How they describe themselves: zip.liqpay.com is a service that enables Recipients of a payment (companies and/or individuals) to make the process of passing payment details to a payer easy and convenient. This service speeds up the process of entering payment details and allows Payers to avoid mistakes.

How they describe their product/innovation: zip.liqpay.com allows recipients of a payment (companies and/or individuals) to shorten payment details transforming them into a short code. As a result, the short digital code is easy to dictate or pass to a payer over SMS or e-mail.

zip.liqpay.com has API, which can be integrated to billing systems of other companies. For example, mobile operators, utility companies, banks, etc.

Privatbank (the largest bank in Ukraine) has already integrated zip.liqpay.com API into its online banking. Privatbank customers are able both to shorten payment details and use a short code to make a payment via online banking.

Contacts:

Bus. Dev. & Sales: Maria Gurina, Liqpay, Business Development Officer, [email protected], +380665277569

Press: Alexander Vityaz, Founder & CEO, [email protected]

How they describe themselves: Luup’s truly universal mobile payment platform is redefining payments as it enables mobile remittances, branchless banking and mobile corporate payments – on any mobile device, anywhere in the world. The Luup solutions are bank-grade, live and proven in retail and corporate contexts, as well as scalable and easily managed. They solve business challenges, reduce costs, and increase revenue. For customers the benefits are new, convenient, and secure services that enable cost savings and financial inclusion. Luup is the only independent global provider of mobile payment solutions and is uniquely placed for growth. Luup is creating an extensive payments ecosystem; see www.luup.com

How they describe their product/innovation: Luup is redefining payments with its universal mobile payment platform and solutions. At FinovateEurope, Luup is launching a service that revolutionises corporate & government travel authorisation and budget management. Enabled by Luup’s successful Remote Authorisation & Mobile Wallet products, the new service optimises processes, creating huge efficiency and productivity gains. Gone are the days when employees have to chase managers for budget and trip approvals while costs rise exponentially by the hour. With Luup’s latest service, travel budgets are managed in Luup’s wallet system that enables travel requests, authorisations and payments within minutes from anywhere, on any mobile device.

Contacts:

Bus. Dev. & Sales: Georg Fasching, VP Products & Solutions, [email protected]

Press: Beatrice Martin-Vignerte, Director of Corporate & Marketing Communications, [email protected]

How they describe themselves: InComm is the industry leading marketer, distributor and technology innovator of stored-value gift and prepaid products, using its state-of-the-art, point-of-sale transaction technology and payment solutions to revolutionize retail product sales and customer experiences. With more than $13 billion in retail sales transactions processed in 2010, InComm is the nation’s largest provider of gift cards, prepaid wireless products, reloadable debit cards, digital music downloads, content, games, software and bill payment solutions. InComm partners with consumer brand leaders around the world to provide more than 225,000 retail locations the products and services their customers demand.

How they describe their product/innovation: InComm’s innovation is a mobile commerce platform that will deliver promotion, loyalty, and general payment solutions to national merchants and their customers. This will differ from other mobile wallet platforms in that the solution will tailor to the retailer’s needs, providing a merchant-branded environment and thus, the ability to be directly involved in the consumer’s wallet experience. When combined with loyalty and gifting, merchants will have a fully functional application that simplifies the consumer’s life, reducing the need for magnetic swipe technology and harboring next generation technologies such as near field communication.

Contacts:

Bus. Dev. & Sales: Michael Frasier, Director Business Development, [email protected],

310-294-3557

Press: Sarah Arvizo, Wonacott Communications, [email protected], 310-477-2871 x675

How they describe themselves: IND Group is a leading developer and provider of online and mobile banking products on the European e-finance market. Through quality and innovation, we are proud to offer our innovative products to more and more satisfied customers around the world. Our products incorporate the most innovative technologies available in order to provide the best customer experience with ease of access and high security, while giving users up-to-date and sophisticated functions in modern banking. Since IND Group’s inception in 1997, the company has expanded not only in Europe, but in the Middle-Eastern region as well, currently providing state-of-the-art technology for 25 banks in more than 15 countries on three continents.

How they describe their product/innovation: IND’s “wow” innovation is a new online and mobile banking platform, which is reinventing the way a bank can communicate with its customers. Use of natural language, simplicity, usability and data visualization are the key differentiating factors. Easy-to-use main features include the account and transaction visualization, wizard-type money transfers and investments, zero-effort personal finance management, online sales engine and support center. Through IND’s use of iPhone and Android applications, mobile banking is more than just the extension of online banking features. We think the capabilities of the mobile should be fully used, like GPS location, camera and the fact that it is always online.

Contacts:

Press: Katalin Rabai, Marketing Director

Sales: Tamas Braun, General Manager, IND U.K., [email protected]

How they describe themselves: Jingit is an integrated payment and cash based transactional advertising platform. Consumers are paid real cash instantly for engaging with brands. Jingit respects consumers, their time and their privacy while enabling brands to engage consumers in a no risk, no waste, pay-as-you-go model. Jingit removes friction in online and real world payments, and will seamlessly enable consumer mobile payments. Instant earn. Instant spend.

How they describe their product/innovation: With Jingit, you earn real cash (not credits, points or virtual currency) by engaging with brands. Instantly spend that cash to buy goods online with your Jingit balance, or in the real world with a Jingit Visa® Debit Card.

Contacts:

Bus. Dev.: Joe Rogness, Co-CEO

Press: Eric Davis, Haberman & Associates, 612-372-6465

How they describe themselves: Kabbage provides working capital to online merchants as they list products for sale, leveraging information generally available on online marketplaces to assess risk and help determine advance amounts and related fees and interest. This approach allows Kabbage to understand our borrowers better and, as a result, provide them with cash and when they need it.

How they describe their product/innovation: Kabbage has launched the SocialClimbing™ feature of its system, which enables online merchants to associate their social activities with their Kabbage account. By doing so, Kabbage incorporates information from these social media sites to underwrite risk and enable online merchants to receive a benefit by actively engaging with audiences interested in their products and services.

Contacts:

Bus. Dev.: Marc Gorlin, Chairman, 404-410-7837

Press: Lauren Simon, Marketing Associate, 404-406-1900

Sales: Russell Walraven, Marketing Director, 678-986-6748

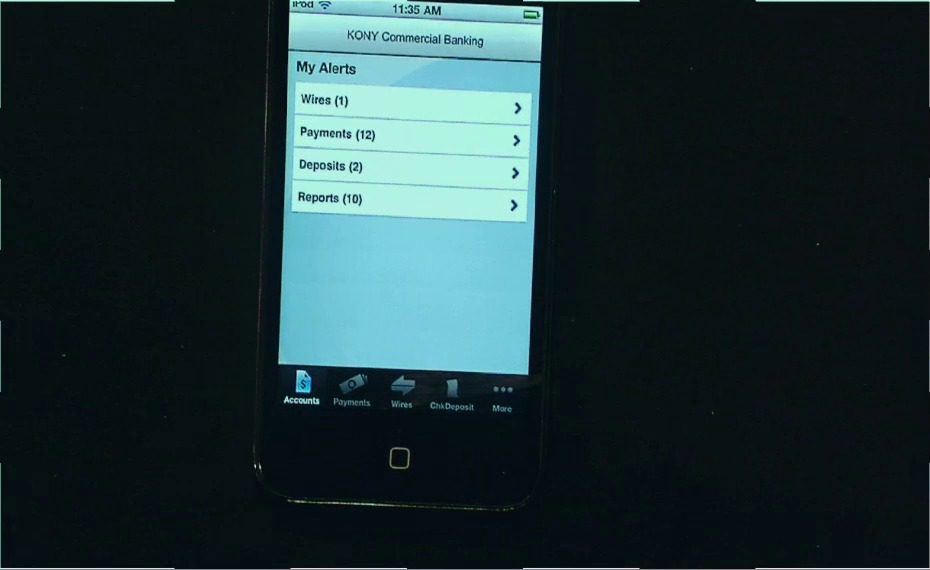

How they describe themselves: Kony enables enterprises to offer consumers and employees feature-rich mobile applications in less time and at lower costs than any other solution. Leveraging a single application definition, applications are designed and developed just once, in a device-independent manner, and deployed across multiple channels, including native applications, device-optimized mobile web, SMS, web gadgets, kiosks, and tablets without compromises. Kony’s unique platform is proven to future-proof a company’s mobile investment by enabling applications to be changed once for all channels, ensuring faster adoption of new operating systems and standards as they are introduced, while eliminating maintenance, upgrade and future development costs.

How they describe their product/innovation: Kony Commercial Banking leverages Kony’s Platform and our expertise in mobile banking. It allows the corporate treasurer and executives to track and approve transactions from any mobile device they choose to use including tablets. Each user is able to view the transaction amount, date, account involved, the approval status of other users and a memo. This solution is unique in offering secure, multi-user transactions accessible anytime, anywhere. Plus, from the development perspective the application is updated and deployed to any mobile device, mobile web or tablet from a single application definition.

Contacts:

Bus. Dev.: Robin Kearon, VP Channels & Alliances, [email protected], 201-240-5391

Press: Julia Gaynor, Affect Strategies, [email protected], 212-398-9680

Sales: Mark Mszanski, Vice President Financial Services, [email protected],

908-500-4087

How they describe themselves: LearnVest.com is the leading personal finance and lifestyle website for women. Since its debut as a TechCrunch50 Company in September 2009, LearnVest has helped over one million women gain control of their finances. LearnVest provides trusted content, tools, and support to help women tackle their finances at each stage of life. LearnVest tools include: financial Bootcamp Programs, the LearnVest My Money Center, and premium support services such as “Ask an Expert” and LearnVest Coursework. LearnVest educates subscribers via the “LearnVest Daily,” a bite-size email guide of money and lifestyle tips for living on a budget.

How they describe their product/innovation: LearnVest’s new suite of products helps users manage their finances under the LearnVest Method – “Get informed, get organized, get support.” The new Take Control Bootcamp email program educates users on managing and maximizing cash flow. The My Money Center allows users to get organized by viewing all of their accounts in one place, and personalize budget items and spending goals through a Financial Inbox. The LearnVest Advice Center includes online multimedia courses and one-on-one email access to LearnVest’s Financial Planning Team so that members can get the answers they need when building a long-term financial plan.

Contacts:

Bus. Dev.: Alexa von Tobel, CEO & Founder, [email protected], 212-675-6711

Press: Dani Dalesandro, Sunshine Sachs, O: 212-691-2800, C: 973-945-2083

Sales: Jacqueline White, Director, Sales, [email protected], 212-675-6711

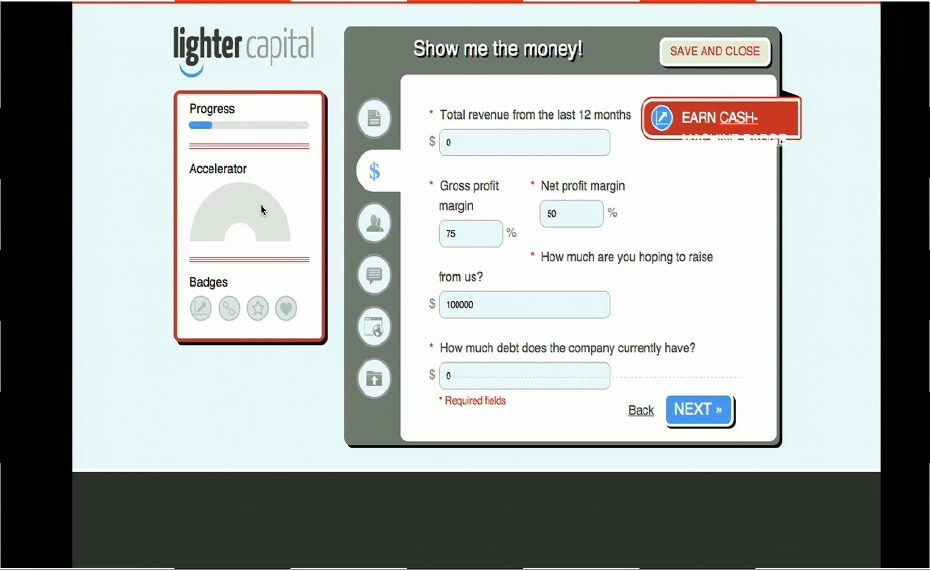

How they describe themselves: We founded Lighter Capital to give small businesses a better funding option. As entrepreneurs ourselves, we felt it was time for some serious change in the financial services industry. So, what are we doing differently? We’re combining an innovative financial structure with a technology-enabled lending process, and capping it all off with a more open and avant-garde approach to small business lending.

How they describe their product/innovation: RevenueLoan™ is our light-weight and flexible financing option that fits an unmet need in the small business funding market. Our revenue-based finance model exchanges growth capital for a fixed percentage of a company’s revenues. Entrepreneurs prefer this as there’s no dilution, no loss of control, and no fixed repayment schedule. For us, this provides a more scalable funding strategy as we have more consistent repayment than venture investors while achieving higher rates of returns than banks. We’re also the first small business lender to build a company’s social media and web presence directly into our loan evaluation process.

Contacts:

Bus. Dev.: Andy Sack, CEO, [email protected]

Press: Drew Schwarz, [email protected], 425-522-3746

Sales: Rob Belcher, Principal, [email protected], 303-870-9529

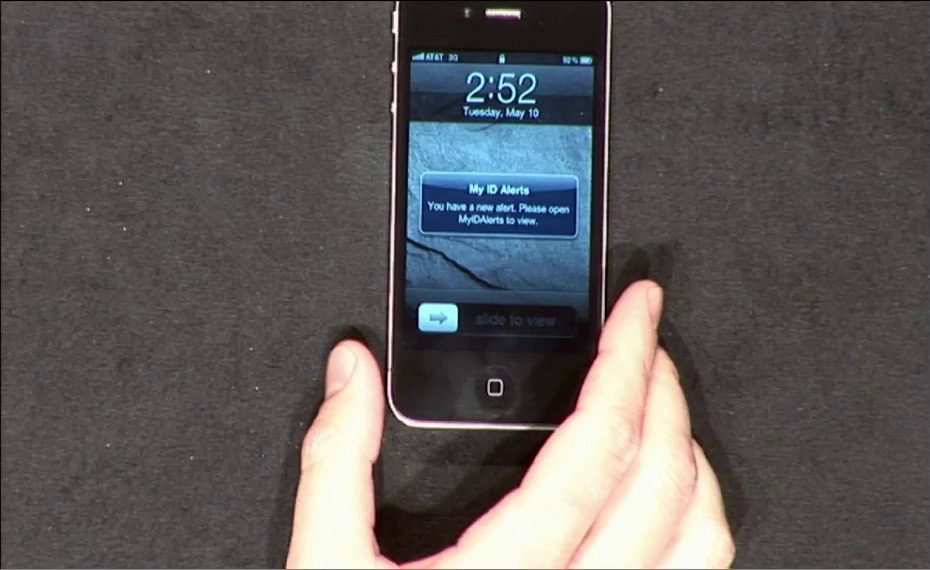

How they describe themselves: ID Analytics is transforming consumer risk management with patented analytics, proven expertise, and real-time insight into consumer behavior. By combining proprietary data from the ID Network® – one of the nation’s largest networks of cross-industry behavioral data – with advanced science, ID Analytics provides unprecedented visibility into identity risk and creditworthiness. Every day, the largest U.S. companies and critical government agencies rely on ID Analytics to make risk-based decisions that enhance revenue, reduce fraud, drive cost savings, and protect consumers. Please visit us on the web at www.idanalytics.com.

How they describe their product/innovation: Introducing My ID Alerts – a new service that stops identity fraud before it starts. My ID Alerts provides real-time mobile ID Alerts the instant someone attempts to use your personal information – potentially without your permission. My ID Alerts monitors your identity 24/7, and our patent-pending Not Me™ Notification System can help stop fraudulent accounts at the source, often before they get opened. Subscribers also have the backing of our $1,000,000 Identity Theft Insurance Policy for even greater peace of mind. A subscription to My ID Alerts is just $4.95 per month. Visit www.myidalerts.com for more information.

Contacts:

Bus. Dev., Sales: Mike Bruemmer, Director, Business Development, [email protected], 512-466-1396

Press: Brigitte Engel, Director, Marketing, [email protected], 858-312-6333

How they describe themselves: Ideon Financial Solutions is a strategic and product innovation partner for leading financial institutions in North America and Europe. Ideon assists its partners in distributing innovative and profitable products to their customer base. Ideon has trained more than 16,000 sales managers that have sold 170,000 products through programs with our partners, representing total product volume in excess of $100 billion in notional value. Ideon works with its partners from its offices in the United States, Switzerland and Spain.

How they describe their product/innovation: Ideon’s Choice Savings is a front-to-back solution that complements your existing deposit systems and equips your institution to rapidly deploy and sell the next generation of savings products that clients can customize to their own needs.

Contacts:

Bus. Dev.: Matt Murphy, Managing Director, [email protected], 210-667-0942

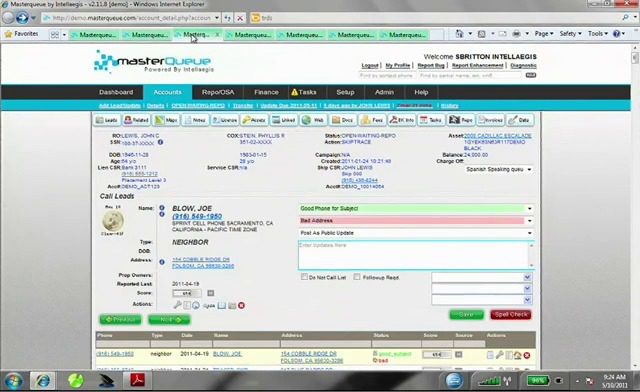

How they describe themselves: Intellaegis is a software development company that was founded by several successful entrepreneurs and their partners to build next generation products for the financial services industry.

How they describe their product/innovation: masterQueue® is Intellaegis’ inaugural product; a web-based, first-to-market risk management/collection workflow Software-as-a-Service (SaaS) tool that delivers sophisticated business intelligence and bottom line results for the financial service industry. masterQueue® elevates the value of public records to quickly locate, track and recover lost assets through a fully integrated workflow, metrics and vendor management product.

Contacts:

Bus. Dev., Press, & Sales: John Lewis, [email protected], 916-730-3335