Global financial software provider Finastra, the combination of D+H and Misys that was forged a year ago this month, has added a new major element to its mix. The company announced today that it would acquire fellow Finovate alum Malauzai, a firm that specializes in retail and business banking solutions for community banks and credit unions. Terms of the acquisition were not disclosed.

Calling these smaller financial institutions “the fabric of American financial services,” Finastra CEO Simon Paris said bringing Malauzai into the Finastra fold will be a major boon for large and small FIs. “Together, our two companies deliver a fully integrated open core platform for payments, lending, and digital, across Finastra’s 4,500-strong U.S.-based community market customers and Malauzai’s non-core U.S.-based customers.” Paris added that Malauzai’s “leadership” and “open approach” are in “perfect alignment with our open platform vision.”

Malauzai co-founder and Chief Product Officer Robb Gaynor during a live demo of the company’s Conversational Banking for Business solution at FinovateFall 2017.

It’s also worth noting that the acquisition was the consumption of a relationship between the two companies that began years ago. Finastra and Malauzai have been collaboration partners with more than 130 shared customers since 2015. As such it was no surprise to hear Malauzai CEO Tom Shen echo Paris’ praise for the synergies between the two companies. “By combining a best-in-class core experience, backed by leading innovative mobile and Internet banking capabilities and our mobile-only design approach, community financial institutions win,” Shen said.

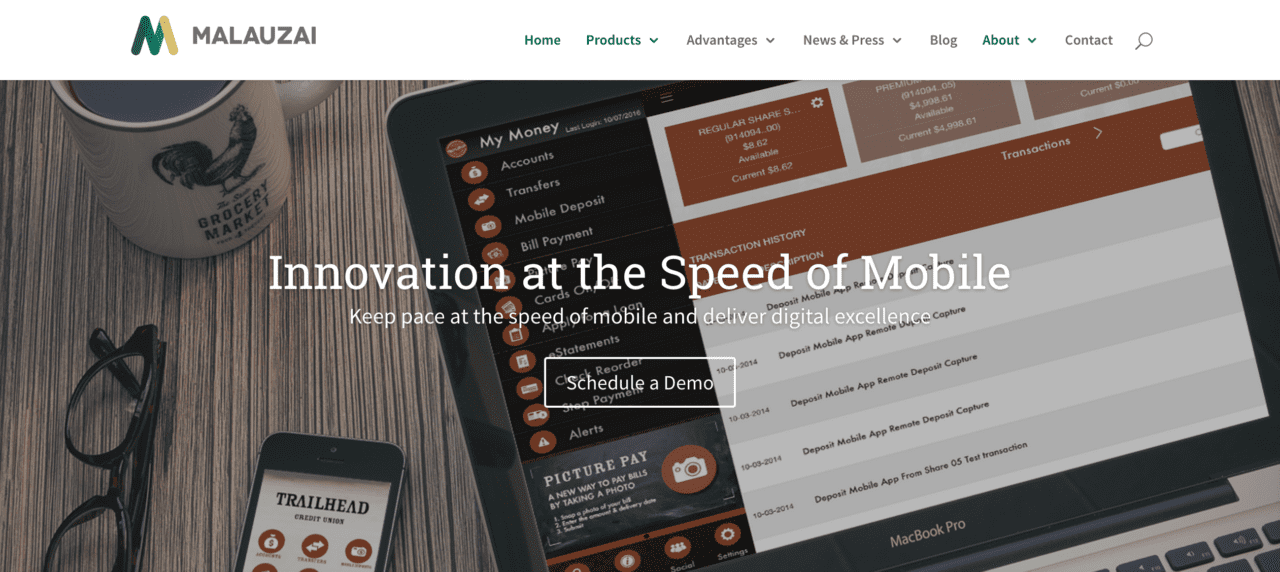

Founded in 2009 and headquartered in Austin, Texas, Malauzai has distinguished itself as a major provider of digitally-innovative products and solutions for local and community-based financial institutions. For the company’s FinovateSpring 2015 demo, co-founders Robb Gaynor and Danny Piangerelli were joined on stage by representatives from six different community banks that were offering Malauzai-powered features including P2P payments, picture bill pay, and debit card on/off to their customers and members.

Solutions like MOX Pay and Conversational Banking for Business, both demoed at recent Finovate events, further distinguished Malauzai has a partner for financial institutions looking to provide their retail and business customers with the same level of digital innovation as the larger banks.

“The acquisition creates a compelling proposition for our existing customer base and enables Finastra’s customers to deliver a seamless banking experience with a robust breadth of services, via a single provider,” Shen said. Malauzai serves more than 350 community financial institutions in the U.S. and has more than one million active users of its solutions.

Malauzai has raised more than $24 million in funding from investors including Wellington Management and Live Oak Banking Company. In May, the company teamed up with its future acquirer to help Horicon Bank launch its digital banking platform . InApril, Malauzai partnered with fellow Finovate alum Geezeo to develop a new mobile app for Axiom Bank, the second-largest community bank in Florida.