PhotoPay’s optical character recognition (OCR) technology helps replace manual data entry. The company demonstrated BlinkOCR at FinovateEurope 2015.

While there are a handful of successful companies with OCR solutions on the market, PhotoPay has three distinguishing features:

- Works with no internet connection

- Recognizes data type by context (email, URL, reference number, dollar amount)

- Flexible enough to capture data from non-standardized paper, computer screens, and unique documents, such as a letter invoice

Facts

- Self funded

- 13 employees

- Partnered with banks in 10+ countries

- Over 16 million end users of PhotoPay technology

- Based in the UK

- Creator of the Photomath app calculator

The software works in 40 countries. A total of 15 banks in Europe have implemented the solution, including the second largest bank in Germany and second largest bank in the Netherlands.

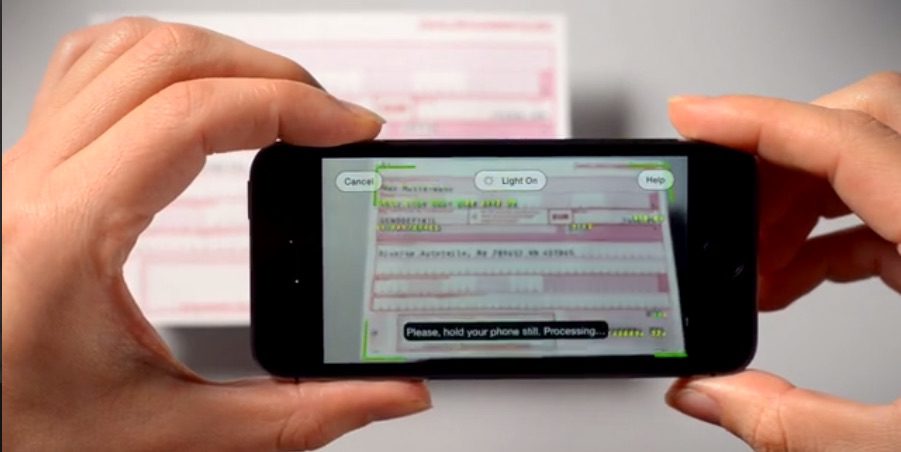

The BlinkOCR software development kit (SDK) has 50 lines of code, making it easy to embed into a bank’s existing mobile app. The user experience is simple:

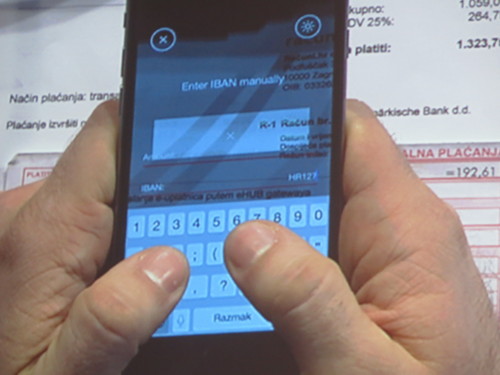

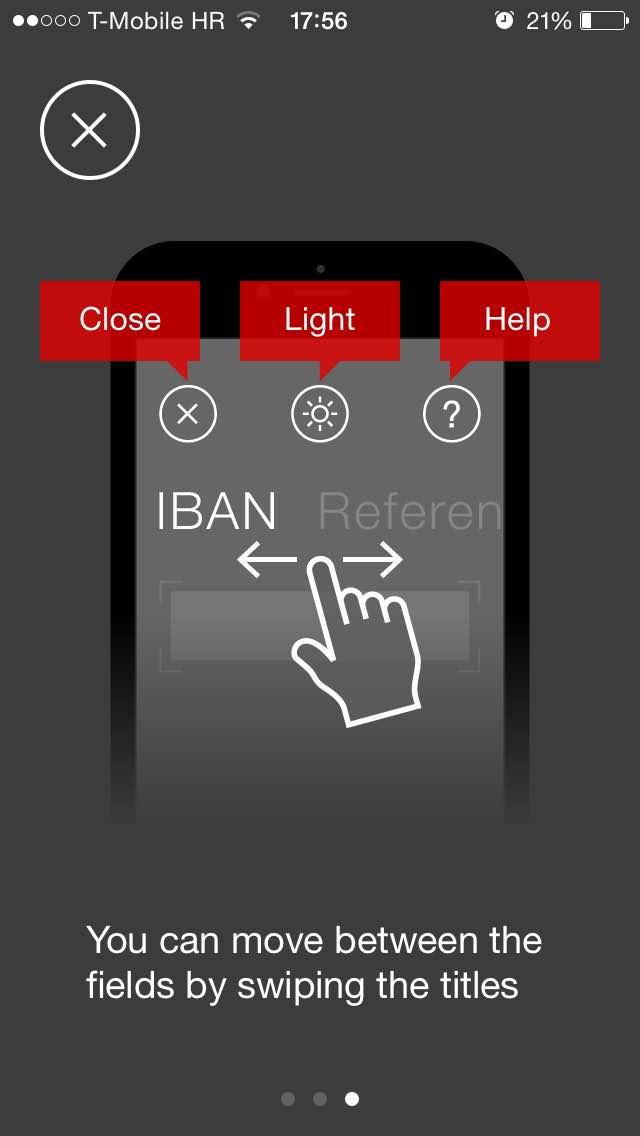

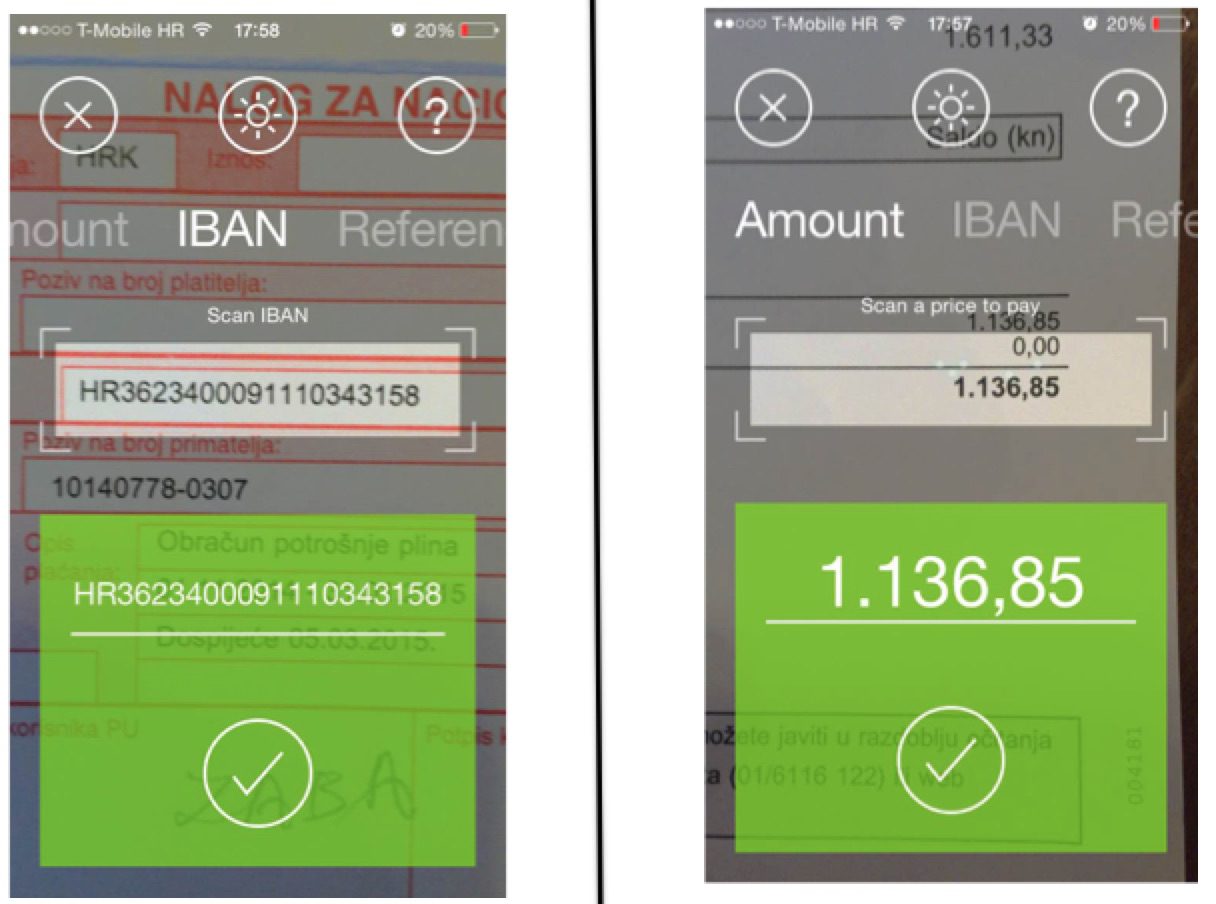

1) Select the desired field

2) Scan the fields necessary for payment (IBAN, reference number, and amount due):

3) Edit the data, if necessary, and select the checkmark to finish and confirm the payment.

Other solutions for financial institutions include:

- Standardized payment forms

The user photographs their entire bill, and PhotoPay captures, recognizes, and categorizes the data from the document. This enables the customer to pay the amount they owe without keying in data. The technology currently works with standardized payment forms for 15 European countries.

- Customer mobile on-boarding solution

PhotoPay’s BlinkIDScan captures data from ID documents and securely stores the data locally on the phone. Depending on the document type, the user scans elements such as the machine readable zone (MRZ), the form, or barcode, to capture the data.

The technology is free for end-users, and helps remove the sting from the chore of paying bills. In fact, one large European financial institution reported that, after implementing PhotoPay’s technology, the number of bill payments on its mobile app increased six-fold.

PhotoPay demonstrated at FinovateEurope 2015.

The company created the Photomath app in October of 2014 to showcase its OCR technology. The app has been downloaded more than 11 million times on iOS alone in the last 3 months (it will launch on Android soon). Additionally, the Netexpolo Forum and UNESCO recently awarded the Photomath app the 2015 Netexpolo prize in the field of educational technology.