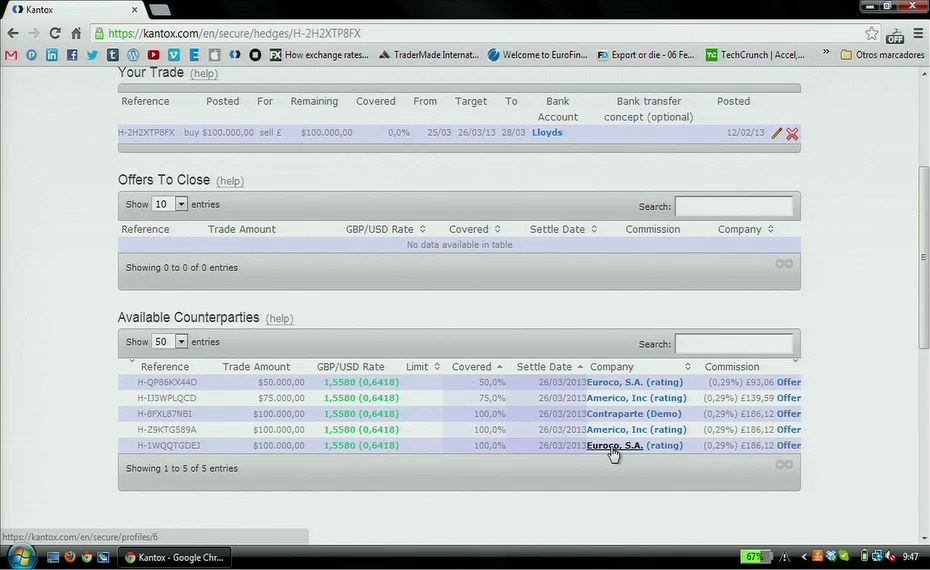

How they describe themselves: D3 Banking is the creation of Lodo Software. Lodoâs roots are in the lower downtown district of Denver, Colorado, where it all began in 2007. Today, we are headquartered on the Silicon Prairie in Omaha, Nebraska. Over 190 financial institutions use solutions from Lodo to provide customers with data-rich financial management and planning tools. Our premise is that today’s consumer expects convenient access to a full range of personalized financial services. Financial institutions that want to gain the trust of these consumers are struggling with disparate systems that limit what they can know about â and do for â the customer. We created D3 Banking for those customers and financial institutions.

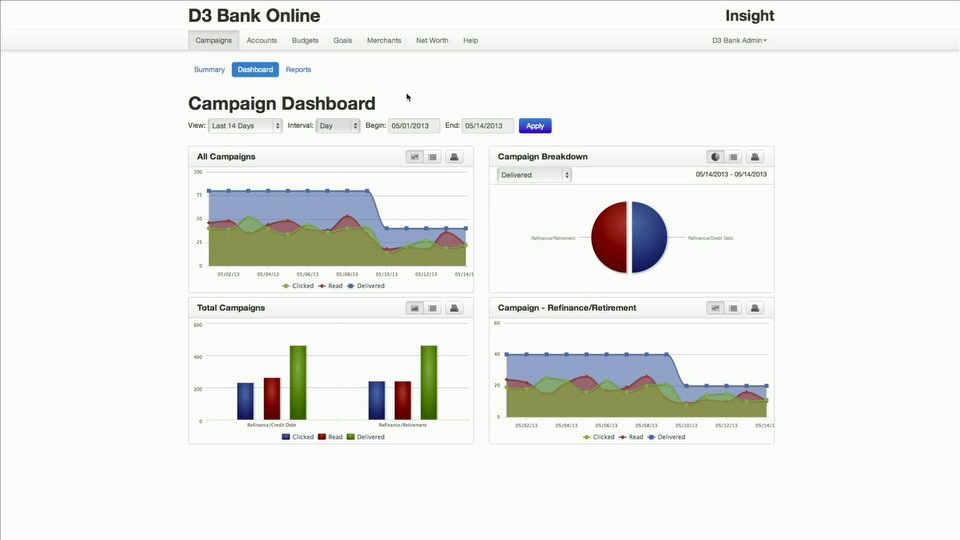

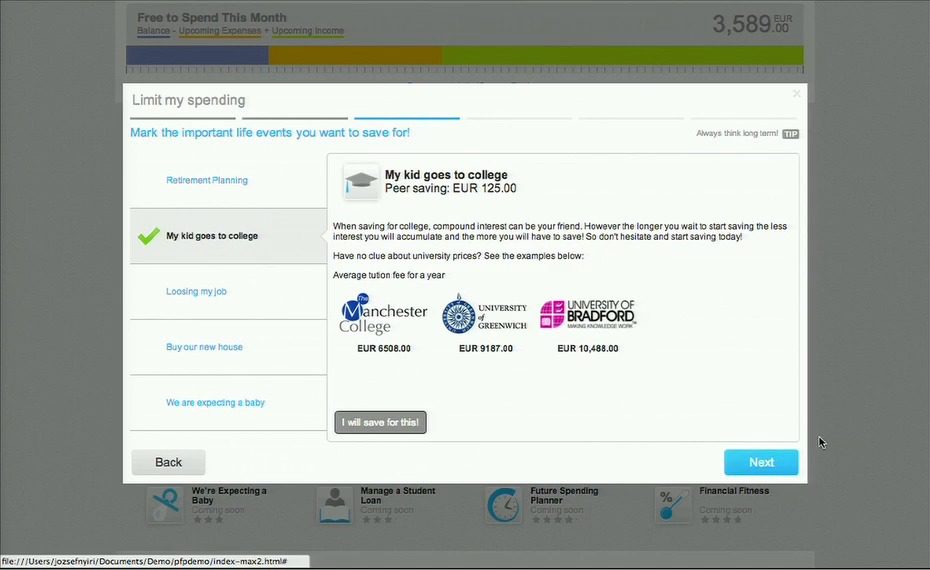

How they describe their product/innovation: D3 Banking is data driven digital⢠banking. It provides a full range of integrated financial services using a powerful, predictive analytics engine to deliver a personalized customer experience anytime, anywhere, on any device. The D3 Banking components utilize next generation technology and can be deployed on a single server or distributed across servers to support cloud-computing environments. Those components include: D3 Analyticsâ˘, D3 Insightâ˘, D3 UXâ˘, D3 Appsâ˘, D3 APIâ˘, D3 Connect⢠and D3 Controlâ˘. These components provide the resources necessary for financial institutions to deliver a consistent, relevant and profitable experience to their customers.