How they describe themselves: A software company focused on the fixed income Municipal Market. Our DIVER Platform addresses the needs of Credit Analysts, Risk and Portfolio Managers, Financial Advisors, and Compliance Professionals with easy to use cloud-based, SaaS solutions. We help our users solve for the unique realities of the Municipal Market: stale financial data, over-reliance on insurance and raters, increased regulation and fiscal stress that has led to unprecedented actions (Detroit bankruptcy) and attention (unfunded pension obligations). Our platform has three offerings, each leveraging our database of over 250 distinct data sets.

How they describe their product/innovation: A comprehensive information delivery and Compliance solution serving Financial Advisor Networks. DIVER Advisor is designed to protect the firm via a robust Compliance infrastructure. Financial Advisors gain insights to activity around client positions through real-time dashboards and easily access internal credit research. A simple to generate CUSIP-driven reporting module addresses adherence to Regulatory Requirements.

Product Distribution Strategy: Direct to Business (B2B), through financial institutions, other fintech companies, Trading Platforms, Portfolio Management platforms, & licensed to firms

Contacts:

Bus. Dev. & Sales: Michael Vossler, MD Bus. Dev., [email protected],

(o) 203-276-6514, (m) 917-375-7377

Press: Patti Boyle, CMO, [email protected], (m) 610-202-7342

How they describe themselves: We solve problems, that’s what we help banks do. We’re the ultimate financial innovations company with visionary products that are breakthrough in sheer simplicity (simplicity being another word for higher ROIs). Our solutions are intuitive. They’re for banks. We know how banks work, how banks think, with technology solutions designed for what banks need. Backed by Hasso Plattner Ventures, we continue to expand our way of thinking as well as our global reach with offices in South Africa, London, Brisbane, and Mumbai. We also have a number of partnering agreements with industry leaders across the globe.

How they describe their product/innovation: Online business loan PreApprover is a customer-driven, self-service tool that identifies suitable loan customers from unsuccessful applicants with minimal effort from the bank. PreApprover reduces the amount of resources spent on the screening process and enables more business customers to apply for loans.

Product Distribution Strategy: Through financial institutions

Contacts:

Bus. Dev., Press, & Sales: Andrew Buchanan, Global Head of Sales, [email protected], (t) +44 207 692 4080, (m) +44 0 7766 804968

How they describe themselves: IntelliResponse is the leading provider of virtual agent technology solutions for the enterprise. We create profitable online conversations for our private and public sector customers around the world. With our patented Enterprise Virtual Agent (EVA) solutions, corporate websites, mobile applications, social media channels and agent desktops can all be transformed by an engaging virtual concierge, empowering customers to ask questions using natural, conversational language and delivering an effective and engaging online experience.

How they describe their product/innovation: The IntelliResponse Virtual Agent solution delivers a single, accurate, and approved answer to self-service questions posed across a wide array of customer interaction channels, including corporate websites, voice and text enabled mobile applications, social media platforms, and agent desktops.

With the addition of voice recognition technology, the IntelliResponse Virtual Agent solution enables mobile users to simply ask their question in natural conversational style and receive one right answer wherever they are.

With IntelliResponse’s voice of the customer analysis tool, banks and other financial service institutions can intelligently organize the millions of customer questions in theme clouds to be able to quickly identify trends, ideas for campaigns, and more.

Contacts:

Sales: Mike Minelli, VP Sales, [email protected]

How they describe themselves: IBSS delivers a patented RealTime 100% cloud based four factor online end user identification solution. IBSS technology can significantly improve the existing online security of any internet based application. IBSS’s patented 360 real-time biometric human identification technology provides a superior end user alternative for solving the current problems found with anonymous and transferable user names and password login standards. As a web-centric solution, IBSS’s biometric technology is simple to use, affordable, and can be rapidly deployed across any enterprise with no special hardware or software requirements. IBSS’s real-time human biometric technology is ideal for enhanced online banking customer identification, and advanced email communications security and privacy.

How they describe their product/innovation: Genesis Enterprise Edition is a full-scale comprehensive biometric identification management system. Our system uses an industry superior 4 factor identification design: 1. RealTime legal verification of end user personal information; 2. Coupled with RealTime biometric facial authentication; 3. Coupled RealTime Voice authentication; 4. Coupled RealTime event session biometric monitoring of each online financial transaction equipped with a biometric authenticated timeline audit log record. IbssMail provides a full 360 biometrically secured email platform that provides superior privacy and protection of financially sensitive online email communications.

To experience IBSS technology, sign up for a free beta trial www.ibssmail.com Promo: MAY1

Contacts:

Bus. Dev.: David Ackerman, President, [email protected], 858-610-3221

Press: Lori Bradley, [email protected], 254-744-7235

Sales: David Merritt, VP Sales, [email protected], 619-850-8900

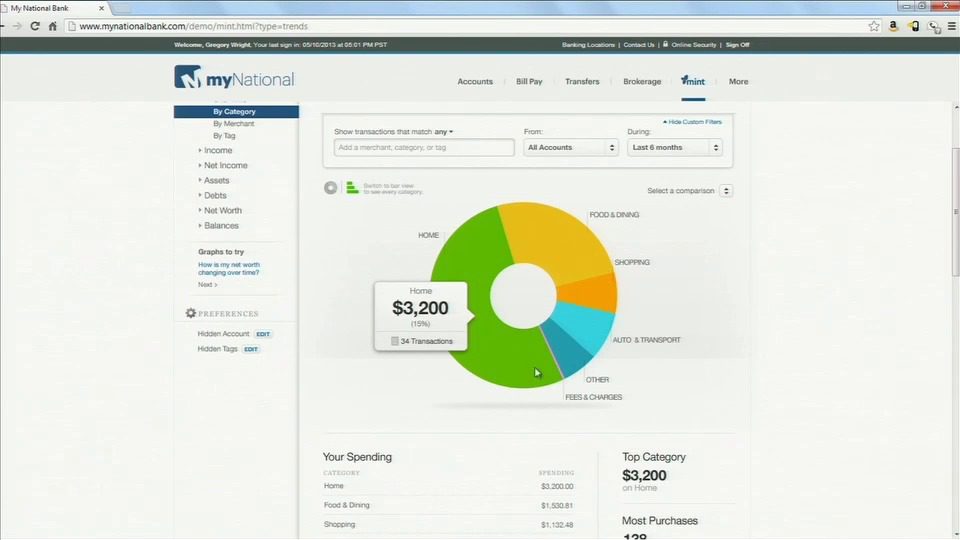

How they describe themselves: Intuit Financial Services helps banks and credit unions grow by offering innovative online and mobile banking solutions that make it easier for consumers and businesses to manage their money. Applying more than three decades of customer insights and innovation to design its products, Intuit provides solutions that help financial institutions achieve higher customer engagement and profitability.

How they describe their product/innovation: As the economy continues to recover, consumers and the nation’s more than 21 million personal businesses are looking for tools that will make it easy for them to manage their complete financial picture, including getting ready for tax time. Intuit will demo a new Mint.com feature called Mint MyBusiness, designed specifically to help consumers who are also small business owners to manage their finances—personal and business—all in one place. Additionally, the company will demo the integration of Mint within the digital banking experience of financial institutions, blurring the lines of traditional banking tasks and financial management.

Contacts:

Bus. Dev.: Jane Wallace, VP General Management, Intuit Financial Services, [email protected] & Steve Carlson, Director Marketing & Business Development, Intuit Financial Services, [email protected]

Press: Tobin Lee, Director Corporate Communications, [email protected], 818-436-8384

Sales: [email protected], 1-888-344-4674

How they describe themselves: InvoiceASAP is the first fully integrated Mobile Invoice Network with Secure Cloud Storage. Users create and send invoices & estimates on a mobile device and attach rich media like signatures, photos and audio files providing a new standard in documentation. InvoiceASAP provides full integration with accounting platforms like QuickBooks and QuickBooks Online. Deep CRM integrations provide a totally integrated user experience. InvoiceASAP is an open platform with a public developer API for customized Mobile Enterprise solutions.

How they describe their product/innovation: InvoiceASAP is showing how the platform works with QuickBooks Online, Capital One Spark Payments for mobile payments, and mobile printing using the Zebra (Nasdaq: ZBRA) family of Bluetooth printers. We’re launching the Zebra printer integration on stage as well our open API for Enterprise developers.

Contacts:

Bus. Dev., Press & Sales: Paul Hoeper, CEO, [email protected], skype: Paul.Hoeper

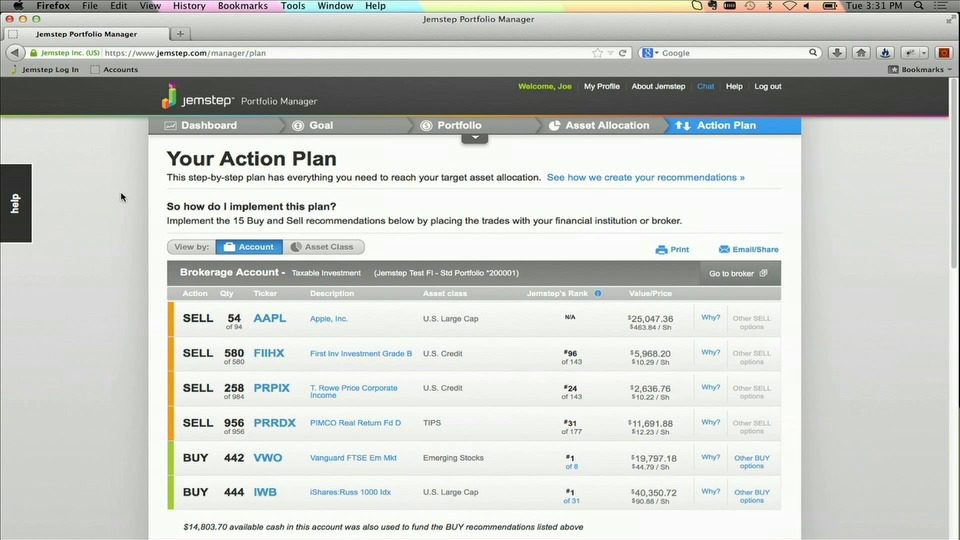

How they describe themselves: Jemstep.com is an online investment advisor that is changing the way people plan and invest for retirement with an easy-to-use online service that helps them maximize their nest egg without undue risk. Using patented technology and proven portfolio management methodologies, Jemstep shows people exactly what to buy, sell, and hold in order to maintain the optimal portfolio for their retirement goals and financial situation. Providing the high-caliber, personalized advice that has traditionally been available only to wealthy investors, Jemstep empowers all investors to take charge of their retirement planning and invest with confidence.

How they describe their product/innovation: Jemstep Portfolio Manager is an easy-to-use online service that helps people lock in more money for retirement. It gets to know each person’s financial circumstances and preferences, and, in minutes: (1) Projects the amount of money their current portfolio will give them to spend in retirement; (2) Recommends a target portfolio optimized to generate more money; (3) Spells out an Action Plan detailing what to buy and sell in each of their accounts (including their 401k), helping them minimize taxes, reduce fund fees, and select top-quality investments; (4) Keeps people on track with continuous monitoring that watches for changes in their profile, portfolio, and the market and alerts them when it’s time to make a change.

Contacts:

Bus. Dev. & Sales: Simon Roy, President, [email protected], 650-492-5642

Press: Suzanne Pallo, Sr. Director Marketing, [email protected], 408-886-4137

How they describe themselves: Kabbage has pioneered the first financial services data and technology platform to provide funding to small businesses in fewer than 7 minutes. Kabbage leverages data generated through business activity such as seller channels, social media, shipping data, and other sources to understand performance and deliver financing to small businesses.

How they describe their product/innovation: Kabbage has partnered with Intuit to provide simple and easy access to funding for QuickBooks customers. Kabbage is the first company on Intuit’s QuickBooks Financing Platform to underwrite customers solely based on QuickBooks data. With Kabbage, customers receive instant approvals; funds can be available within minutes when they use PayPal to receive funding.

Contacts:

Bus. Dev.: Sam Wheeler, VP Business Development, [email protected]

Press: Ann Noder, Pitch PR, [email protected]

How they describe themselves: Kofax® is a leading provider of smart capture and process automation software and solutions for the business critical First Mile of customer interactions. These begin with an organization’s systems of engagement, which generate real time, information intensive communications from customers and provide an essential connection to systems of record (large, enterprise applications and repositories not easily adapted to contemporary technology). Kofax improves the customer experience and reduces operating costs for increased competitiveness, growth and profitability.

How they describe their product/innovation: Kofax will demonstrate how banks can onboard customers to specific products, services or accounts and capture customer content, data, and documents in support of the onboarding process directly from the mobile device. Customers will be prompted to submit information that is automatically extracted, validated for accuracy, and then utilized in the decision process. In cases of exceptions or errors, users will interactively be guided through the resolution process of providing a trailing document (supplemental information) or providing additional clarification or information for the purpose of opening the account.

Contacts:

Bus. Dev.: Diane Morgan, [email protected], 949-378-3158

Press: Gina Ray, [email protected], 949-370-0941

Sales: Drew Hyatt, SVP Mobile, [email protected], 415-999-8870

How they describe themselves: Leaf empowers small business owners to run and grow their businesses by providing a mobile payment platform built for local commerce. Leaf’s cost-effective platform helps retail stores, restaurants, and other local merchants improve the speed and ease of checkout, and offers easy-to-use business management, analytics and customer engagement. By making the complex tasks of running a business easy, Leaf allows merchants to spend more time focusing on what’s important – the needs of their customers.

How they describe their product/innovation: Leaf will unveil the second generation of its LeafPresenter. Out-of-the-box, the LeafPresenter tablet lets small business owners create a virtual version of their store: catalogs, items, customers, employees and inventory. The device can be set up in minutes and is designed to be handheld or stationary in its base so merchants can immediately begin accepting payments, analyzing business performance and engaging with their customers. By supporting numerous payment technologies, the LeafPresenter gives merchants the power to work with the credit card processor, gift card provider or next generation payment options of their choice, including PayPal, LevelUp and various digital wallets.

Contacts:

Bus. Dev.: Aron Schwarzkopf, CEO, [email protected]

Press: Keri Bertolino, SVP, fama PR, [email protected], 617-986-5007

Sales: Alex Mackenzie, Director Sales, [email protected], 617-877-2332

How they describe themselves: LendUp is an online socially responsible lender that makes loans to borrowers that banks and credit unions decline. LendUp is the creator of the LendUp Ladder, an innovative program that uses small dollar loans to provide a path out of the payday loan debt trap and help borrowers build credit. LendUp is accessible on any web-enabled device and offers first time borrowers up to $250 for up to 30 days and proven borrowers up to $1,000 for up to a year.

How they describe their product/innovation: The LendUp Ladder changes the dynamics of a small dollar loan: rather than being a dangerous first step into cycle of debt, small dollar loans become an opportunity to learn good financial behavior and to build credit.

Contacts:

Bus. Dev., Press & Sales: Kate Schwartz, Head of Marketing, [email protected]

How they describe themselves: LICUOS is the global B2B payment platform where businesses can compensate and settle their commercial debts. The platform provides netting, payment and funding services for accounts receivable and payable for businesses, allowing them to reduce their dependence on the traditional banking system alternatives to significantly improve their working capital and cash flow management.

By applying our solution, businesses from all economic sectors and sizes, including public administration and nonprofit, achieve an important reduction in their funding needs and credit risk exposure.

How they describe their product/innovation: LICUOS is demoing its core technology: a unique proprietary and patent-pending technology that enables an efficient and highly secure processing of accounts payable and receivable transactions, 24/7 and in real-time, to deliver the best financial optimization and user experience. Our algorithms automatically identify and generate the most convenient and efficient netting, payment and funding proposals. They manage all of the associated transactions that allow businesses to significantly reduce or eliminate their commercial debts. LICUOS gives businesses full control and visibility into the payment process and allows them to easily communicate and negotiate with their business partners.

Contacts:

Bus. Dev., Press & Sales: Iker de los Ríos, Co-Founder & CEO, [email protected]