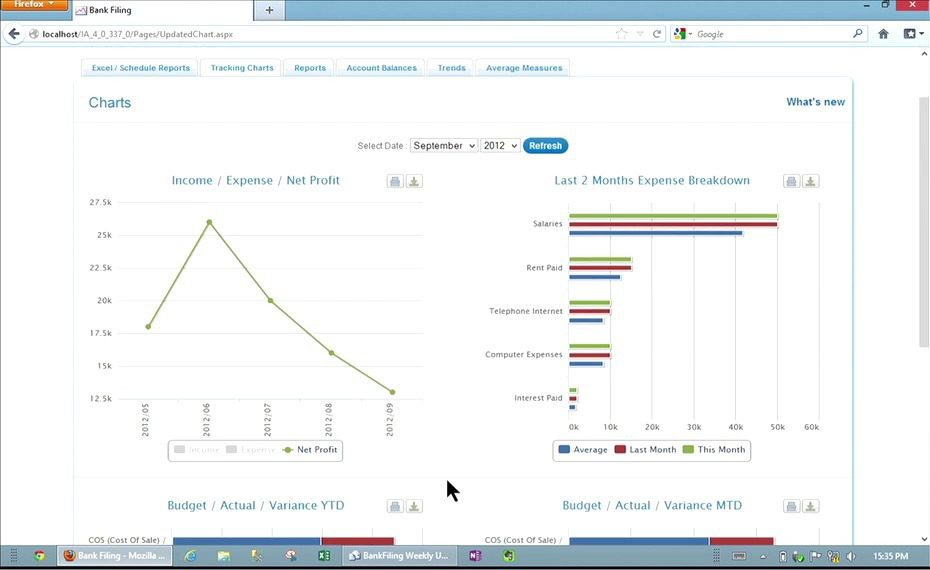

How they describe themselves: Luminous is a boutique, banking innovation company specializing in developing solutions that reduce costs, boost growth, and deliver ROI. Luminous is active in North America, United Kingdom, Europe, Africa, India, and Asia Pacific. Products include: BankFiling, Insights, Business Money Manager, Personal Money Manager, and Merchant Insights.

How they describe their product/innovation: BankFiling is an innovative solution that saves banks millions by automating the timely collection of financial information from business customers with credit exposure to the bank.

Contacts:

Bus. Dev. & Sales: Andrew Buchanan, Global Head of Sales, [email protected], (ph) +44 207 692 4080, (m) +44 (0) 7766 804968

Press: Philippa Newnes, Head of Marketing, [email protected],

(m) +61 401 915 153

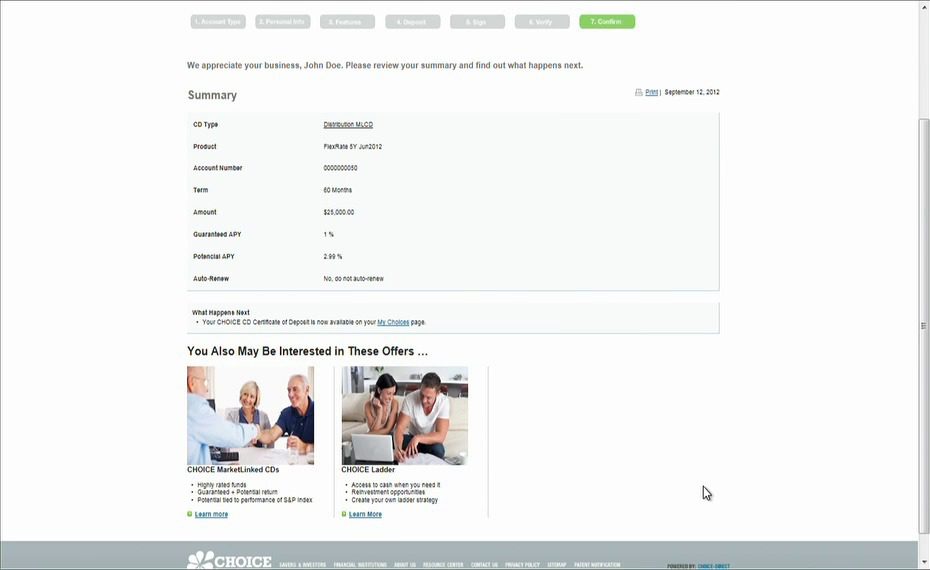

How they describe themselves: CHOICE is a front to back technology solution for the creation, distribution and management of savings and investment products that can be dynamically personalized by customers at the point of sale.

CHOICE can be rapidly integrated with existing core systems, used on a Software As A Service basis and will soon be available as a white labeled direct-to-consumer offering across multiple channels and devices.

With CHOICE, the restrictions of the classic product catalogues disappear and consumers are finally provided with true solutions that resolve their personal and specific needs in a highly intuitive and attractive manner.

How they describe their product/innovation: The CHOICE direct-to-consumer model that is currently in development allows users to create their own savings and/or investment solutions from the convenience of any channel and device by selecting the term, guaranteed minimum rate, liquidity and source of additional potential return, all with the security of FDIC insurance, in a completely transparent, clear and honest manner.

The search for income in a low yield environment creates unwanted risk for many consumers. With CHOICE, that problem is removed. Furthermore, in an improved rate environment, CHOICE is able to offer consumers significantly higher returns than they can obtain through traditional players.

Contacts:

Bus. Dev., Press & Sales: Â Matthew Lifshotz, Director, [email protected],

(646) 490-3650

How they describe themselves: IDology, Inc. provides real-time identity verification solutions to those conducting business in customer-not-present environments such as on the Internet or in a call center. We are a leader in SaaS-based solutions. Operating on an advanced rules-based engine, IDology’s ExpectID solution suite offers a faster, safer way to identify legitimate customers so you are able to complete more transactions in less time and protect sensitive data without having to compromise consumer’s comfort or privacy. IDology helps businesses drive revenue and meet compliance regulations while decreasing costs and preventing fraud.

How they describe their product/innovation: Our new product, ExpectID Enterprise, is the next generation of knowledge-based authentication and allows businesses to present custom, out-of-wallet questions to consumers using their own data. Banks are able to leverage IDology’s SaaS solution to generate out-of-wallet questions from their internal proprietary customer transactional data located behind their firewall and without ever having to share that data with us. This allows Banks to replace their shared secret questions (What is your mother’s maiden name?”) with a higher security model that isn’t compromised by social media. ExpectID Enterprise helps Banks meet FFIEC compliance guidelines while creating a safer authentication method on high-risk transactions.

Contacts:

Bus. Dev.: Steve Fine, VP Business Development, [email protected], (678) 324-3828

Press: Jodi Florence, VP Marketing, [email protected], (678) 324-3812

Sales: John Dancu, CEO, [email protected], (678) 324-3780

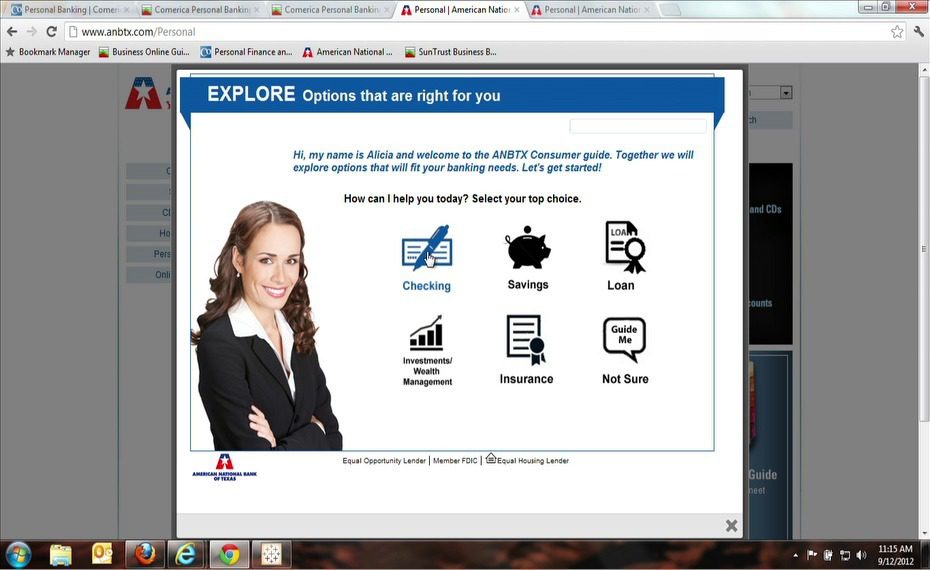

How they describe themselves: Ignite Sales holds a patent on “Matching bank products to customer needs”. The founders sought to help turn branches and websites into sales channels – beyond transactions. In addition, Ignite intended to help banks be truly customer centric, helping consumers choose the right products for themselves. Our chairman, Bob Mahoney, former Cleveland Fed Chair under Alan Greespan and retired CEO of Deibold knew that branches would need to be more like stores. R&D began ten years ago and today we have analytics on millions of interactions between banks and consumers. We started executing our go-to market strategy in 2011.

How they describe their product/innovation: Ignite Sales is launching the world’s first Bank Product Concierge™ which will change the way retail banks are able to sell financial products consistently to consumers and to manage their branch network. The solution is turning bank branches, call centers and websites into account opening machines, helping them easily and cost effectively reach their customers to upsell and cross-sell products. The Concierge Analytics Dashboard™, the first in the industry, provides the only way for bank executives to determine what products should be sold based on Eligibility Data™.

Contacts:

Bus. Dev.: Julie Hamrick, Chief Analyst, [email protected], (972) 789-5521

Press & Sales: Barbara Boe, VP Marketing, [email protected], (972) 789-5522

Mitchell Orlowsky, CEO & President, [email protected], (972) 789-5524

How they describe themselves: Americans are failing to save. For hundreds of years the industry has argued discipline and budgets were the answer, but look at the results. The fact is, our brains were designed fifty thousand years ago to hunt and gather, and today the option to gather (buy) has never been more optimized. No matter how cleverly you try to change Consumer behavior, a diet will most often yield more frustration than results. Therefore, instead of trying to change the Consumer to fit saving, ImpulseSave has transformed saving to fit the Consumer. We’ve made saving just as easy and gratifying as spending.

How they describe their product/innovation: ImpulseSave’s new savings tools make saving just as easy, as front-of-mind and as fun as spending. Our users are saving between two and three times the national average and are engaging on a daily and weekly basis. Through our simple web and mobile apps we offer an alternative gratification experience to consumption that redirects that money toward saving. In addition to, instead of, or whenever the impulse strikes them, Consumers now have a “Point of Saving” at every point of sale, and at every point in between.

Contacts:

Bus. Dev. & Sales: Phil Fremont-Smith, Co-Founder & CEO, [email protected],

(617) 910-6681

Press: Nina Velasques, [email protected], (212) 334-9770

How they describe themselves: IND Group is an Internet and mobile banking, PFM and payments technology software vendor for financial institutions. Focusing on customer experience, our goal is to evolve e-banking technology to web 2.0, turning it into a sales and customer engagement platform. Due to the economic slowdown new business models, fierce competition and changing customer behavior place a great importance on business adjustments. Our unique innovations and multichannel products support banks in these developments. Growing since its inception in 1997, IND is operating in several European countries and represented through its partner network in CIS countries and the Middle East.

How they describe their product/innovation:  Story of My Finances is a completely new approach to digital financial customer service. It takes online banking and PFM to a next level of mass retail financial planning and advice. Stories are customer driven financial life processes, like “How to spend less”, “Prepare for a rainy day”, “Buy a home” or “Retirement planning.” Stories help end-customers to get financially fit and to have a peace of mind. Stories are the missing link between everyday people and financial products. We believe that we can improve people’s financial life by licensing our white-label technology to financial institutions.

Contacts:

Bus. Dev. & Sales: JĂłzsef NyĂri, Founder & Chief Innovator, [email protected]

Press: Adrienn Baráth, Marketing Director, [email protected]

How they describe themselves: IBSS delivers a 100% cloud based four factor online end user authentication software solution that can dramatically improve the online security of any internet based application. IBSS’s patented real-time biometric human identification technology provides a superior end user alternative toward eliminating the current problems of anonymous and transferable user names and password login standards. As a web-centric solution, IBSS’s biometric technology is simple to use, affordable, and can be rapidly deployed across any enterprise with no special hardware or software requirements. IBSS’s real-time human identification technology is ideal for improving online security for email communications, web collaboration, online financial transactions, electronic health records, e-Education, or any other high-value group content data. IBSS is striving to improve online user accountability through the use of superior real-time human identification technology that will replace outdated usernames-passwords.

How they describe their product/innovation: IBSS is launching its “Genesis Enterprise Edition”, representing an advanced, affordable, real-time human identification technology for online financial service transactions. Factor 1: Real- time legal identification of end user personal information. Factor 2: Coupled real-time biometric facial authentication. Factor 3: Coupled real-time speaker authentication. Factor 4: Coupled real-time session biometric monitoring of each online financial transaction event, supported with a scalable biometrically authenticated timeline audit log record. IBSS’s technology is a full perimeter online access security solution that provides superior end user identification of the actual banking customer, as well as the actual online financial services representative used in the collaborative sharing of confidential financial information through a common group shared database. IBSS’s superior identification improves bank security for both online consumer transaction activity identification, and equally promotes a higher degree of consumer trust of online bank employee identification integrity by using the same biometric identification standards used by their own customers.

Contacts:

Bus. Dev., Press, & Sales: David Ackerman, President, [email protected], (858) 610-3221

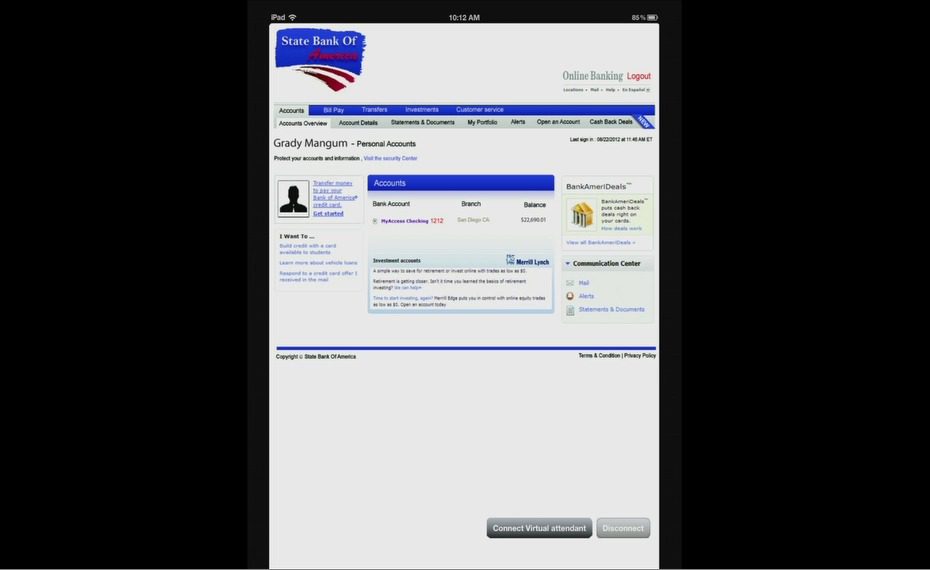

How they describe themselves: Leadfusion is the industry leader for Financial Experience Management® (FEM). Patent-pending FEM solutions build relationships that drive sales for financial institutions. Since 1995, Leadfusion’s products have helped consumers make over 1 Billion financial decisions.

With a proven SaaS platform and team of experts, Leadfusion makes it easy for financial institutions to produce a compelling and consistent multi-channel experience that delivers personal value for consumers and enhances the corporate brand. Leadfusion solutions accelerate conversion, turning prospects into customers and customers into loyal advocates. Leadfusion’s FEM suite consists of Researching, Marketing, and Selling Solutions designed to operate independently or as a single integrated platform.

How they describe their product/innovation: Leadfusion’s new Cross Channel Selling solution unites the online and offline experiences for consumers who are evaluating financial products, while also delivering powerful selling tools to retail branch personnel. For the first time, a consumer can begin the consideration of a financial product or service in any channel, and continue that investigation in a different channel – picking up where they left off. By creating a unified experience, Cross Channel Selling makes the selection of a financial product easier and more convenient for the consumer. And with Cross Channel Selling, financial institutions can offer consistent product recommendations across channels while placing helpful selling and lead management tools in the hands of the front-office staff.

Contacts:

Bus. Dev.: Ronan Winter, VP Business Development, [email protected], (858) 259-2122

Press & Sales: Mark Nelson, VP National Sales, [email protected], (858) 259-2110

How they describe themselves: LearnVest.com is an award-winning financial management and lifestyle site. Since its debut as a TechCrunch50 Company in 2009, LearnVest has helped over one million members gain control of their finances.

LearnVest provides trusted content, tools, and support to help users tackle their finances at each stage of life. LearnVest products include: email newsletters, Bootcamp Programs that delve into financial pain points, the Money Center where members can track their spending, and customized Financial Plans straight from LearnVest’s team of Certified Financial Planners.

LearnVest was on Time Magazine’s annual list of “50 Best Websites” and was included on Forbes’ list of the “Top 100 Websites for Women” for the third year in a row.

How they describe their product/innovation: LearnVest is uniting the Money Center with our unique financial planning platform. We believe that financial plans should be dynamic guides that are central to your everyday decision-making.

There are two key additions: First, premium members can now share a view of their Money Center with their LearnVest planner. This allows the planner seamless access to their clients’ most current financial profiles. Second, LearnVest is introducing a Priorities feature that allows members to set goals (such as debt repayment) and track their progress against them.

Contacts:

Bus. Dev.: Karim Naraghi, VP Business Development, [email protected], (646) 564-3472

Press: Dani Dalesandro, Sunshine Sachs, [email protected], (212) 691-2800

Sales: Jacqueline White, VP Strategic Partnerships, [email protected], (646) 454-0430

How they describe themselves: Linkable Networks is transforming the way consumers take advantage of great savings from the brands they love, while delivering pinpoint targeting and attribution for advertisers. Linkable Networks’ technology allows consumers to link manufacturer-level, category-level and store-level offers, known as “MyLinkables,” directly to their credit or debit card of choice, with no need to clip coupons, print coupons or load to a store’s loyalty card – and the discounts appear directly on the consumer’s bank statement. Consumers can register through their bank, retail ads or at www.mylinkables.com and can also share them via Facebook and Twitter.

How they describe their product/innovation: MasterCard and Linkable Networks will co-present and demo the industry-first capability of enabling any MasterCard-issuing bank to present a comprehensive card-linked offer platform to their cardholders with no technical integration, allowing for these issuers to participate in this burgeoning market with no strain on internal technical and financial resources, as well as an ability to launch the capability in days, not months or years.

Contacts:

Bus. Dev. & Sales: Gene Wisniewski, SVP of Sales, [email protected],

Office: (617) 986-5200

Press: Deanna Meservey, Senior Account Executive, Racepoint Group, [email protected], Office: (617) 624-3273, Cell: (781) 285-6921

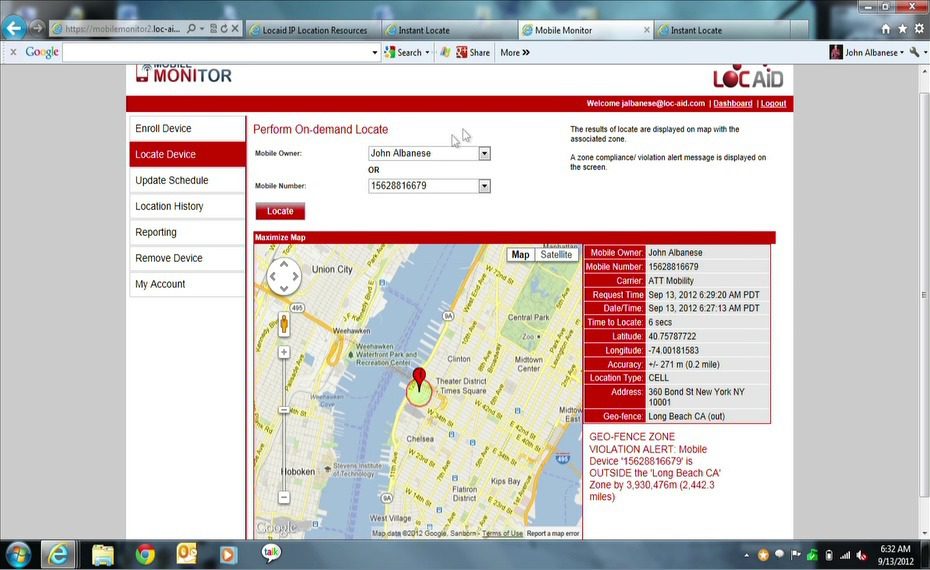

How they describe themselves: Locaid is the world’s largest Location-as-a-Service (LaaS) company. We operate a location privacy platform that allows mobile developers to locate over 350 million devices for enterprise authentication, fraud management, consumer location services and opt-in mobile marketing. Locaid locates smartphones, feature phones, tablets and any mobile device on leading wireless carriers including America Movil, AT&T, Rogers, Sprint, T-Mobile and Verizon Wireless.

How they describe their product/innovation: Locaid Geofence™ is a new API that allows financial services, bank and card issuers to combine and compare real-time customer locations with card swipe and transaction location data (POS et al). Using Locaid’s Location-as-a-Service, banks can compare mobile location to POS locations to determine fraud potential, reduce false positives and drive enhanced cardholder engagement. The Geofence API also allows the bank to create alerts whenever cardholders enter or leave the defined areas, such as branch or ATM locations.

Contacts:

Bus. Dev.: Rip Gerber, President/CEO, [email protected]

Press: Carolyn Hodge, CMO, [email protected]

Sales: Jeff Allyn, SVP Sales, [email protected]

How they describe themselves: Luminous is the world’s first provider of bank-integrated money management solutions. The company has created a range of innovative solutions that offer financial institutions the ability to increase revenue and decrease costs in the areas of credit risk management, cross selling opportunities, reduced administration costs, customer retention and customer acquisition.

Luminous is active in North America, United Kingdom, Europe, Africa, India and Asia Pacific. Products include: BankFiling, Insights, Business Money Manager, Personal Money Manager and Merchant Insights.

How they describe their product/innovation: BankFiling is an innovative solution that enables banks to recover significant cost leakage by automating the timely collection of periodic financial information from business customers with credit exposure to the bank.

Contacts:

Bus. Dev. & Sales: Andrew Buchanan, Global Head of Sales,

[email protected], Mobile: +44 (0) 7766 804968,

UK Phone: +44 207 692 4080

Press: Â Philippa Newnes, Head of Marketing, [email protected],

Mobile: +61 401 915 153