This month we’ve explored several new features that promise to propel mobile banking into the mainstream market. Unlike developing nations, where mobile is the ONLY way to conveniently bank, in the U.S. and other online-centric countries, mobile has to compete with online for awareness and usage.

This month we’ve explored several new features that promise to propel mobile banking into the mainstream market. Unlike developing nations, where mobile is the ONLY way to conveniently bank, in the U.S. and other online-centric countries, mobile has to compete with online for awareness and usage.

There doesn’t seem to be a single killer app for mobile. But a growing list of things that mobile does better than online will eventually tip the scales in favor of the new channel. Here’s what we’ve seen so far:

- Location-based ATM/branch finders (here)

- Remote check depositing (here)

- Simple login with 4-digit pin (here)

- Insurance discounts after graduating from iPhone-based program (here)

The latest addition to the list:

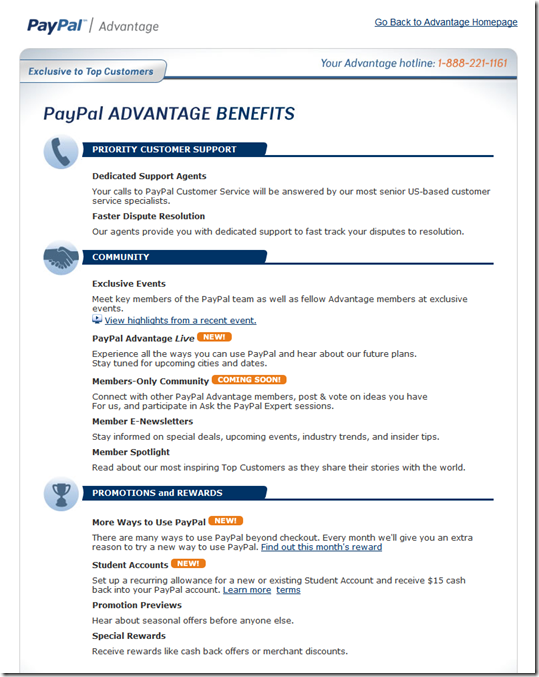

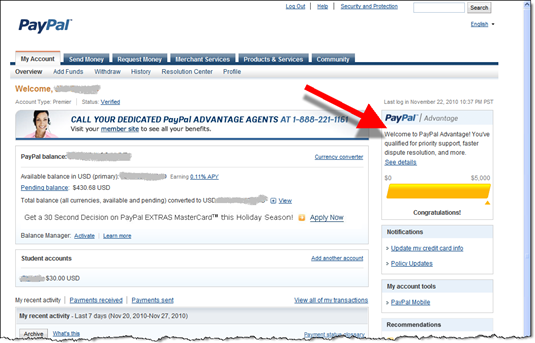

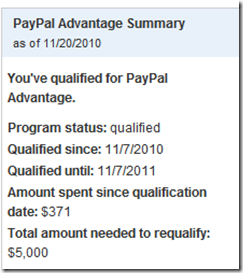

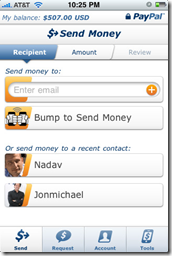

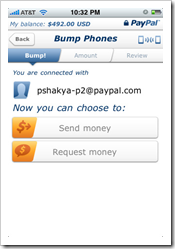

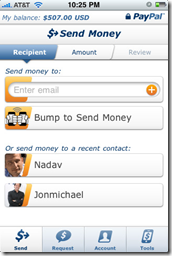

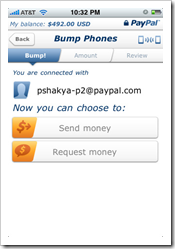

- PayPal’s Bump to Pay (see video below): Users of PayPal’s latest iPhone app can transfer funds to each other merely by entering the amount and moving their phones within close proximity of each other (see screenshots below).

As David Eads points out at Mobile Manifesto, bumping to pay has some drawbacks in the real world:

…..most of the time I want to send money to someone, I’m not standing beside them. And if I am, most of the time I would feel awkward actually touching the person. Imaging bumping someone for admission to a high school football game. Imagine bumping a street vendor for a newspaper or flowers. Imagine bumping a scalper for tickets outside the game.

My take: I agree with David that physically placing iPhones next to each other seems awkward today. But then again, so was writing paper checks back in the day when everything was paid for in cash/coins.

If so-called bump pay is super-convenient, fairly priced, and the perceived security issues are overcome, there’s no reason why it couldn’t become the predominant method of person-to-person payments. While it’s way too early to make any kind of prediction, I’m just saying, don’t dismiss it yet.

David’s closing remark is spot on:

The key for P2P is getting people comfortable with the idea of transacting electronically between individuals. Bumping and Zooming makes it more fun.

Bumping is now an integral part of PayPal’s iPhone app

—————————–

Off-topic addendum: As much as we like new bells and whistles, bump pay pales in comparison to the really big news at PayPal this week: the announcement that it’s teaming with China UnionPay and Singapore’s DBS Bank to offer payment services. The 2-year DBS deal will put PayPal in the hands of the bank’s four million customers, 1.3 million of whom are currently banking online.

How big are these deals? A good indicator is PayPal’s plan to double its staff in the region to 2,000 employees. Wow, has any financial company anywhere in the world added 1,000 to its staff in the past two years?

——————————-

Note: For more coverage of mobile banking and payments, see the most recent issue from Online Banking Report.