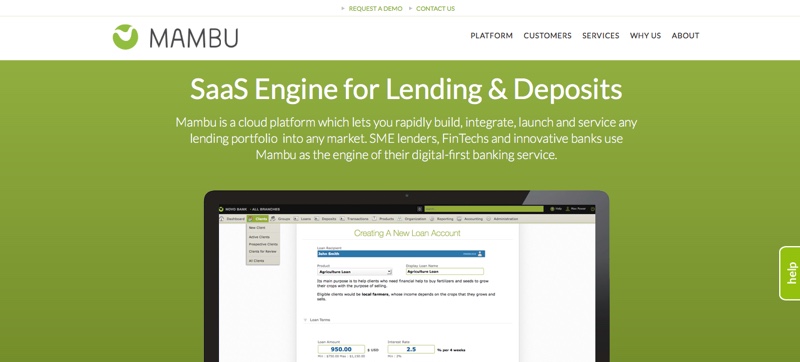

Just one month after signing a deal with fellow Finovate alum Kreditech that will support the Germany-based lender’s entry to the Indian market, Mambu is back in the headlines with a partnership with Mexican systems integrator Softtek. Via the agreement, Softtek will launch a banking platform as a service (BPaaS) solution that will give the firm the ability to deliver a variety of SaaS and local apps and technologies from multiple vendors from a singular, cloud-based, API-enabled platform – powered by Mambu.

“New entrants are using digital technology to meet changing customer expectations as well as reach the large underbanked sector,” MD for Mambu Americas, Edgardo Torres-Caballero explained. “To succeed, competitors must emulate the operating models of these disruptors and develop the flexibility and speed to market necessary to meet market demands.”

“BPaaS is the optimal model to meet this objective,” Torres-Caballero said.

Noting that the collaboration will give clients “the best of both companies,” Softtek Mexico CEO Carlos Funes said, “Powered by the global leading SaaS banking engine Mambu, which provides advanced capabilities and the agility demanded by the financial sector, we have combined this with Softtek’s experience and knowledge of this industry in Mexico in order to provide a complete offering which will help accelerate the transition of our customers to the digital economy without disrupting their existing business.” The company’s VP of Financial Sector, Jose Luis Sanchez added that there were “more than 3,000” FIs in Mexico that could “potentially benefit” from this partnership.

“With a 100% digital platform that is flexible, scalable, and agile, it will enable these institutions to provide innovative cloud-first banking services and credit to its customers in the consumer and corporate market,” Sanchez said.

Mambu demonstrated its cloud-based banking engine at FinovateAsia 2013. The company ended 2017 announcing a partnership with Argentina-based fintech Wenance, which will use Mambu’s technology to fuel its expansion into Latin America. In October, ABM Amro’s New10 choose Mambu’s SaaS engine to power its line of SME lending products in the Netherlands, and in September, German challenger bank N26 reported that it too would deploy Mambu’s platform to support current accounts, overdraft, and loan products.

With more than $13 million in funding, Mambu includes Acton Capital Partners and CommerzVentures among its investors. Eugene Danilkis is co-founder and CEO.