). “We created Plinqit as a tool to not only help customers safely and securely meet their savings goals, but to also help financial institutions compete for deposits and develop deeper relationships with their customers,” Craig said when the partnership with First Arkansas Bank & Trust was announced in the summer of 2020.

Last fall, Plinqit announced an integration with the digital banking platform of fellow Finovate alum Q2. Funds saved on the Plinqit app are FDIC- or NCUA-insured, and the service is free to users.