How they describe themselves: Liqpay is a universal payment platform, which combines secure and the simplest p2p money transfers between end-to-end users (based on mobile phone number as ID), payment acceptance solution for online merchants and a wide range of easy e-commerce solutions for banks that can be integrated into online-banking, such as “Shop application for Facebook”, “Auction application for Facebook”, “Invoice solution”, and “Money transfer to a face”. Liqpay.com’s vision is that, in principle, if you have a mobile phone, you already own an account on Liqpay.com.

How they describe their product/innovation: “Money transfer to a face” is the innovative system of the easiest money transfers. Customers do not need to know ANY requisites of the recipient, as the service allows users to send money transfers by choosing the FACE of the recipient in the list of Facebook friends. As for the recipient, he decides HOW he wants to receive the money: to a Visa card, to a Liqpay account (e.g. mobile phone number), Western Union, bank account, etc.

Contacts:

Bus. Dev., Sales: Maria Gurina, Liqpay, Business Development Officer, [email protected], +380665277569

Press: Alexander Vityaz, Founder & CEO, [email protected]

How they describe themselves: IND Group is a leading developer and provider of banking front-office products on the European e-finance market. Through quality and innovation, we are proud to offer our innovative products to more and more satisfied customers around the world. Our products incorporate the most innovative technologies available in order to provide the best customer experience with ease of access and high security, while giving users up-to-date and sophisticated functions in modern banking. Since IND Group’s inception in 1997, the company has expanded not only in Europe, but in the Middle-Eastern region as well, currently providing state-of-the-art technology for 25 banks in more than 15 countries on three continents.

How they describe their product/innovation: IND “wow” innovation is a new online and mobile banking platform, which is reinventing the way a bank can communicate with its customers. Use of natural language, simplicity, usability and data visualisation are the key differentiating factors. Easy to use main features are the account and transaction visualisation, wizard-type money transfers and investments, zero-effort personal finance management, online sales engine and the support centre. Our approach for mobile banking is iPhone and Android apps. Mobile banking is more than just the extension of online banking features. We think the capabilities of the mobile should be fully used, like GPS location, camera and the fact that it is always-online.

Contacts:

Bus. Dev.: József Nyíri, CTO, [email protected]

Press: Katalin Rábai, Marketing Director, [email protected]

Sales: Tamás Braun, Regional Sales Manager, [email protected]

How they describe themselves: Ixaris develops innovative applications that make sending and receiving money fast, simple and economical. Its Opn (pronounced ‘open’) platform makes it possible for anyone to create and run payment applications that use global payment networks like Visa, MasterCard and SWIFT. Whether it’s collecting money from any bank account around the world or sending money by issuing a Visa or MasterCard, Opn makes it easy. As the first open payment application platform that connects developers with global payment networks, Opn relies on ground-breaking proprietary technology and extensive banking relationships to allow entrepreneurs to develop new payment applications or simply enhance their existing business with customized payment capabilities.

How they describe their product/innovation: We will be demoing Opn Card Guardian, an application that automates the corporate purchasing process through one-time-use virtual Visa cards. We incorporated the word “guardian” into the name of the paylet to convey the extra protection it provides during the purchasing process.

Opn Card Guardian generates a virtual Visa card that is pre-loaded with funds for a specific transaction. This purchase is then completed automatically on behalf of the merchant, with no human intervention, using the issued virtual Visa. Executing the paylet through an API makes it very easy to integrate and convenient to access via any internet browser-based PC.

Contacts:

Bus. Dev.: Jim Broom, Sales Director, [email protected]

PR: Nicola Koronka, Hotwire, [email protected]

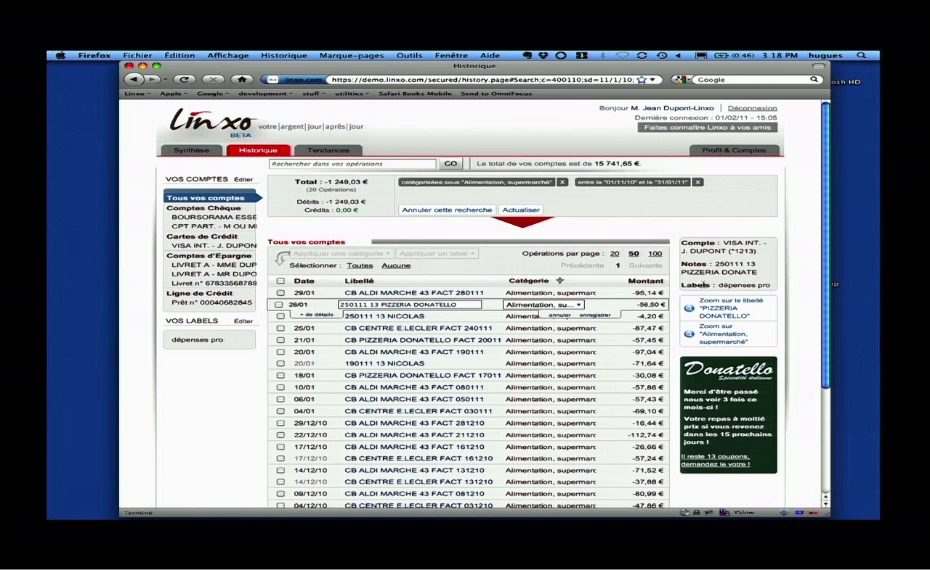

How they describe themselves: Linxo is a French startup, founded in April 2010, specializing in online personal finance management and savings optimization. In October 2010, the company launched its service enabling users to view their accounts from several French banks in one place, automatically synchronized.

The platform powering the service is composed of several building blocks:

- The first bank account aggregation service supporting French financial institutions

- A categorization engine for transactions

- A customizable front-end based on a widget architecture with integration points

How they describe their product/innovation: PFM so far has been mostly about integrating financial information from several closed systems into another closed system. While these systems have clear benefits, Linxo believes that a single company cannot address the broad range of end user needs.

The new version of Linxo’s platform is open to partners for application development. Typical use cases for “Linxo Apps” include integrating a partner dashboard, linking to a fidelity or rewards program, showing offers, linking to the partner service.

Contacts:

Bus. Dev, Press, Sales: Bruno VanHaetsdaele, CEO, [email protected], +33 (0)7 60 22 83 94

How they describe themselves: Liqpay.com is the universal payment platform which combines secure and the simplest p2p money transfers between end-to-end users, payment acceptance solution for merchants and also rich set of powerful and flexible API for developers. Liqpay.com’s vision for their customers is that in principle if you have a mobile phone, you already own an account in Liqpay.com.

How they describe their product/innovation: Simple eCommerce solutions for banks including “$hop App for Facebook”, “Auction app for Facebook”, and “Invoice Solution”, that can be integrated into i-banks (both for individuals and businesses). These solutions can provide mass and easy access to eСommerce for i-bank customers. “$hop App for Facebook” and “Auction app for Facebook” are social oriented solutions as they are placed to social networks where customers can pay for products with Visa/MasterCard. All accepted payments are disbursed to linked bank account or any credit/debit card in i-bank.

- “$hop App for Facebook” allows a person / company to create a store in the i-bank and place it on the Facebook page. It includes integrated payment acceptance and merchant / partners payouts (Liqpay payment gateway and API for Banks), built-in affiliate program, socialization of trade

- “Auction app for Facebook” allows a person/company to create lots and place it on the auction storefront in Facebook. It includes integrated payment acceptance (Visa, MasterCard), and accepted payments are disbursed to company bank account or card account.

- “Invoice Solution” allows banks to integrate “invoice solution” into i-bank. Any Company/ person, connected to i-bank, can create an invoice 1) directly from i-bank 2) or by placing “invoice” button anywhere on the web. Created invoice is sent to Customer by email/SMS/Fax. Any customer can pay for company services by cards via internet (Liqpay) or by wire transfer. Payments are disbursed to company bank account or card.

Contacts:

Bus. Dev., Sales: Maria Gurina, Liqpay Business Development Officer, [email protected], +380665277569

Press: Alexander Vityaz, Founder & CEO, [email protected]

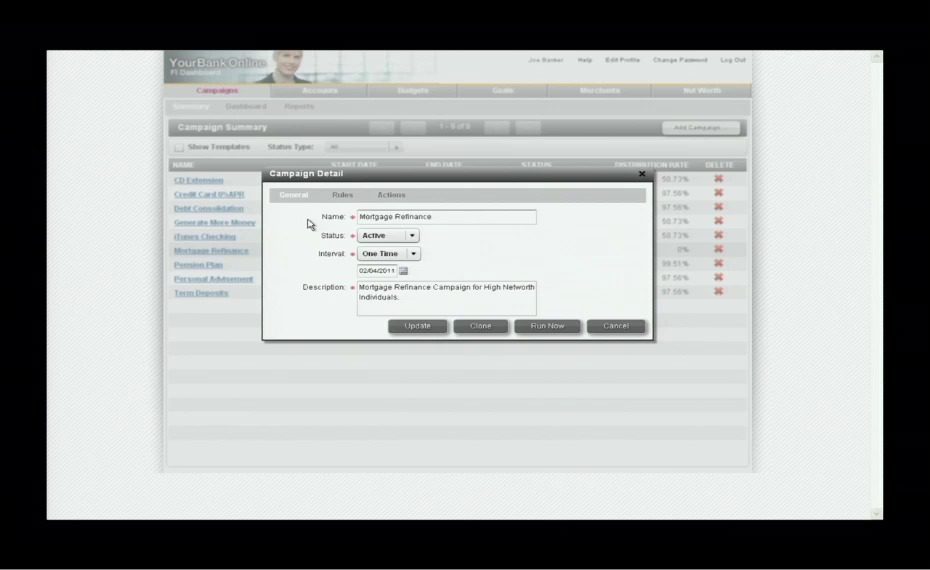

How they describe themselves: Lodo Software helps financial institutions drive revenue and enhance customer loyalty using online personal finance management tools.

Lodo’s OurCashFlow is designed to be bank-branded and hosted, tightly integrating with online banking sites. The software supports a full range of PFM features including multicurrency and multilanguage support.

The OurCashFlow FI Dashboard offers a powerful cross-selling tool that taps the data gathered by the PFM platform. It helps financial institutions leverage a holistic view of customers’ accounts to tailor and personalize cross-sell campaigns for maximum impact and ROI.

How they describe their product/innovation: Lodo’s FI Dashboard helps financial institutions launch highly targeted cross-sell campaigns using information gathered by the PFM platform.

The software organizes and analyzes customer data to help financial institutions tailor their offers and advice, ensuring they reach the right customers at the right time.

Promotional messages are defined and scheduled within the tool and are presented to customers via their PFM dashboard. Lodo’s software tracks how many customers view each promotional message and how many click through to respond, validating reach and response rates for every campaign.

Contacts:

Bus. Dev.: Mark Vipond, CEO

Press: Judy Hartlieb, Director of Marketing

Sales: Ron Zaysoff, Director of Sales

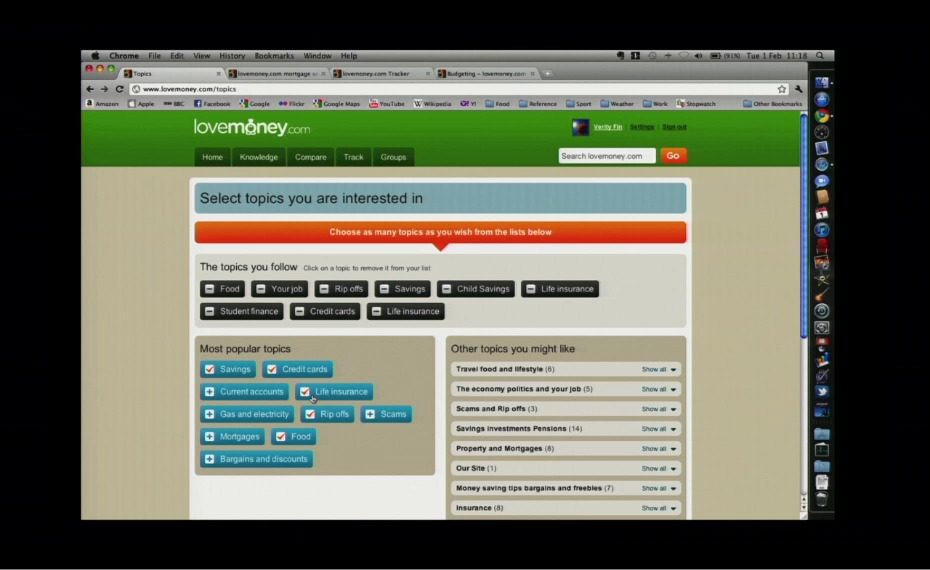

How they describe themselves: lovemoney.com is a personal finance portal at the forefront of user empowerment in the UK money space. It is built around five core content domains: Knowledge, Comparison, PFM, Financial Planning and Social Interaction. Users personalize their experience by tailoring their topic interests, asking questions of the community and interacting with products, experts and advisors. The platform ‘learns’ from group behavior and serves content and products based on profile cohorts. Our innovative product selection, PFM and planning tools complete the offering, placing it at the forefront of cutting edge PF destinations. Put simply, our mission is to make you richer.

How they describe their product/innovation: lovemoney.com has released ‘version 2’ of the portal. We are demoing our freshest features that comprise: streamlined registration and topic selection, “People like you” and “Just you” content filtering, single customer view population of multiple financial services, Money Tracker (PFM in the UK), Plans (our unique asset digitisation service), Q&A, Groups and the all-important Personal Homepage. lovemoney.com is the first personal finance platform in the UK that joins all of these elements up to form a truly integrated money hub. The features demonstrated at Finovate are the output of innovation in a downturn!

Contacts:

Bus. Dev.: Saul Devine, Managing Director, [email protected], +44 (0) 207 297 8181,

Ian Major, Operations Director, [email protected], +44 (0) 207 297 8147

Press, Sales: Ian Major, Operations Director, [email protected], +44 (0) 207 297 8147

How they describe themselves: Ixaris specializes in developing innovative global applications based on open-loop (Visa and MasterCard) prepaid card schemes. Its specialized platform provides both consumers and businesses with convenient access to electronic payments and facilitates the global transfer of funds in real time through the Visa, MasterCard and SWIFT networks. Ixaris currently offers a range of co-branded payment applications to businesses in the healthcare, leisure, financial services, travel and performance marketing industries and currently manages financial transactions exceeding $15M per month.

What they think makes them better: When compared to other “open payment” offerings, Ixaris Opn is a truly “open” payment platform that allows developers to build payment applications over open loop networks such as Visa, MasterCard and SWIFT. Its proprietary paylet technology offers developers far greater control over the look and feel of their applications without sacrificing security and compliance, while third-party financial providers, including issuers and card processors, can participate in Opn as providers of the underlying services. Opn supports payment applications for users both within a shared community as well as private communities where the client retains exclusive access to a group of users.

Contacts:

Bus. Dev. & Sales: Mike Anderson, Business Development Director, 206-453-0026, [email protected]

Press: Matt Lloyd, Founder, M2L2 Communications, 617-834-3146, [email protected]

How they describe themselves: Jack Henry & Associates, Inc. encompasses three primary brands. JHA Banking provides mid-tier and community banks with enterprise-wide information and transaction processing solutions that are available for in-house and outsourced implementation; Symitar provides credit unions of all sizes with industry-leading information and transaction processing solutions that are also available for in-house and outsourced implementation; and ProfitStars provides best-of-breed solutions that enhance the performance of domestic and international financial institutions of all asset sizes and charters using any core processing system, as well as diverse corporate entities.

What they think makes them better: Jack Henry’s primary and sustainable competitive advantage is its company-wide commitment to provide premier service levels. Jack Henry is driven by a fundamental commitment to provide service levels that consistently exceed its clients’ expectations, and generate industry-leading client satisfaction and retention rates.

Jack Henry maintains the focused work ethic and fundamental ideals fostered by its co-founders – Jack Henry and Jerry Hall: 1) Do the right thing, 2) Do whatever it takes, and 3) Have fun.

These simple but powerful tenets have enabled Jack Henry to prosper in an extremely competitive business environment, to provide rewarding professional opportunities for its more than 4,400 associates, to generate an impressive rate-of-return for its shareholders, and to establish a corporate culture that generates rewarding levels of client satisfaction and retention.

Contacts:

Bus. Dev.: Steve Tomson, Director of Sales, [email protected], 972-354-5108

Sales: Martin Webster, ProfitStars Sales Manager, [email protected], 800-356-9099

Press: Jacquie Scheider, Marketing Manager, [email protected], 770-752-6410

How they describe themselves: Kapitall is a whole new way to invest online and play the market. With our intuitive “drag-and-drop” interface, anyone can explore the market, build their skills with practice portfolios, analyze their choices with powerful yet easy-to-use tools, and share their ideas with like-minded investors, including their Facebook friends. And via a partnership with TD AMERITRADE, Kapitall users can now import “live” portfolios to track their holdings and make trades directly from Kapitall.

What they think makes them better: By making investing a more intuitive and social experience, Kapitall engages and empowers a far broader audience of online investors – particularly younger people who aren’t well-served by the tedium and complexity of established choices. To achieve this, Kapitall has transformed online investing from information-heavy, static webpages into a highly-interactive, visual experience inspired by social gaming – the way the next generation of investors prefers to learn, play and connect with others.

Contacts:

Bus. Dev. & Sales: Sally Wood, VP Business Development & Marketing, [email protected], 212-965-8441

Press: Ellen Edelman, Spark PR, 908-322-8998

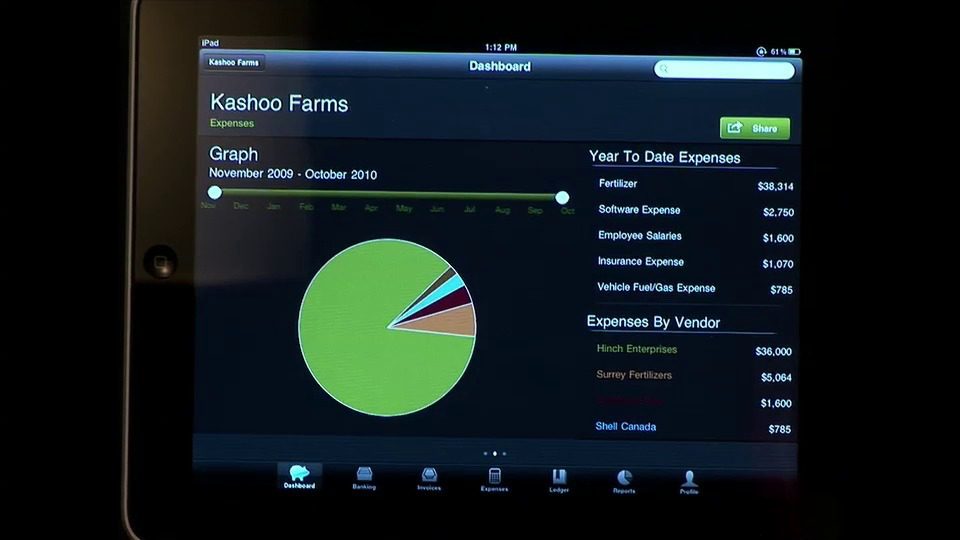

How they describe themselves: Kashoo.com transforms how small businesses manage their finances. At its core, Kashoo.com is a powerful yet affordable online accounting solution designed specifically for small business. With no accounting experience, the business owner can quickly and efficiently “do the books” and move on to the business of running the business. With the help of powerful visualization dashboards, business owners keep on top of the numbers impacting business, make better strategic decisions, and proactively take action. Financial goals are met and disasters are avoided. With powerful insight into the operational performance of the company, business owners rely on Kashoo.com for more than accounting.

What they think makes them better: Unlike desktop accounting applications, Kashoo.com was built from the ground up to leverage cloud computing to enable collaboration, mobility, and data sharing in a simple, secure, affordable solution. Accessible over the Internet and on mobile devices like the iPhone, Android, and iPad, Kashoo gives the business owner control to manage the company’s finances anytime, anywhere. And because Kashoo.com is designed specifically for the small business owner, no knowledge of accounting is required. Kashoo.com goes beyond “doing the books” giving the business owner the power to collaborate in real-time with partners, to stay on top of key metrics, and to optimize business performance.

Contacts:

Bus. Dev. & Press: Jim Secord, CEO, 778-919-3771, [email protected]

Sales: Scott Pledger, VP Marketing, 604-754-7979, [email protected]

How they describe themselves: Kiboo is an alternative banking/payment platform designed for teenagers, young adults, and their parents that combines real-time access to checking and savings accounts with rich, customizable tools for budgeting; access to our retail partnerships; participation in social causes and philanthropy; and a vast library of targeted personal finance information.

Kiboo empowers young people (representing $200b in spend annually) and their parents to reach and retain financial independence. Blending social media tools with personalized information and a secure system that both learns and teaches, Kiboo is a values-based alternative for this transitional demographic.

What they think makes them better: Kiboo will convert and retain this coveted but elusive demographic by offering services, tools, and information which has been wholly customized for them based on their world view, social values, vernacular, and aspirations of independence.

Whereas conventional banks have offered few targeted products for this customer group, and other financial websites provide advice but few real-world services, Kiboo leverages both competitors’ missed opportunities.

Kiboo benefits our bank partners with sticky core deposits; we mitigate interchange fees and prevent fraud losses for our retail partners; and we provide our users with safe, secure access to their money and relevant financial information.

Contacts:

Bus. Dev. & Sales: Meredith Fogel, VP Business Development, [email protected], 917-757-3999

Press: Lisa Halpern, Founder & CEO, [email protected], 917-576-7582